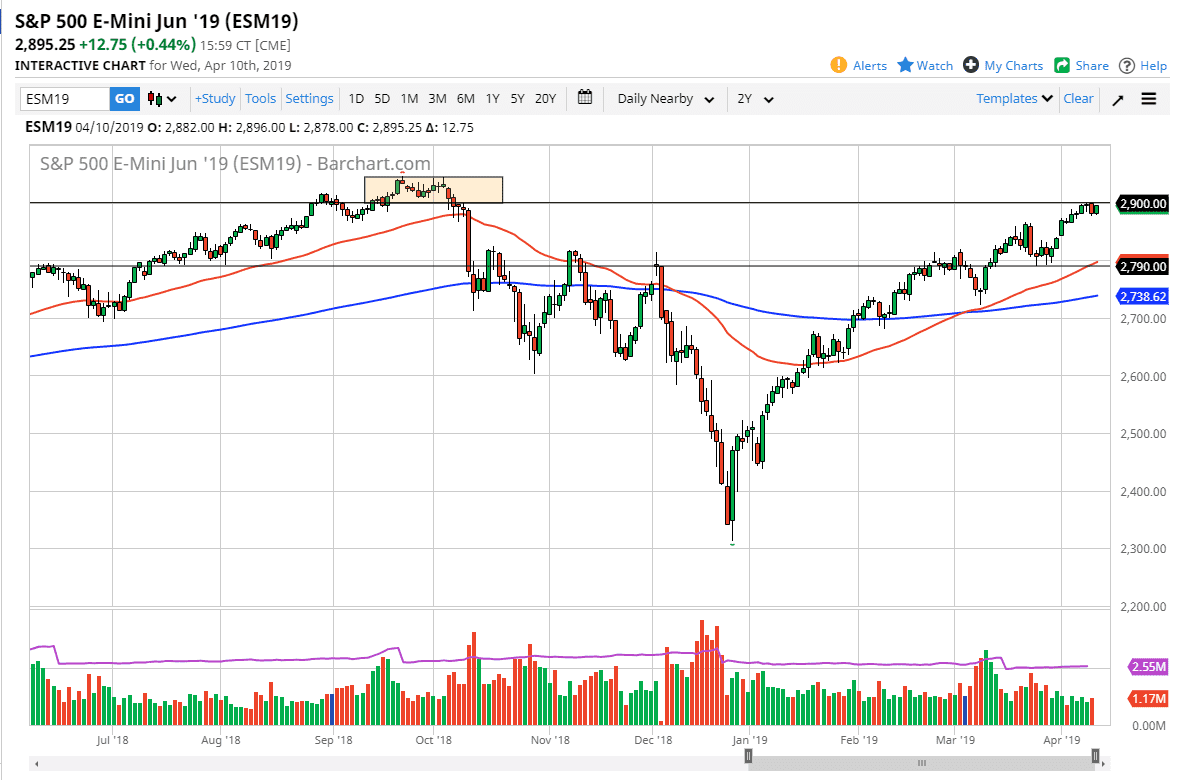

S&P 500

The S&P 500 initially pulled back a bit during the trading session on Wednesday, as we continue to chop around overall. However, by the end of the day the buyers came back to push towards the 2900 level. This is a level that has been massive resistance in the past and should continue to be so, extending all the way to the recent highs from about six months ago at 2940. If we can break above that level then it opens the door to the 3000 level. I personally like buying pullbacks, especially down at the 2850 region. However, the market may not give us that trade so it’s very possible will be buying above 2940. Regardless of what happens next, it’s obvious that you should not be selling this market.

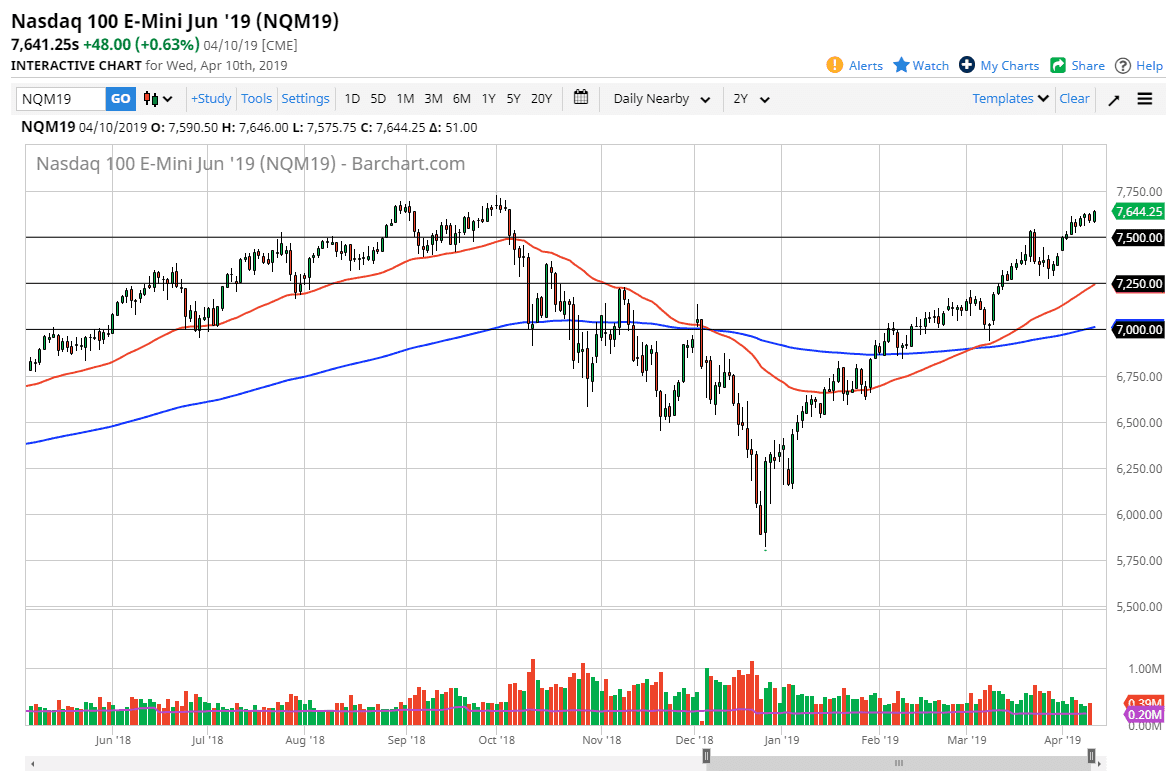

NASDAQ 100

The NASDAQ 100 rallied during the trading session on Wednesday, breaking towards the 7644 level. This is an area that is just below the all-time highs, which is substantively the 7700 level. I think at this point it’s obvious that short-term pullbacks are going to be buying opportunities, but we have a lot of resistance just above that is going to continue to cause major problems. If we can break above that area it’s likely that we will then start carving out a path towards the 8000 level.

In the short term, I think that pullbacks to the 7500 level will be supported, as it’s clear that the stock markets continue to go higher. The Federal Reserve reiterated that is going to stay out of the way during the session on Wednesday, so that obviously will continue to drive prices higher but we are heading into earnings season so anything’s possible.