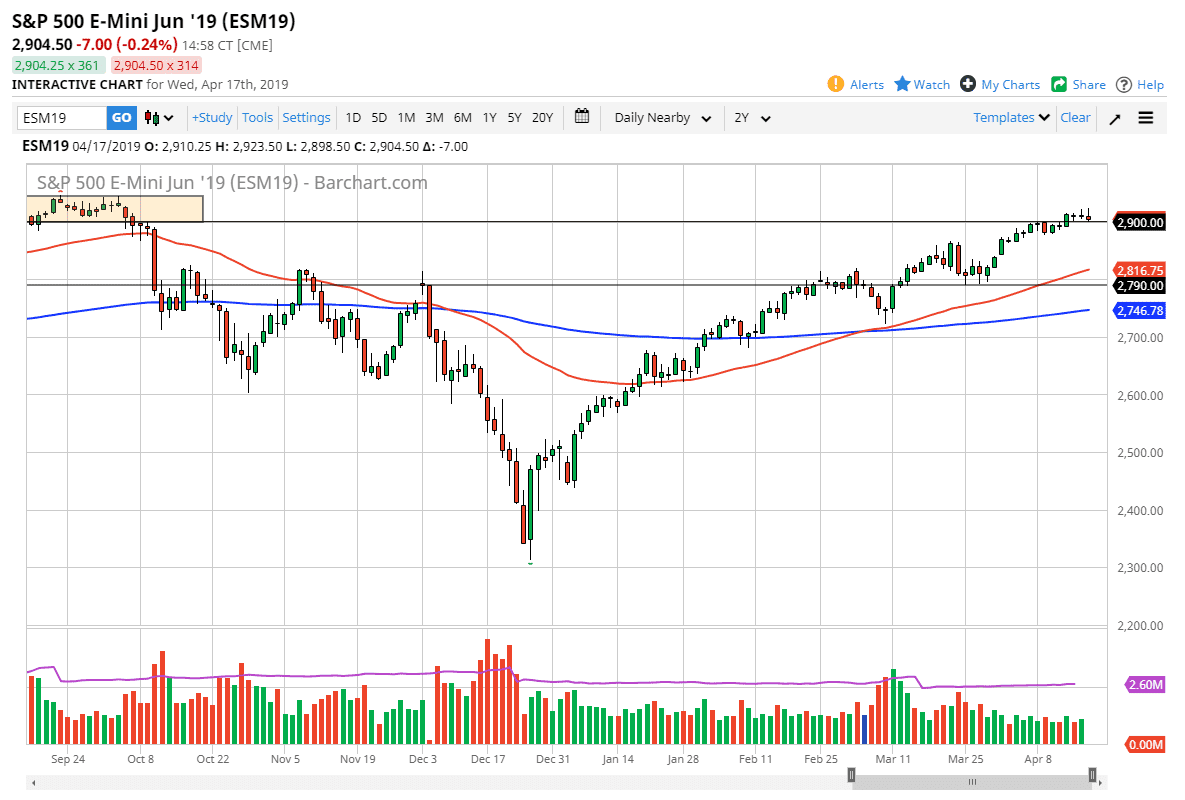

S&P 500

The S&P 500 finally choked up some losses during the trading session on Wednesday after we initially tried to rally. By forming the shooting star that we have, it does look like we are going to run into a bit of trouble, as the market continues to grind through earnings season. At this point though, we are still very bullish longer-term, as we have been in a nice uptrend, but one should be noted that the market looks rather soft in the short term. At this point it’s probably more likely to offer a buying opportunity on a dip than anything else, and that it could be coming immediately. If we were to break above the top of the candle stick for the trading session on Wednesday though, that would be an extraordinarily bullish sign and could send this market towards the 2940 level eventually.

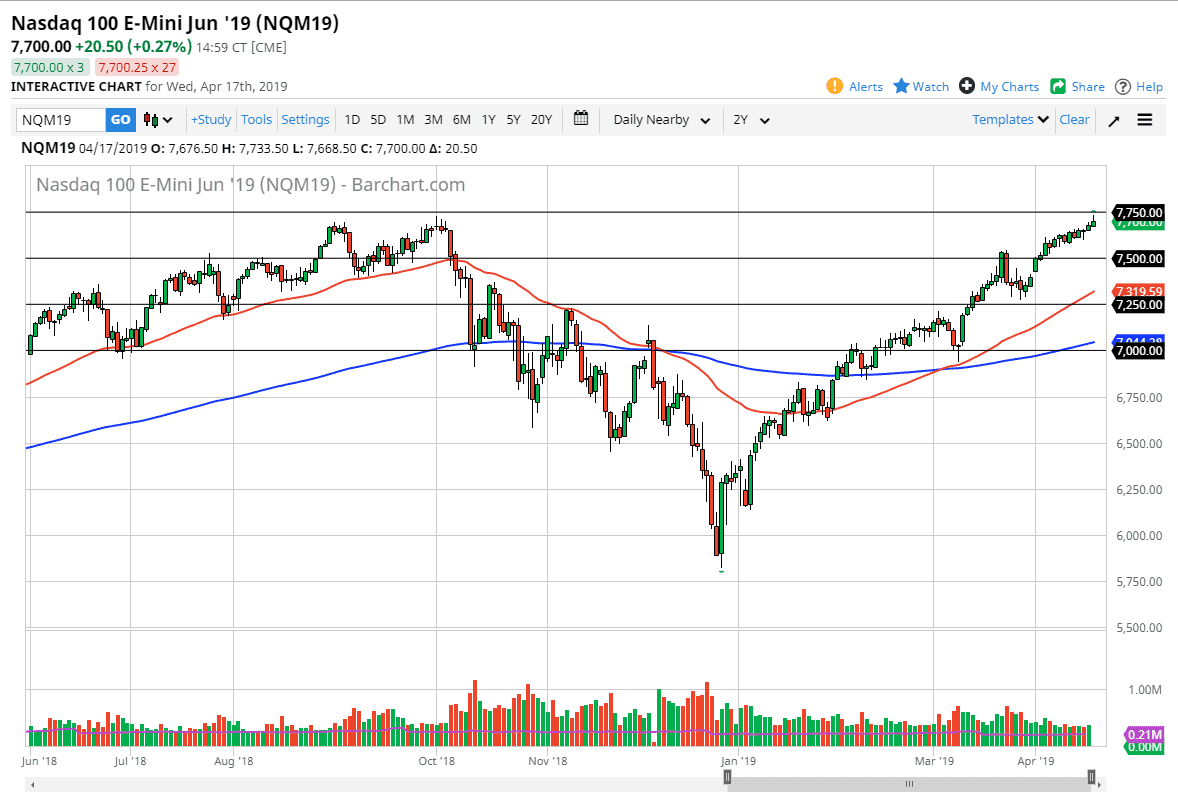

NASDAQ 100

The NASDAQ 100 also tried to rally during the trading session on Wednesday but gave back the gains as we hit far too much in the way of resistance. It looks like a pullback could be coming, but at this point it’s very unlikely that the pullback will be anything of substance, because the market has been in a bullish trend for quite some time. The 7500 level underneath should be massive support, so even if we do fall rather significantly, it is only a matter of time before the buyers come back in to pick this market up.

I have no interest in shorting the NASDAQ 100, at least not yet and I believe that there are far too many supportive levels underneath the 7500 level to be comfortable shorting anytime soon. However, as we are heading into a long weekend it’s very likely that volume will continue to be thin at the very least.