The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 7th April 2019

In my previous piece last week, I forecasted that the best trades would be long EUR/USD and long WTI Crude Oil above $61. This worked out well, as although EUR/USD fell very slightly by 0.02%, WTI Crude Oil ended the week up by 3.70% from $61 which is a very nice win overall.

Last week’s Forex market saw the strongest rise in the relative value of the Australian Dollar, and the strongest fall in the relative value of the New Zealand Dollar.

Last week’s market remained mostly consistent – markets have stayed within their “risk-on” mode as stocks, Crude Oil, and some riskier assets have risen in value.

Last week’s Non-Farm Payrolls data was mixed and boosted the greenback only slightly. Britain’s Brexit drama continues, with the British Parliament narrowly mandating a request for a further extension to the Brexit date, with the U.K. on track to leave with no deal on 12th April this Friday unless the European Union grants an extension before then. This has weakened the Pound as markets contemplate the possibility that the E.U. may refuse to grant the extension, although it is very likely to do so.

In addition to a probable semi-final resolution of Brexit, this week will probably be dominated by U.S. FOMC Meeting Minutes and the ECB Monetary Policy Statement and Main Refinancing Rate.

Fundamental Analysis & Market Sentiment

Fundamental analysis has turned more bearish on the U.S. Dollar and on global stock markets following the Federal Reserve’s more dovish approach to monetary policy and growth. This can be expected to strengthen the Japanese Yen and Swiss Franc and weaken the commodity currencies, although price movements have not been significantly large. This week, prices moved in the opposite direction to those indicated by these fundamental factors.

If somehow the U.K. leaves the U.K. at the end of this week without a deal – which I think is very unlikely – the British Pound will fall sharply, probably by more than 10%. If an extension is agreed, the Pound will be likely to rise somewhat but most likely not by enough to produce a real bullish breakout above the long-term highs.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows that last week the USD Index printed a relatively small, bullish, candlestick within a multi-month area of consolidation. However, the price is up over 3 months and 6 months, indicating a bullish trend. Overall, next week’s direction looks a little more certain, with the technical factors pointing to a slight probability in favor of a further rise next week.

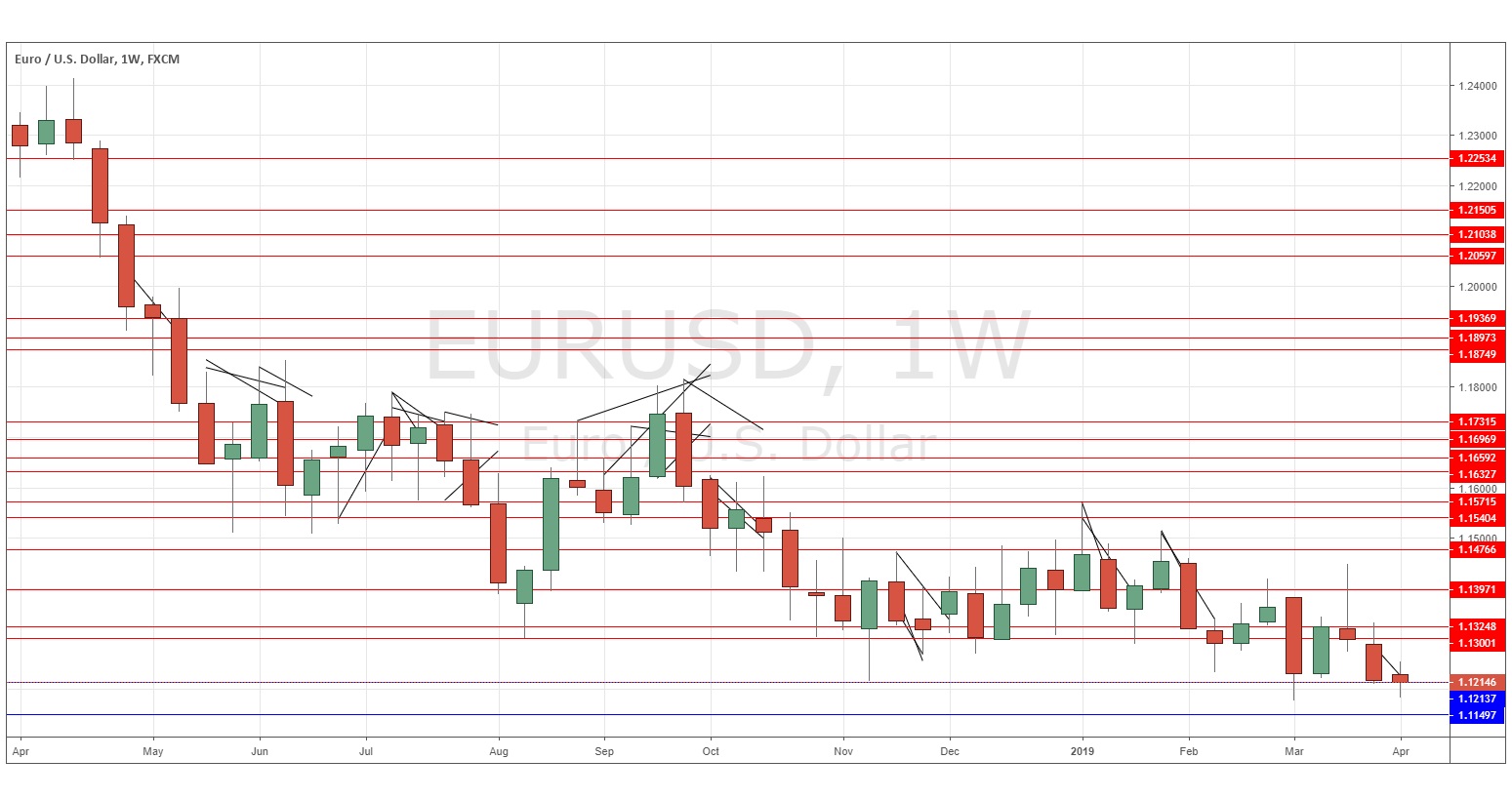

EUR/USD

The weekly chart below shows last week produced a relatively small doji candlestick. The price is in a clear long-term downwards trend, with this week’s close the lowest close for a very long time. The price has not moved much in recent months but there has certainly been a steady drift down, with the price looking heavier and heavier. An important break below these long-term low prices looks likely to happen very soon. However, doji candlesticks can indicate uncertainty.

WTI Crude Oil

This commodity has been moving steadily upwards over recent weeks to touch new 4-month highs above $60. Volatility has increased over this previous week with the price finally really getting established above $60 per barrel. The price also closed almost exactly on its high, which is a bullish sign. All the indications suggest the price is more likely to rise than fall over the coming week.

Conclusion

This week I forecast the best trades will be short EUR/USD below 1.1175, and long WTI Crude Oil.