Gold

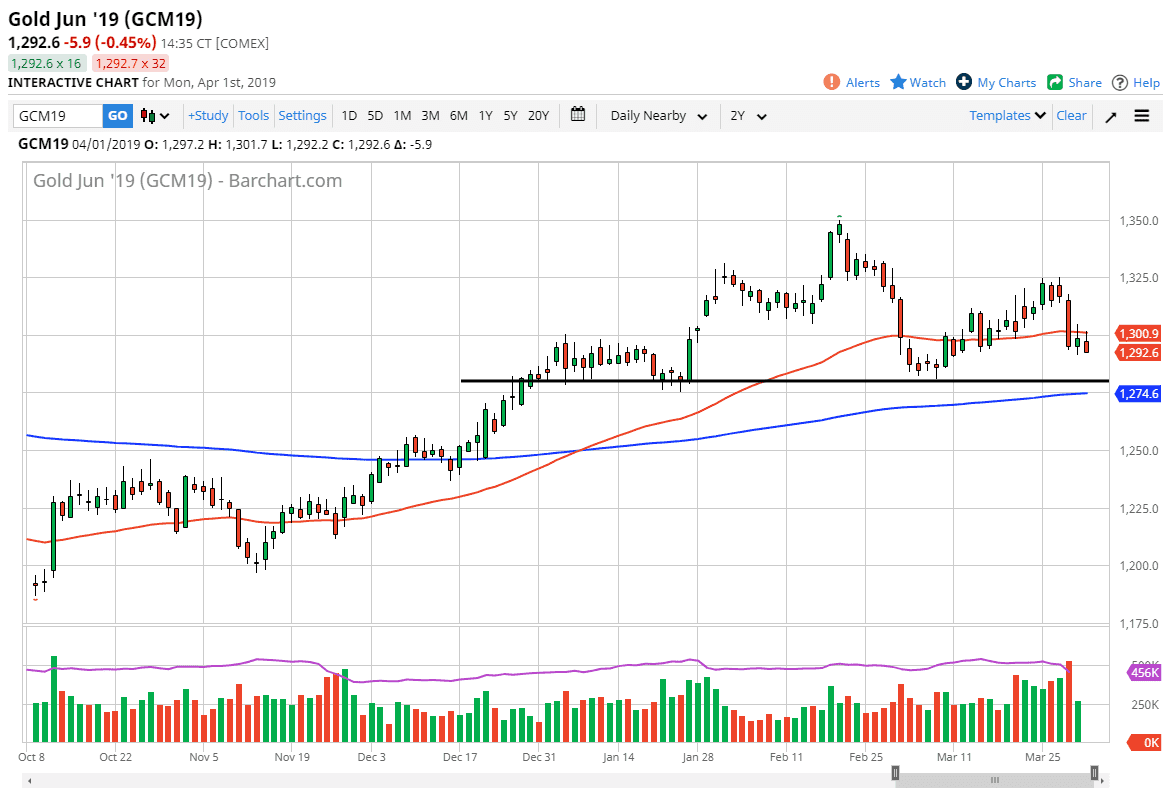

Gold markets initially tried to rally during the trading session on Monday, testing the 50 day EMA. The 50 day EMA sits right at the crucial $1300 level, an area that of course attracts a lot of interest. At this point, there is significant support below at the $1280 level, so I would pay attention to that area. If we were to break down below there, the 200 day EMA is just below that should cause a bit of support. Breaking down below there would of course be an extraordinarily negative sign and could send this market much lower.

As per usual, you are going to need to pay attention to the US dollar in general, as US dollar strength can weigh upon the value of gold. Obviously, the other way around works as well, but one thing that has to be noticed is that the market closed towards the bottom of the range. That is not a good sign, so I think it’s very likely that we probably drift a little bit lower to try to find more demand and of course support.

The alternate scenario of course is that we break above the top of the session on Monday, which would be a very bullish sign and have this market reaching towards the top of the breakdown candle from last week. At this point, I think we are going to continue to see a lot of volatility as the US dollar has been overbought for some time. In general, this is a market that you will probably have to range trade in short increments.