Gold markets got hammered during trading on Tuesday as we broke down through a major support line in the form of the $1280 level, and then crashed towards the next support level at the $1275 level. At this point the buyers are hanging on by a thread and could be in serious trouble.

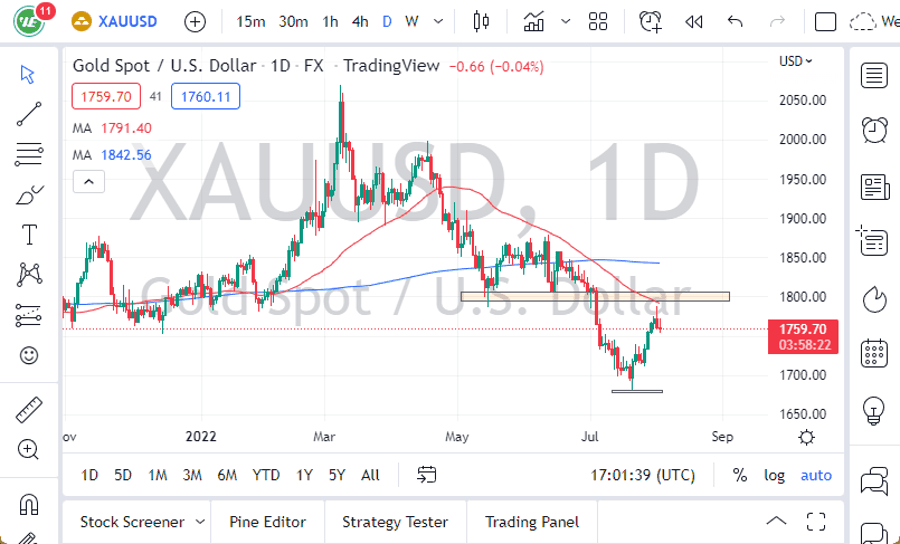

The US dollar of course will have its influence in the gold market as well, so if we do see the US dollar strength then it’s very likely that we will see Gold markets get hammered yet again. The 200 day EMA, pictured in blue on the chart, is currently offering support, but at this point in time it looks as if it is being threatened. After all, the candle stick was very negative, and in fact broke the back of a hammer from the previous session that was also at a trend line.

Gold markets could be very sensitive to what’s going on in the US dollar and perhaps even the bond markets. Remember, we are in the middle of earnings season so flow coming into the US stock market could have a bit of an effect as well. If you squint on this chart, you can see that there was a bit of a complex head and shoulders that could have just kicked off. (For that matter I can also draw a sideways line at the $1275 level, but I digress.)

Looking at that head and shoulders, it’s possible that we could be gearing up for a move down to the $1225 level based upon the measurement. As for the upside, I think it’s going to be very difficult to start buying gold and I think rallies at this point will end up being nice selling opportunities for those who are patient enough to wait for them to show up in the form of an exhaustive short-term candlestick. That being said, it looks like a break down below the $1275 level or an exhaustive short-term candlestick after a rally should send more sellers in the market.