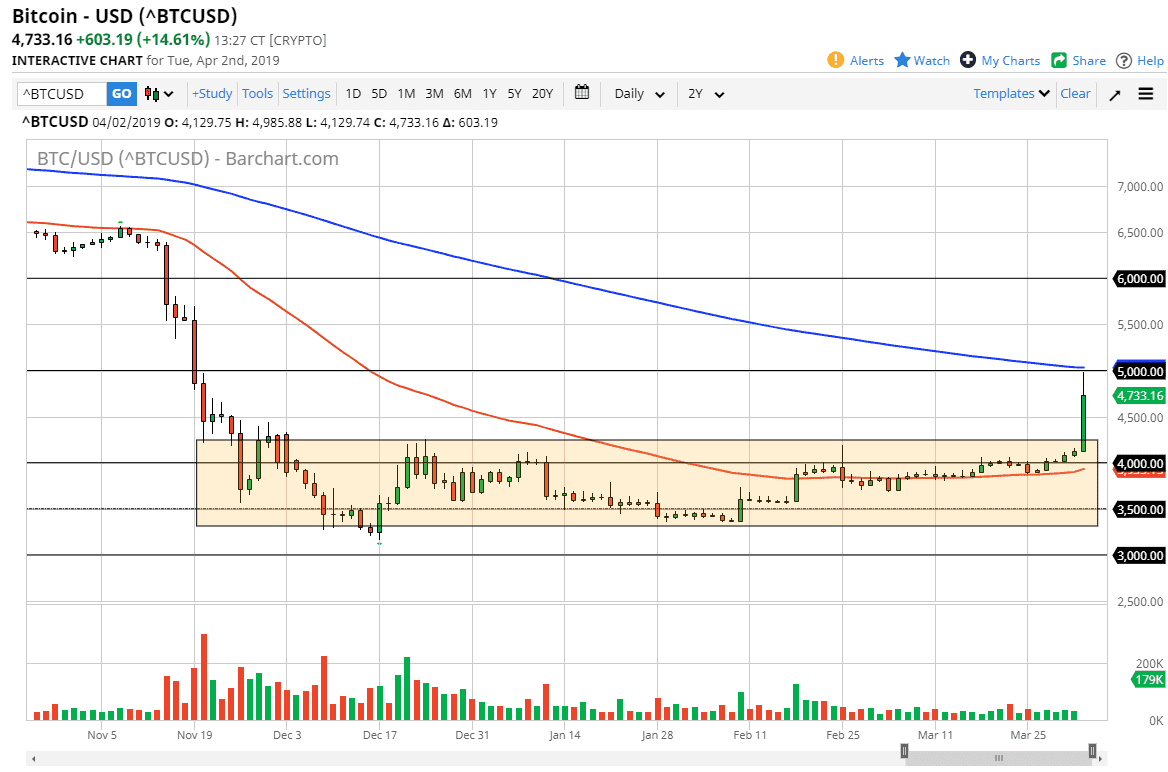

Bitcoin markets exploded to the upside on Tuesday, finally breaking above the resistance of the $4250 level, showing an extreme amount of volatility. Because Bitcoin has rallied as hard as it has, I think we finally are going to see this market pick up a little bit of legs. That doesn’t necessarily mean that we are going to take off to the upside for the bigger move quite yet, because we have given back quite a bit of the gains late during the session once we reached the crucial $5000 handle.

That being said, I do like the idea of buying dips on short-term charts with Bitcoin, as it has shown quite a bit of resiliency and obviously a move like this doesn’t happen every day. At this point, the $4250 level should be support, and as the market has been so quiet, and we have seen so much in the way of resistance there when we were in the previous consolidation area. Speaking of the consolidation area, we have already fulfilled the potential move from that rectangle, but I believe at this point there’s going to be some of that fear of missing out coming back into the market.

If we did break down below the $4000 level, that would be horrible for Bitcoin, because it would be yet another false breakout. Don’t get me wrong, this is not when we start looking at the market in start yelling “to the moon!”, but it is the first attempt to finally start an uptrend in a market that has been beaten down for quite some time. Now that the mainstream media has pretty much abandoned Bitcoin, there is a chance that we could have found a bottom.