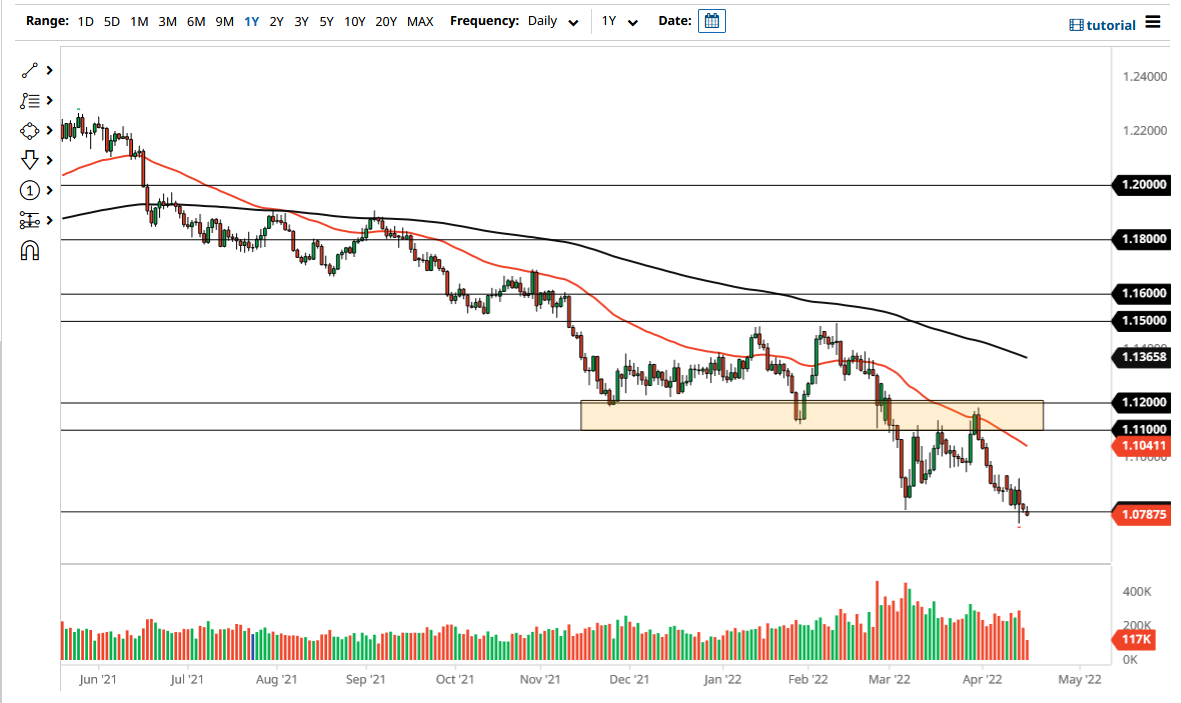

EUR/USD

The Euro initially tried to rally during the trading session on Tuesday but ran into a buzz saw of resistance near the 1.13 level, and of course there was a lot of negativity when it came to risk appetite in general, and that of course sent traders looking for the US dollar. In general, this pair has been very soft, and although we have this nasty looking shooting star, I don’t think it’s a meltdown waiting to happen I think rather it’s probably a pull back to test major support. The alternate of course is that we break out to the upside and slice through the top of the shooting star which is a very bullish sign.

The 1.12 level underneath is massive support, so if we do break down from here I believe that we are probably looking at a scenario where the first signs of support will probably be picked up as short-term value. I would look for major trade one way or the other here.

GBP/USD

The British pound went back and forth during the trading session on Tuesday as well, showing signs of lackluster movement. At this point, the British pound looks likely to stay above the 1.30 level, an area that has been massive support. If we can break down below there, then the market probably starts to reset closer to the 1.28 handle. With all of that in mind, if we break above the top of the candle stick for Tuesday that would be a very bullish sign. I do believe that we are approaching a scenario where we very well could break down and look for that reset lower, which could offer quite a bit of value if you are patient enough.