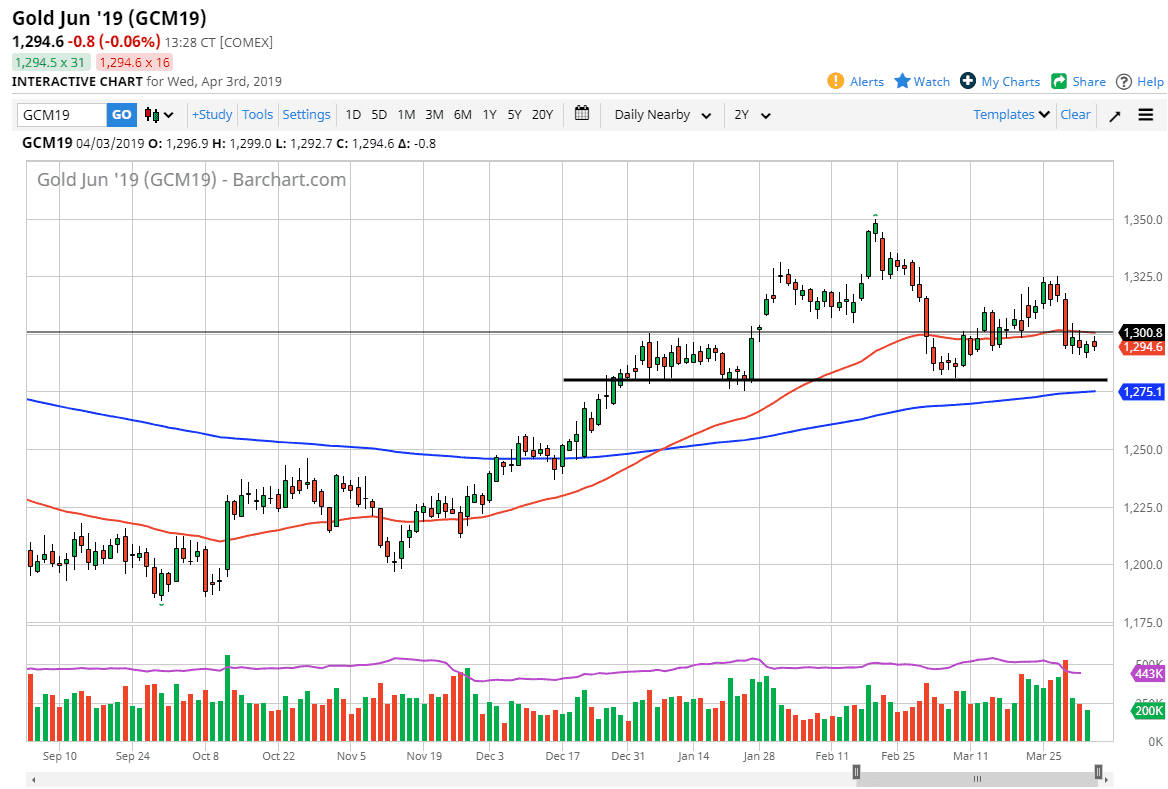

Gold markets did very little during trading on Wednesday as we continue to grind sideways. However, what is most important at this point is the fact that we are traded between a couple of major areas. The $1300 level above of course is major resistance, just as the 50 day EMA is sitting there will cause a lot of interest. Breaking above that level would of course be a major turn of events, just as a major breakdown would be through the support below.

Speaking of the support below, the $1280 level is the beginning of massive support. That support extends down to the 200 day EMA, which is just below there. Ultimately, it’s very likely that we continue to see market participants follow that area as a bit of a guide as to a “floor” in the uptrend. We have recently made a low or high, so that of course is something to worry about. The 200 day EMA being broken to the downside would probably kick off more technical selling.

That being said, the US dollar has its influence as usual, so if the US dollar rallies significantly, it will probably put major pressure on the gold market and could send Gold prices through that support. Of course, the opposite is also true, if we can close above the $1300 level on a daily chart. That tells me that there is still plenty of demand, and with a weakening dollar that should continue to drive this market towards the $1325 level. Currently, it looks as if we are simply trying to figure out where we are going to go next, so this holding pattern is what I would expect until we get some type of resolution with the greenback.