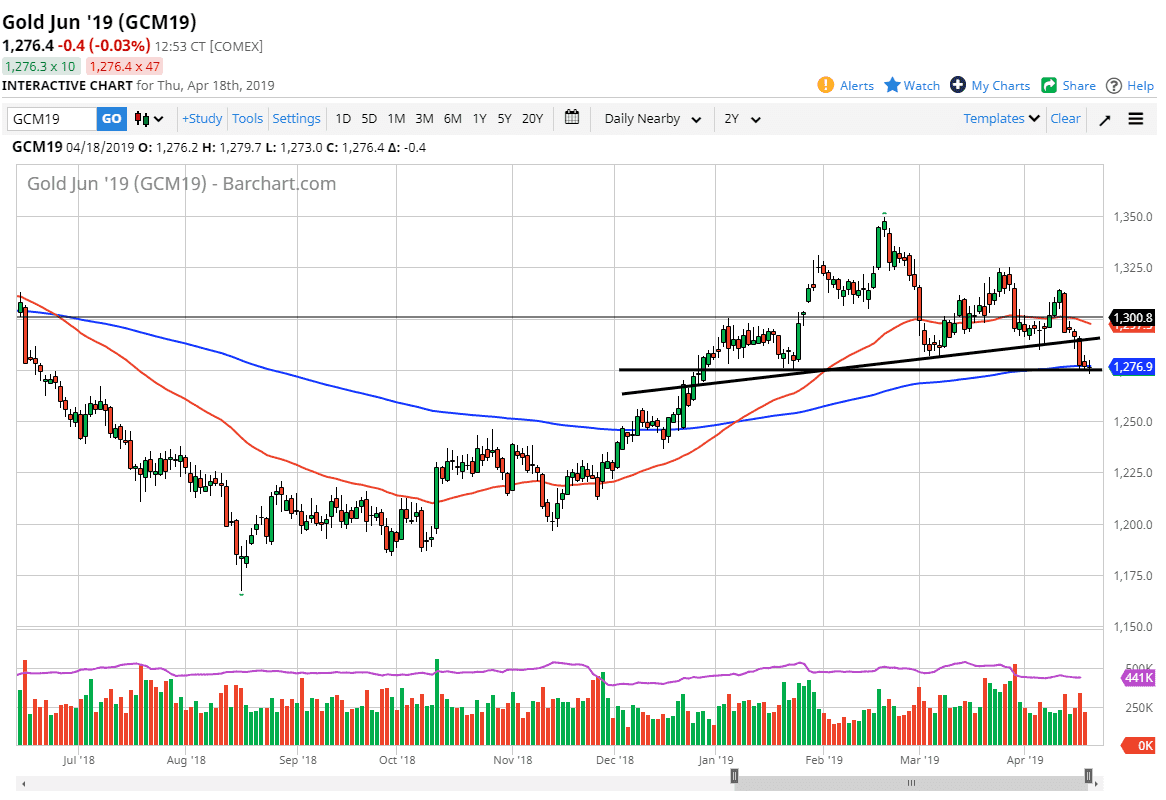

Gold markets went back and forth during the trading session on Thursday as we continue to see the $1275 level offer significant support. The fact that the market went back and forth during the trading session on Thursday isn’t much of a surprise though, considering that we are heading into Good Friday and very limited electronic trading.

Looking at the longer-term charts is all we can do at this point, and there are couple of things to point out. We have recently broken through the uptrend line, and we are now testing major sideways support. The $1275 level is crucial because it would kick off yet another reason to start selling. Beyond that, the 200 day EMA is right in the middle of the candle stick as well, so at this point it’s likely that we will continue to see a lot of back and forth in this region. In other words, there are a lot of reasons to think that this market will continue to struggle for clarity. However, we will eventually take off in one direction or the other and it sets up a couple of profit target.

If we were to break above the top of the candle stick from the Wednesday session, then I think we would go looking towards the top of the Tuesday candle stick, which was the scene of significant selling. However, if we break down below the bottom of the candle stick from the Thursday session, then we will probably reach towards the $1250 level next, and then perhaps even as low as $1225 level as the head and shoulders potential move would suggest. Overall, pay attention to the US dollar and whether it is strong or not. That of course can drive gold in the opposite direction at times.