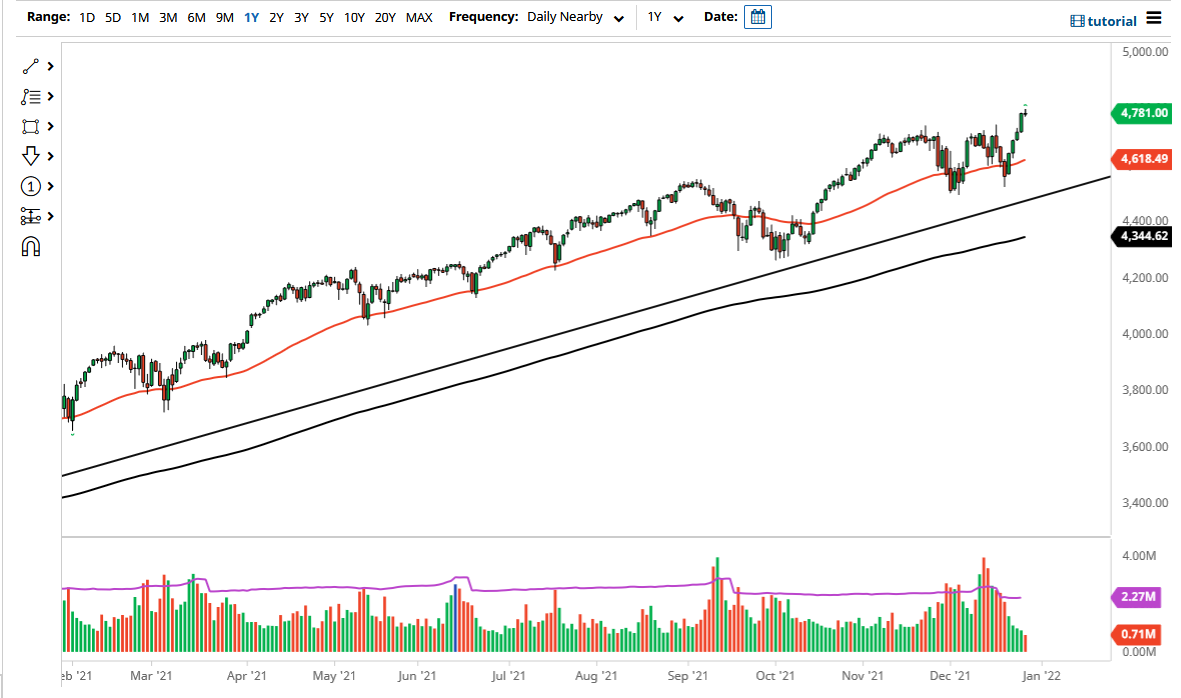

S&P 500

The S&P 500 rallied a bit during the trading session on Tuesday, but then turned around to form a shooting star. The shooting star of course is a negative sign and it looks very likely that we will continue to see a bit of back and forth trading and perhaps we may need to pullback enough to find value underneath. This is a market that had been pressing major resistance as of lately, and at this point I think this is a situation where we will probably have a lot of people getting out of the market, either to take profits or simply out of fear.

In general, I believe that the 2880 level should be support, followed by the 2850 handle and then the 2790 handle. I have no interest in shorting this market yet, as it is very bullish and I think at this point we were likely see the red 50 day EMA also offer support. If you are bullish of this market, and quite frankly at this point there’s no reason to be anything but, you may find the next couple of days better left alone. However, if we break above the top of the shooting star, that could send this market towards the 2940 handle.

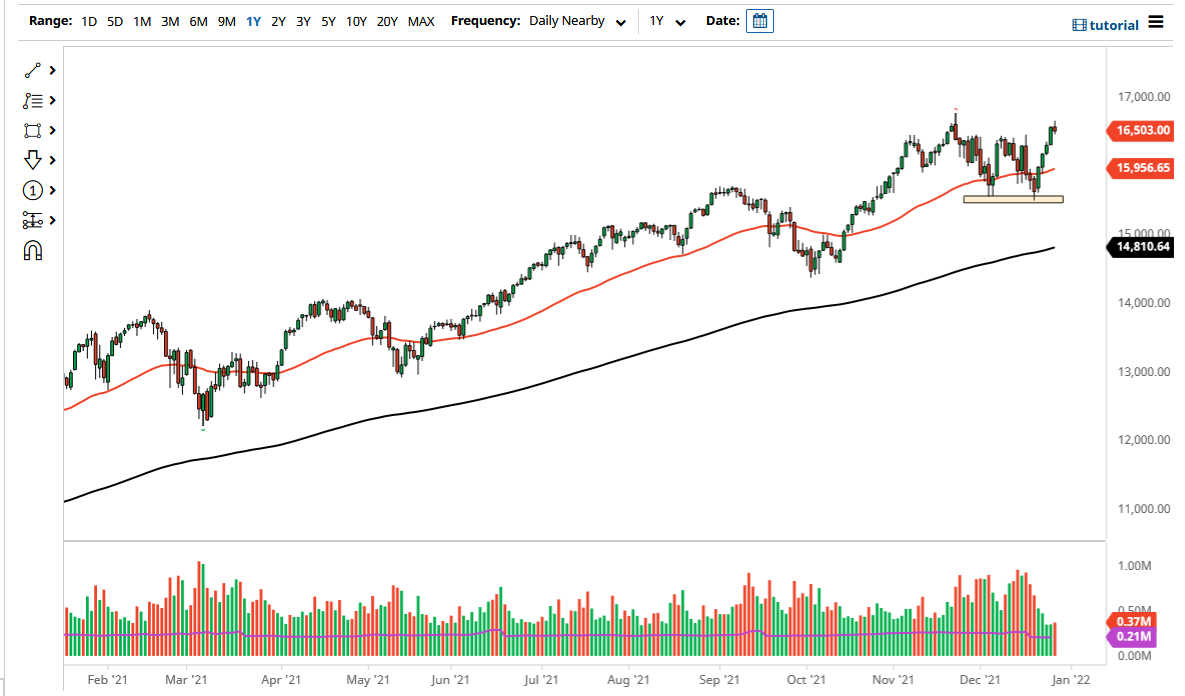

NASDAQ 100

The NASDAQ 100 initially tried to rally during the trading session as well, but then rolled over to show signs of exhaustion. The 7700 level offered a bit of resistance, but then the 7750 level above is also resistive. At this point in time I think it’s only a matter of time before we roll over and try to find value at lower levels. That value should find itself represented in the form of the 7500 level. Markets continue to look bullish, but we are in the middle of earnings season so it’s not can it take much to spook them. Look for value underneath.