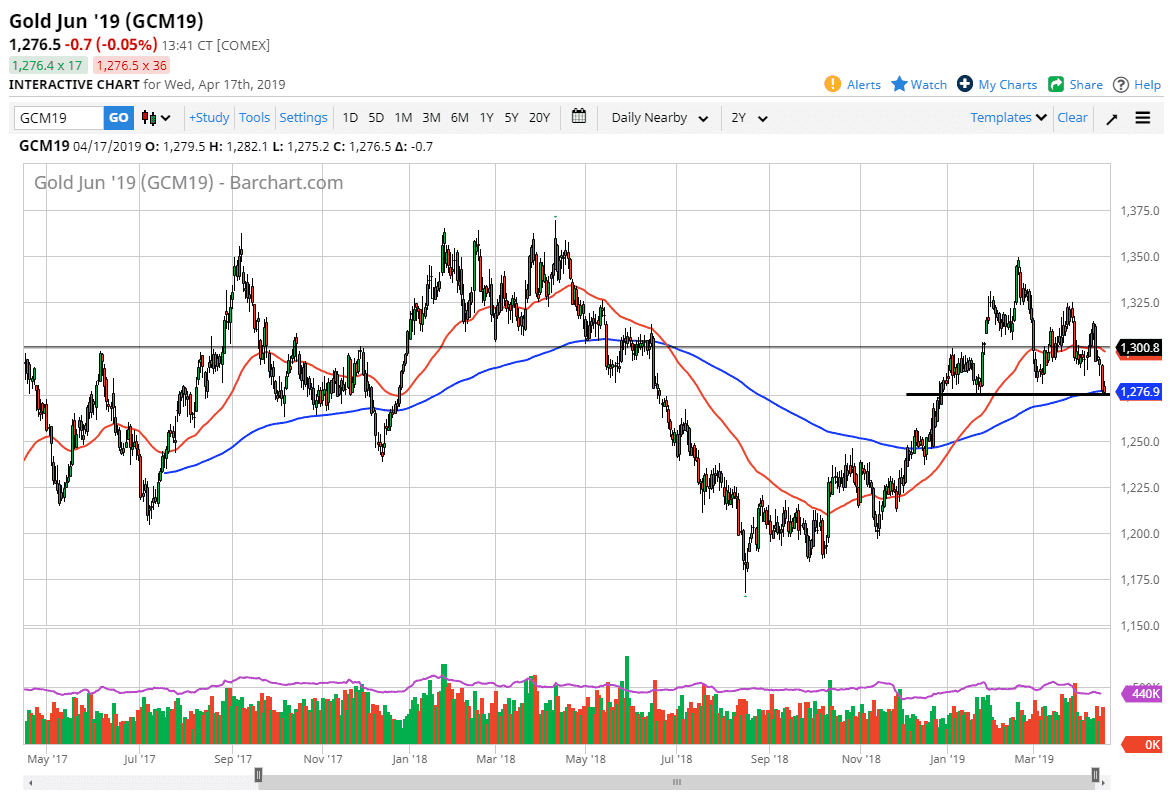

Gold markets fell again after initially trying to rally on Wednesday, but then broke down towards the $1275 level again. We have not broken through there though, but at this point it seems all but inevitable for the market to do so. Because of this I am a seller of short-term rallies which worked out quite well during the trading session on Wednesday, but we are also trading around the 200 day EMA which will of course attract a certain amount of algorithmic trading.

To the downside, I believe that breaking below the $1275 level opens up the market for a move down to the $1250 level. That level is an area of previous bullish pressure, so it’s likely that we will find plenty of support in that area. Longer-term though, when I look at this chart I could make an argument for a head and shoulders pattern, if you tilted the trend line up just a bit. If that’s going to be the case then we probably move closer to the $1225 level, or perhaps even the crucial $1200 level. All things being equal, this is a market that looks horrifically negative right now.

Pay attention to the US dollar because if it strengthens that should put a lot of bearish pressure on gold. Ultimately, the market will be very sensitive to the greenback. This isn’t to say that we can’t rally, because obviously we can. However, I think that there is more than enough resistance above to keep the market down. I’d be more than willing to sell any signs of exhaustion on a short-term chart, especially near the large, round, psychologically significant figures such as $1280 level, maybe even the $1290 level. Either way, I have no interest in buying gold because it looks so beaten up.