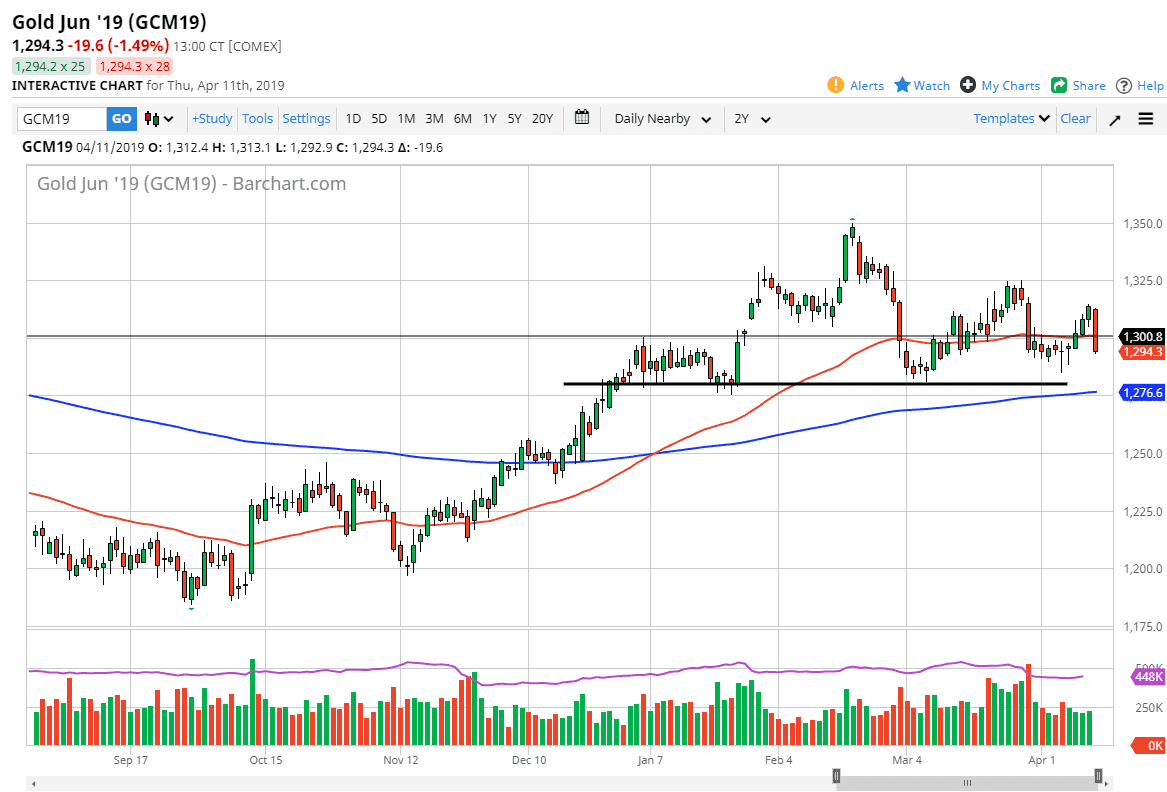

Gold markets broke down significantly during the day on Thursday, in what looked a whole lot like panic. At this point though, there isn’t much in the way of a reason that I can see, and quite frankly the US dollar was strong against some currencies but not against all. This looks a lot like a low liquidity move. Gold had a serious lack of volume just as other markets did, so it’s very difficult to read too much into this market.

The $1300 level was sliced through like it wasn’t even there. The $1280 level underneath is massive support, so I don’t think we will break down through there easily. Beyond that we had formed a couple of hammers from the previous week, so I recognize that there is a bit of demand underneath there, but this type of move is brutal. Markets were jittery to say the least, and most markets, including the gold market, all had extraordinarily low levels of trading volume. Essentially, the machines push the markets around in both directions all day.

Going forward, it’s very likely that we will see buyers between here and the $1280 level, because not only do we have the supportive level, but we also have the 200 day EMA which sits just underneath there. That could give you a lot of reasons to think that the market will find buyers just below. However, if we break down below that level then I think Gold markets unwind down towards the $1250 level. That could be a rather violent move, so keep an eye on this market. You could make an argument for lower highs signifying that we are eventually going to break down, but there are so many factors going on right now that it’s difficult to place a lot of faith in that.