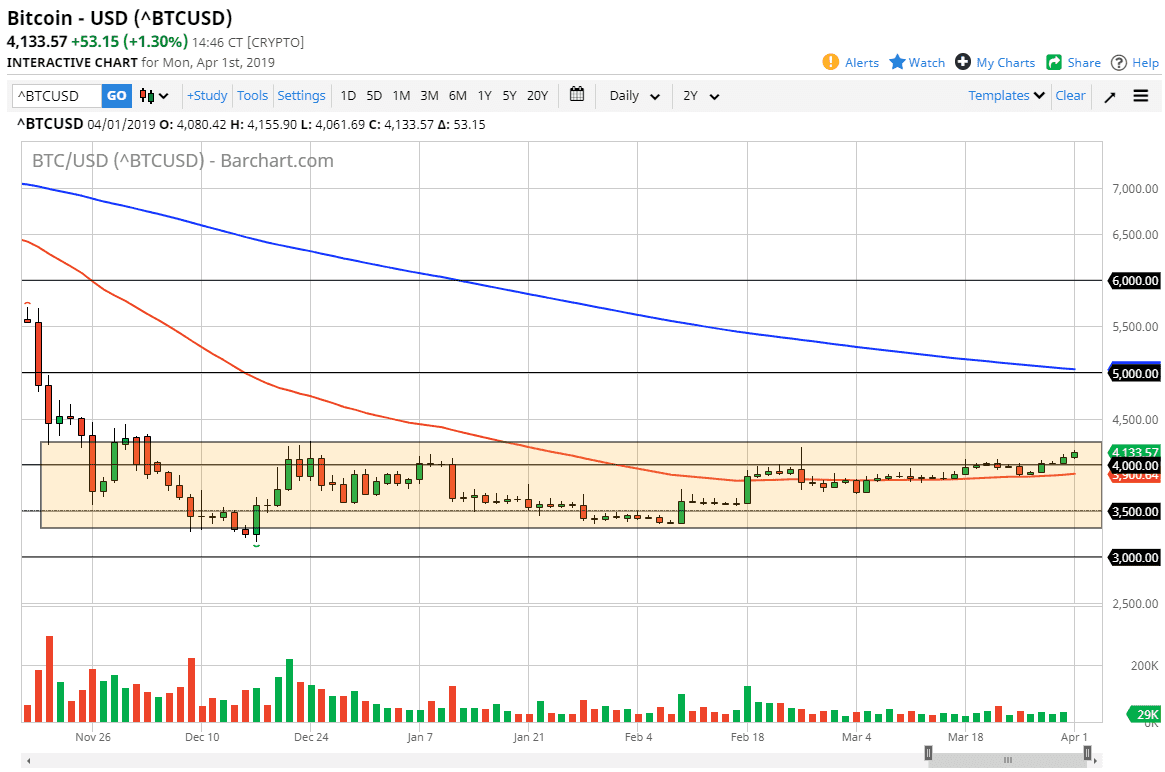

Bitcoin markets rallied again during the day on Monday to kick off the week, as we continue to grind above the crucial $4000 level. As we have been consolidating for some time, and we have a long wick on the candle from February, I’m now watching the $4250 level. That’s the top of the range that the market has been trading back and forth from recently, and therefore I think if we can break above there we go much higher, perhaps towards the $4500 level.

Looking at the chart, the 50 day EMA underneath, pictured in red on the chart, should offer support as well as the $4000 level should based upon the psychology of it. If we break down below the 50 day EMA level, then we could drop down to the $3500 level. That then extends down to the $3250 level. All things being equal, it does look as if Bitcoin is going to try to break out and that could open up the door to much higher trading.

If you been watching me here at Daily Forex recently, you know that even though I am not a believer in Bitcoin, I recognize that we are forming a basing pattern. The question now is whether or not it can last? However, there’s probably an even better question to ask here: are you patient enough to see the rewards? This is what a bottom looks like, and it could lead to much higher trading, but after the carnage that we had seen in the cryptocurrencies markets recently, it’s obviously going to take a lot of confidence building to get to higher priced levels. Buying on the dips should continue to be the best way going forward. I have no interest in selling Bitcoin, at least not in the short term.