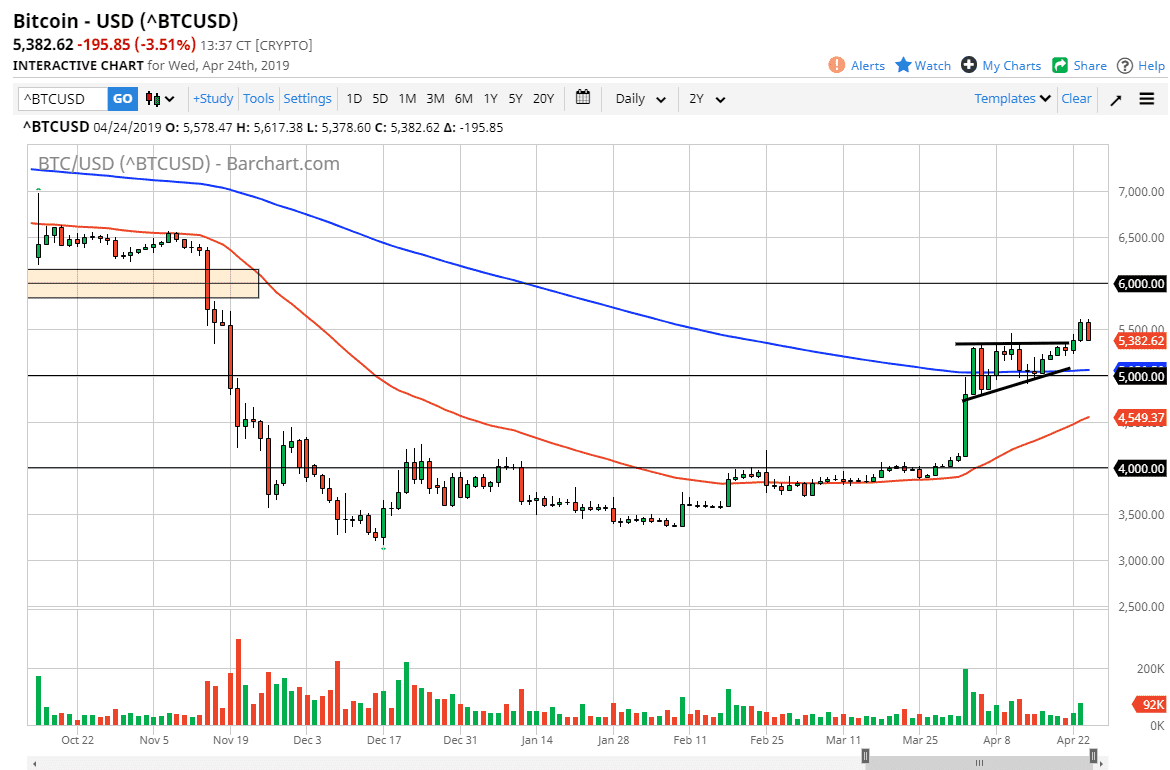

BTC/USD

The bitcoin market fell during trading on Wednesday, reaching down towards the breakout point that we had seen on Tuesday. This is a classic “retest” of previous resistance, and a healthy turn of events. Not only do we have support at roughly $5400, but we also have an uptrend line underneath that could come into play as well. If that’s going to be the case, then it’s very likely that this market will find buyers underneath. I have been saying lately that I wouldn’t be looking to short bitcoin, and you guys know that I’m not even a believer. The chart tells the story, as price is truth.

At this point, we are above the 200 day EMA which of course is a bullish sign and the moving average is starting to turn higher which is also a very bullish. With that being the case, longer-term traders starting to look at bitcoin as a buying opportunity. That isn’t to say that we are going to go straight up in the air, I believe that there is a significant amount of resistance in the form of $6000 above. I think it’s going to take quite a bit of momentum to get above that level, so at this point it’s very likely that we will get a lot of volatility between here and there and I think that there is essentially a “floor in the bitcoin market at the $5000 handle. If we were to break down below that level, then we probably go looking towards the 50 day EMA on the chart, which is currently hovering just above the $4500 level. It’s not until we break down below there that I would have to think about anything but buying value.