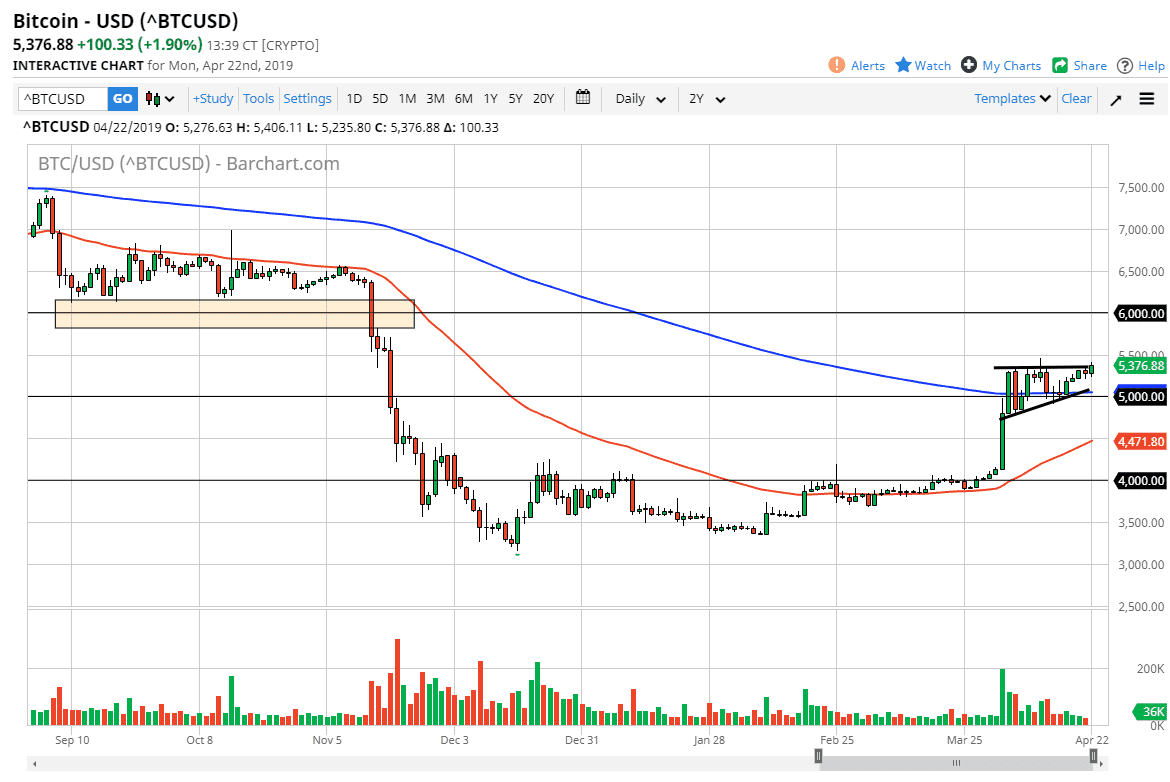

Bitcoin markets rallied a bit during the day on Monday, as markets in general have been very quiet. It’s Easter Monday in Europe, which of course is going to cut back on a lot of volume when it comes to trading markets overall. However, we did rally enough to show just how much bullish pressure there is underneath.

As you know, I’m not particularly a Bitcoin bull, but I do recognize what the charts tell us. The charts tell us simply that we are going to go higher eventually. If we can break above the $5500 level, that gives the green light to go towards the $6000 level. Pullbacks should continue to offer support, especially at the 200 day EMA which sits just above the $5000 handle. Overall, this is a market that has plenty of buying pressure underneath it, as we have been forming an ascending triangle after the shot higher. Now that we are starting to at least attempt to break out of there, there’s a good chance that we will reach towards the next major resistance barrier in the form of $6000.

The alternate scenario of course is that we break down below the $5000 level, which would negate the triangle and could send the market down to the 50 day EMA which is pictured in red on the chart. Even if that happens, I suspect that buyers will come in and try to pick up a bit of value. I don’t really have any interest in trying to short bitcoin at the moment, as the charts clearly show the proper direction is higher. The question now is whether or not we can break above the $6000 level? I suspect that’s going to be a significant fight.