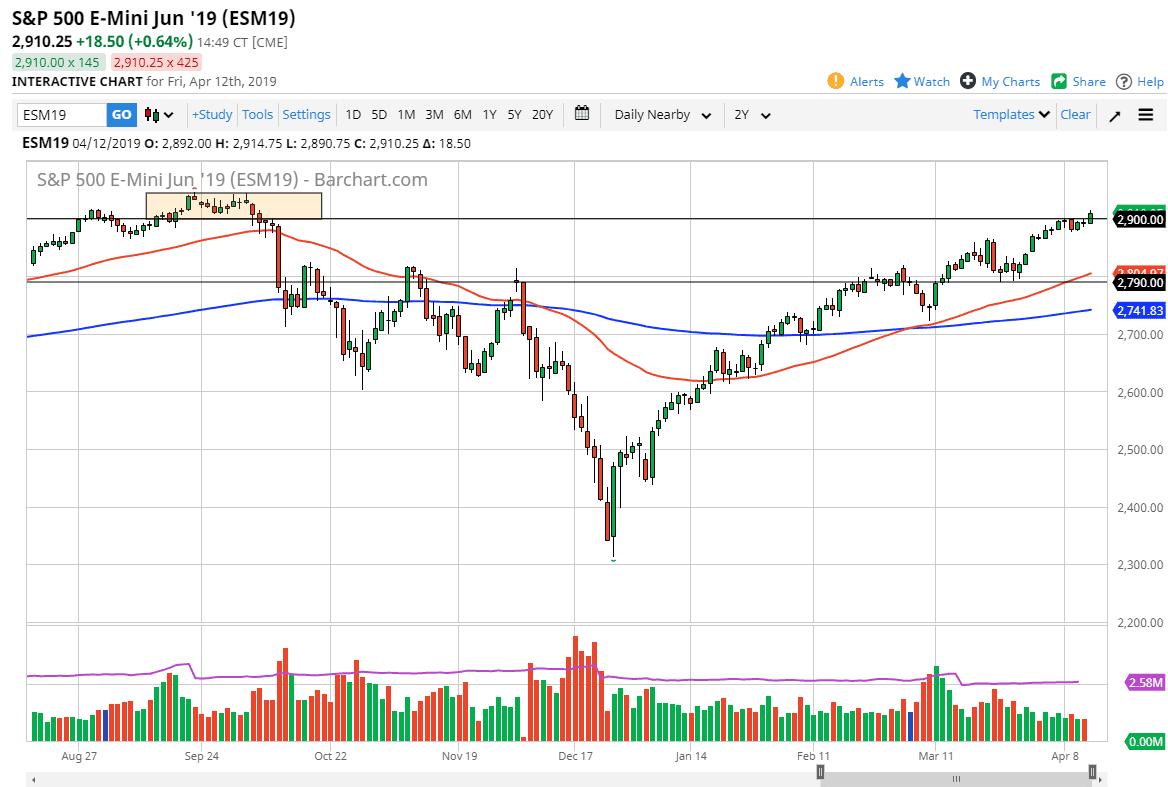

S&P 500

The S&P 500 rallied a bit during the trading session on Friday, breaking above the crucial 2900 level. However, there is still a lot of resistance between here and the 2940 level and wet the daily chart doesn’t show you it’s just how erratic the trading was during the day. Volume just wasn’t there and therefore it’s not as impressive as it looks.

Initially, the Asians and the Europeans push this market higher, but by the time the Americans came on board it wasn’t quite as straightforward buying. In fact, the initial surge during New York trading was to start selling off. We did recover, and most certainly we are in and uptrend so you have to favor the upside. However, the main take away here is that the green candle isn’t as impressive as it appears at first blush. More than likely we are going to see buyers on dips at best.

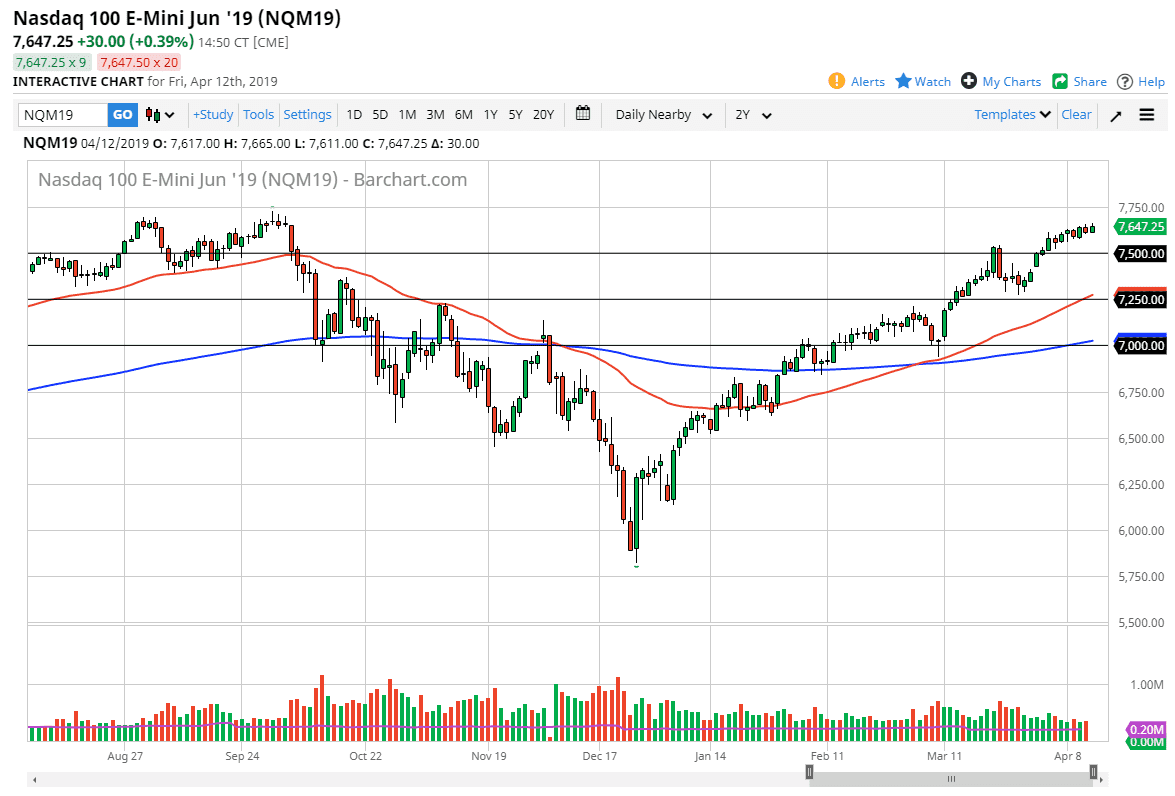

NASDAQ 100

The NASDAQ 100 went back and forth during the trading session on Friday, as we continue to test the 7700 level. We could not break above there, and it now looks as if the market is simply going to grind sideways overall, perhaps even pull back to find buyers underneath. The 7500 level should be massive support, so a break down below there could open the door to another 200 or even 250 point loss. I do like buying pullbacks, as it gives you a chance to pick up a little bit of value. If we can break out to the upside and above the 7750 level, then the NASDAQ 100 will probably drag the S&P 500 right back to the upside with it. I don’t have any interest in shorting but recognize that we are stretched.