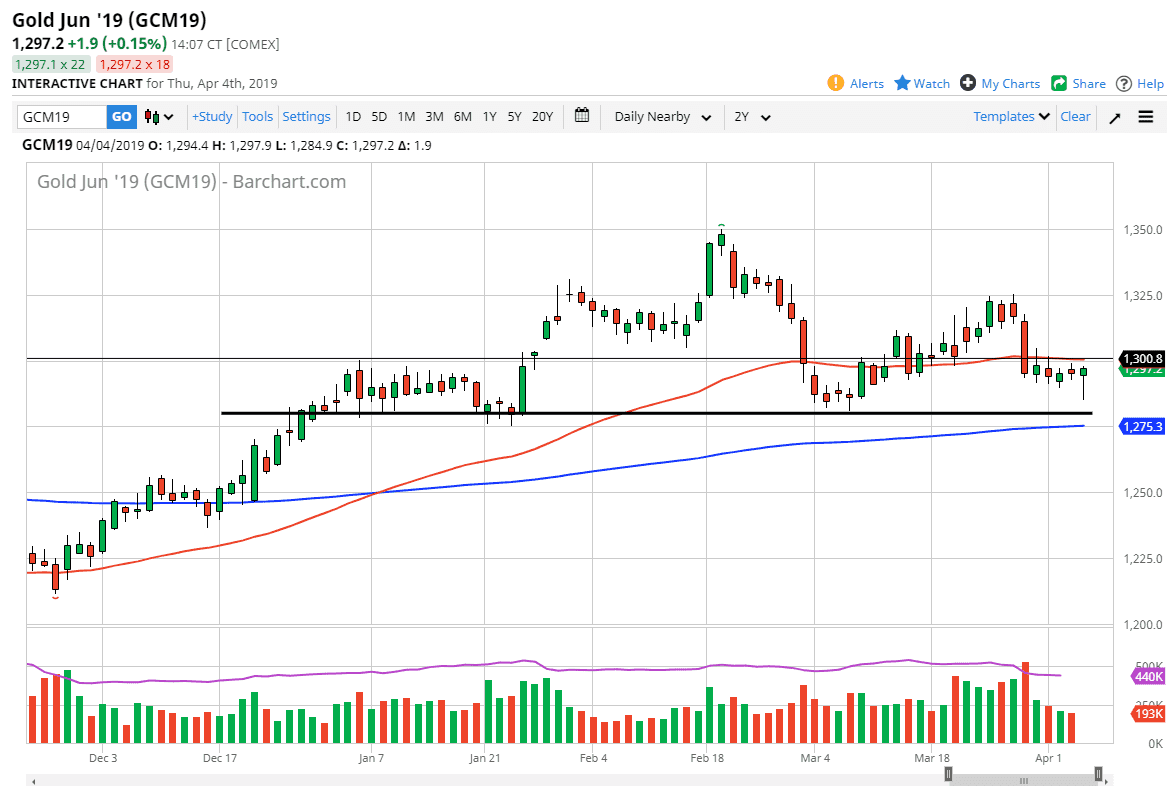

As the Thursday session was very volatile, when I look at the hammer that has formed, it’s easy to see that the buyers certainly made a statement during the trading session on Thursday. After all, we had initially broken down rather violently but found enough support near the $1280 level to turn around and show bullish pressure. The hammer has a long tail, so that is also a very good sign for those who are bullish on the gold market.

We are currently sitting just below the 50 day EMA and the $1300 level, so it makes sense that there is a little bit of resistance just above. I believe that part of this was due to the US dollar strengthening but then giving back quite a bit of this gains later in the day. It makes sense considering that it was the day before Nonfarm Payroll Friday, and of course that will have its say as to where the greenback goes going forward, so a lot of traders probably didn’t want to be overly exposed one way or the other.

At this point, if we can break above the $1300 level, then we probably go towards the $1325 level. That being said, if we were to break down below the bottom of the wick for the trading session, there will be significant support at the $1280 level, and of course the 200 day EMA which is sitting just below. With the jobs number coming out during the trading session on Friday, I would expect a lot of volatility but my default position is to buy short-term pullbacks as the US dollar is finding a lot of resistance in the US Dollar Index, and of course support in the EUR/USD pair. As markets of course have their knock on effect over here.