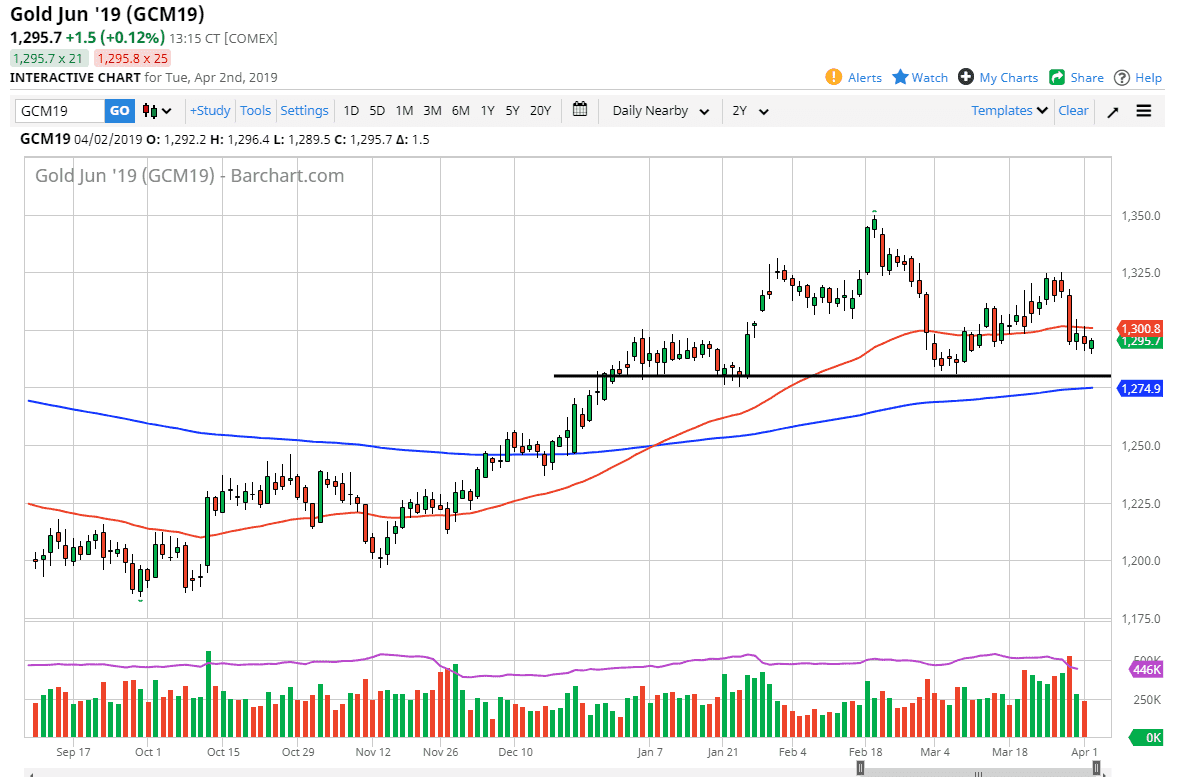

Gold markets initially fell during the trading session on Tuesday but turned around to find signs of support to form a green candle. That being said, the market still finds itself drifting below the crucial $1300 level, and of course the 50 day EMA that is painted red on the chart. Beyond that, we have a huge support level at the $1280 level, which has a history of showing action, and then of course the 200 day EMA just below there.

That should continue to have a lot of importance in this market as well, as technical analysis driven traders will course pay attention. With a confluence of both structural support and the 200 day EMA, I am currently looking at that as a “floor” in the market.

Overall though, I think that the biggest driver of the gold market is of course going to be the US dollar which is currently very strong. With that in mind, it makes quite a bit of sense that the Gold markets have suffered a bit simultaneously. Remember, gold quite often is used as a “anti-dollar” play. If that’s going to be the case going forward, then a stronger US dollar will continue to put pressure to the downside on gold. However, if the US dollar starts to soften a bit, that should send gold markets higher.

At this point, if we can break above the 50 day EMA I think that the market could go looking towards $1325 level. Looking at the chart I think that a break down below the 200 day EMA would confirm a snapping of support at $1280, and could open the door to the $1250 level, possibly even the $1225 level.