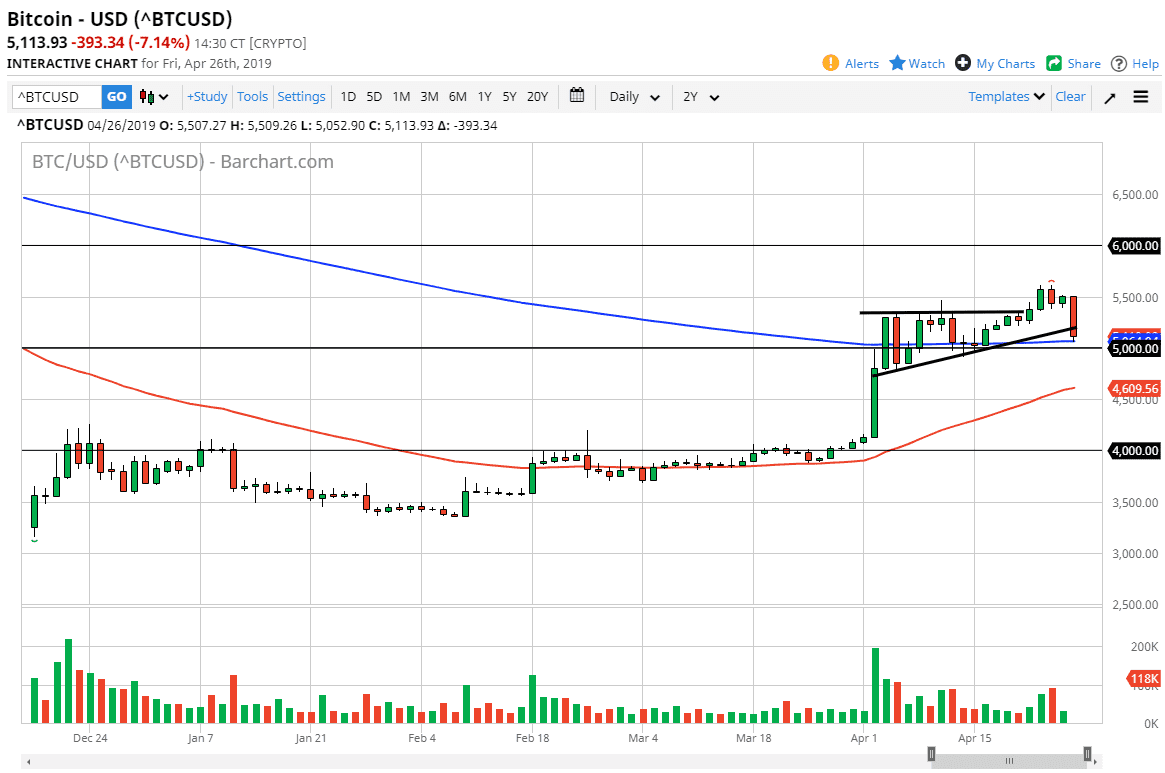

Bitcoin broke down significantly during the trading session on Friday, to close out the week with a very bearish candle stick. This was a bit of a surprise but there are couple things to pay attention to as we have formed such a striking candlestick.

The first thing that I would point out is that the $5000 level continues to hold as support. Beyond that we also have the 200 day EMA sitting just below the bottom of the candle stick as well. With all of that, even though this is a very bearish looking candle stick I do believe that there will be buyers underneath willing to jump in and try to push this market. If we break down below the $5000 level, then it’s possible that we go down to the 50 day EMA which is colored in red. It’s essentially the $4600 level, and I think that perhaps were getting a bit of volatility and churn in Bitcoin at this point as we have had such a bullish move.

It’s really not until we break down below the $4500 level that I would be somewhat concerned, and I think at this point a lot of value hunters probably come back into this market. Those of you have been watching me at Daily Forex know that I am not necessarily a believer in Bitcoin, but truth is in price. If the price goes higher, it doesn’t matter to me whether or not I believe in the asset, I just know that it’s going to be worth more and that’s how I look at the market. So instead of getting into the esoteric fundamental issues, I simply watched the price action. Right now, even though we have had a very negative candle stick for the day on Friday, and it does suggest that perhaps will get a little bit of follow-through to the downside, we have seen a major push higher on high-volume as of late. That leads me to believe that there will still be buyers underneath.