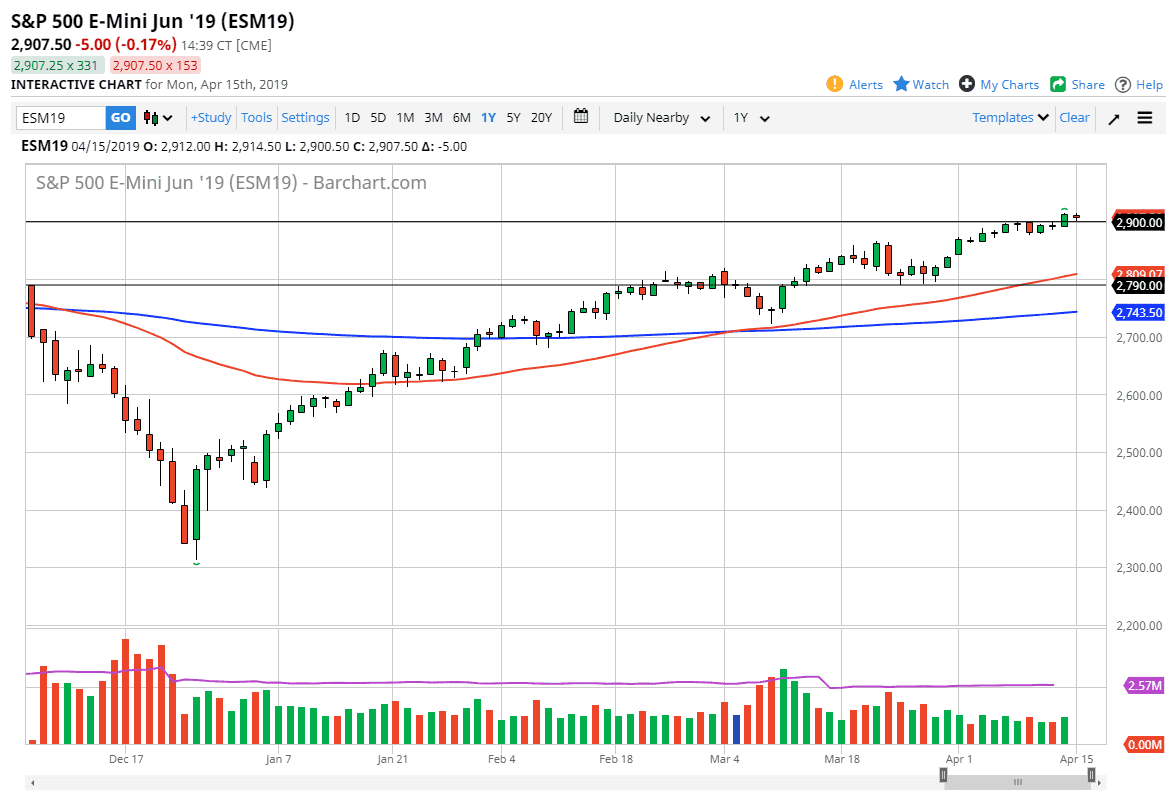

S&P 500

The S&P 500 fell a bit during the trading session on Monday as traders came back to work, but at this point we are still very much in a bullish trend, and the fact that the day was fairly quiet is probably a good sign overall. After all, if people are concerned about being in this neighborhood, they would be leaving rather quickly. We are at extraordinarily high levels, and the fact that the market is relatively quiet here suggests that people are quite comfortable, meaning that they are more than likely going to be buying yet again.

I think at this point, it’s very likely that we will find value hunters underneath on pullbacks, and therefore I am a buyer of those dips and not interested in shorting this market. In fact, I would not be a seller of the S&P 500 until we break down below the 2790 handle.

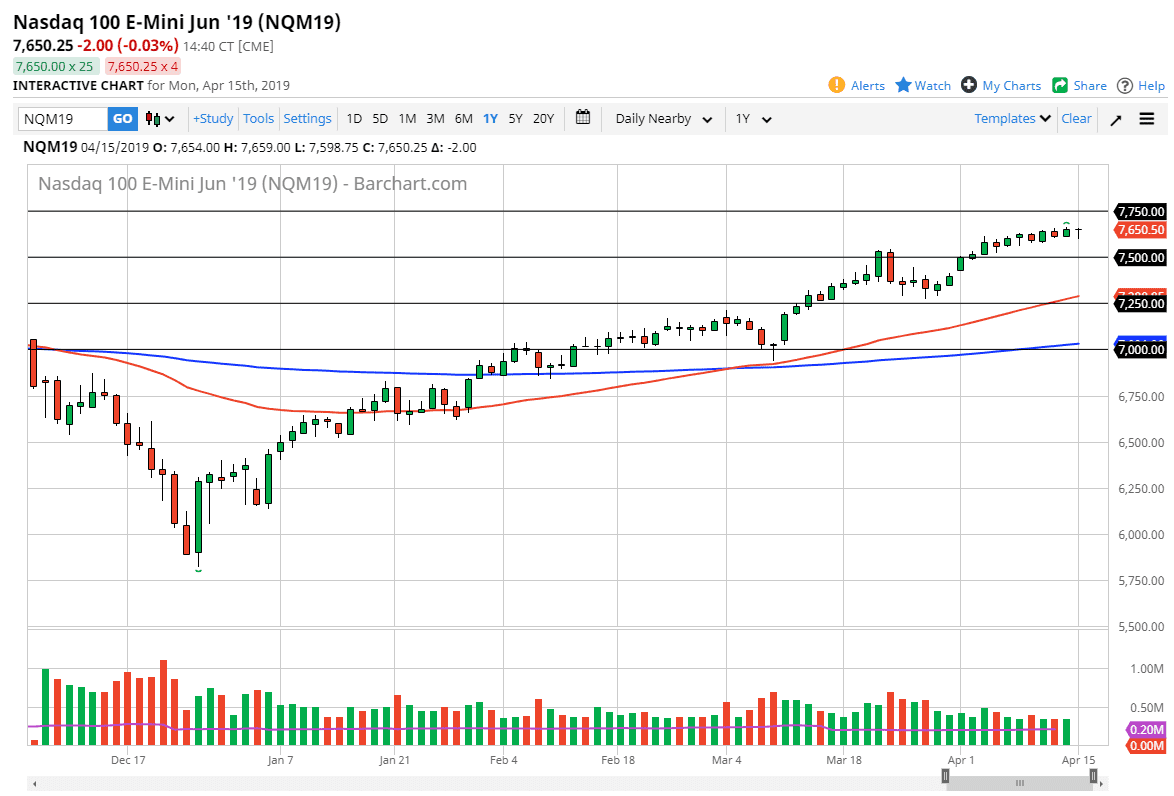

NASDAQ 100

The NASDAQ 100 initially fell during trading on Monday as well, reaching down towards the 7600 level. However, we have bounced significantly to form a hammer and therefore it tells me that the market is still looking to go higher. If we break above the top of the range for the trading session, essentially the 7650 level, then I think we go looking towards the 7750 handle after that. Otherwise, if we break down below the 7600 level I would anticipate that there is a lot of support underneath at the 7500 level which of course is a large come around, psychologically important figure.

We are in an uptrend, so at this point it’s impossible to sell this market. Looking at this chart, it clearly shows that although we have slowed down as of late, we are still very well supported underneath.