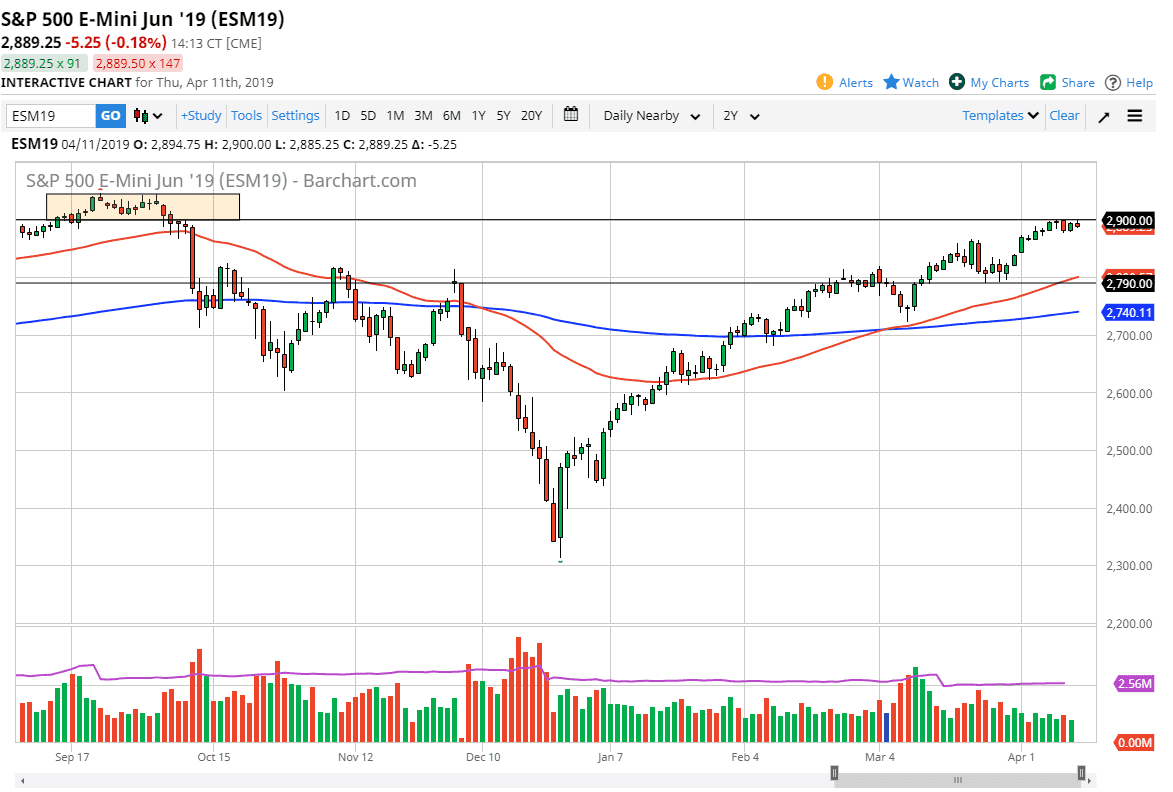

S&P 500

The S&P 500 continues to rotate at extreme highs, which isn’t much of a surprise considering that earnings season starts on Friday. With that in mind, the markets are simply waiting for some type of catalyst as to which direction to go. I would anticipate that at present, it’s probably more likely that we see a bit of a break down than an explosion to the upside, but that break down will more than likely be temporary, as we continue to see liquidity force money into stocks. I like several levels below, including the 2880 handle, the 2860 handle, and the 2850 level. I anticipate a short-term pullbacks will continue to be looked at as value. If we do break above the 2900 level, there is a mess of resistance all the way to the 2950 level.

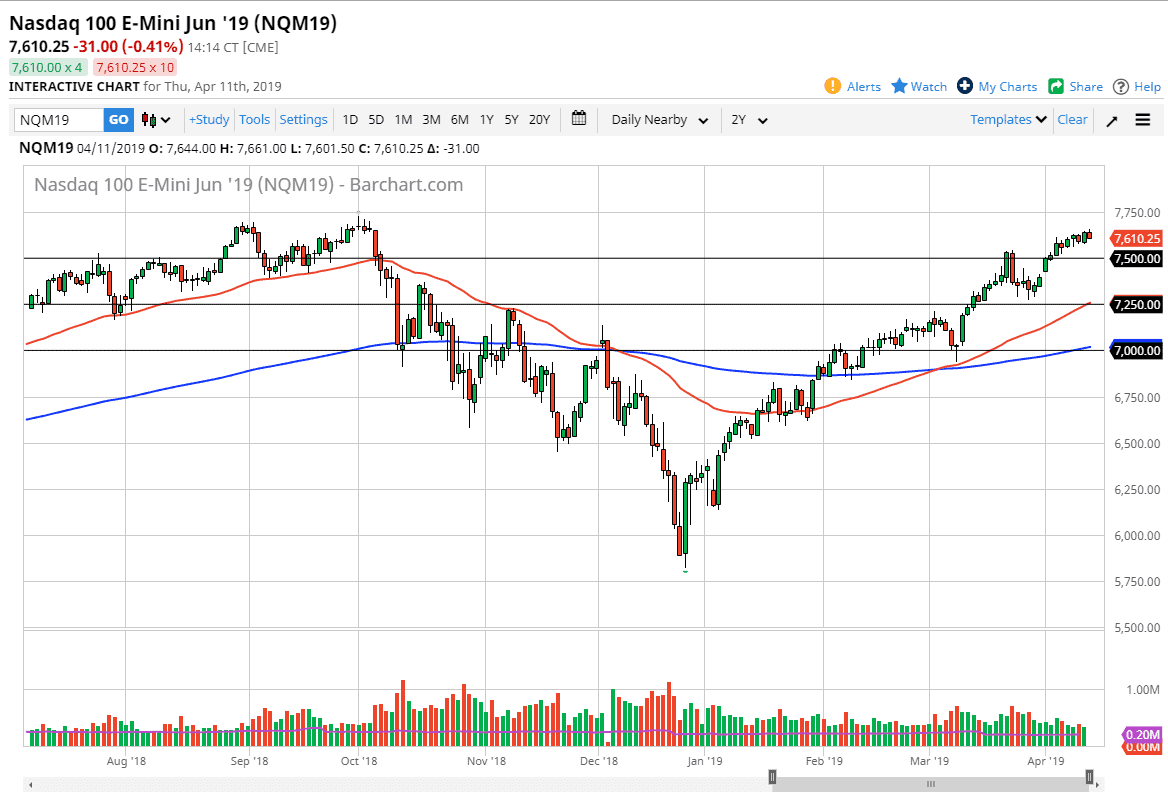

NASDAQ 100

The NASDAQ 100 pulled back a bit during the trading session on Thursday, just as indices around the world struggled a bit. That being the case, the NASDAQ 100 is the one you should be paying attention to more than anything else in America though, because it has been the leader for some time. Looking at the chart I think that there is plenty of support below at the 7500 level. I think that there is significant resistance above at the 7700 level, so a break above there opens the door to the 7750, and then much higher levels, perhaps even the 8000 handle.

As the NASDAQ 100 has lead the S&P 500, I continue to watch the NASDAQ 100 as to where we might be going next in several other markets. I like buying dips and believe that the relative strength continues to favor the NASDAQ 100 overall.