Bitcoin markets initially rallied during the day on Monday but found quite a bit of resistance just above. There were reports on the Bloomberg suggesting that 90% of all volume on some of the largest exchanges is price manipulation. However, that does not seem to be a major deterrent to most bitcoin traders. This has kind of been known for some time. The market isn’t as liquid as currencies, which themselves can be manipulated so this shouldn’t be much of a surprise.

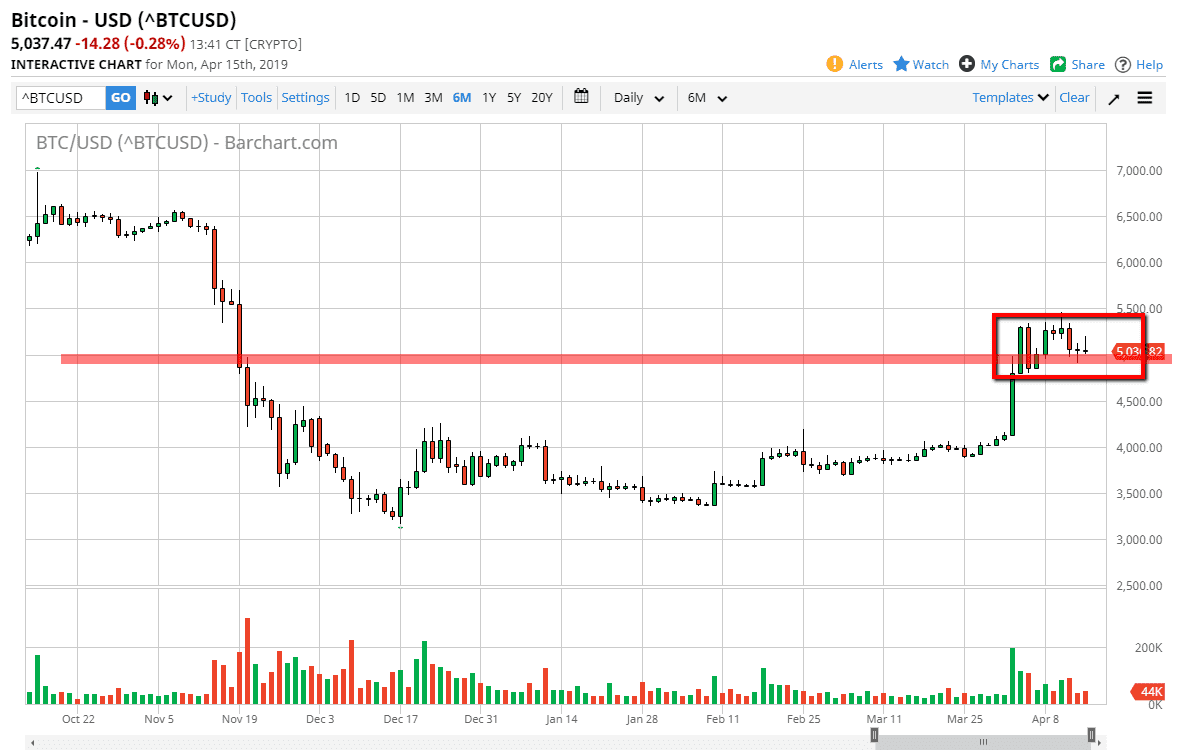

After the initial shock it seems as if we have stabilized at roughly $5000, which is a large, round, psychologically significant figure. Looking at the chart, you can make an argument for a little bit of an ascending triangle although I think that would be a bit of a stretch. I think what is much more likely to be the case is that we consolidate back and forth around the $5000 level in a bid to try to build up enough confidence to take the next move higher.

If we break down below the $4750 level I think at that point we will probably drop back down to the $4250 level and go looking for buyers. The opposite in bullish case would of course be breaking above the shooting star from the candle stick that represents the highs of last week, meaning that we would reach the $5500 level and probably start targeting the $6000 level after that. At $6000, I would expect quite a bit more resistance as it was a major level previously, and the concept of “market memory” will continue to be something worth paying attention to.

Obviously, bitcoin has had quite a bit of a wild ride over the last couple of years. Even if we do find this market going higher, and I think that’s very possible, we are not going to see the type of insanity that we saw in 2017. There is almost no hope of that happening, because the very people that would jump into the market and start throwing money at it $5000 above will almost certainly be getting out because they are still trying to recover their losses from the last time they did it. At that point, the simply be comfortable getting out at breakeven.