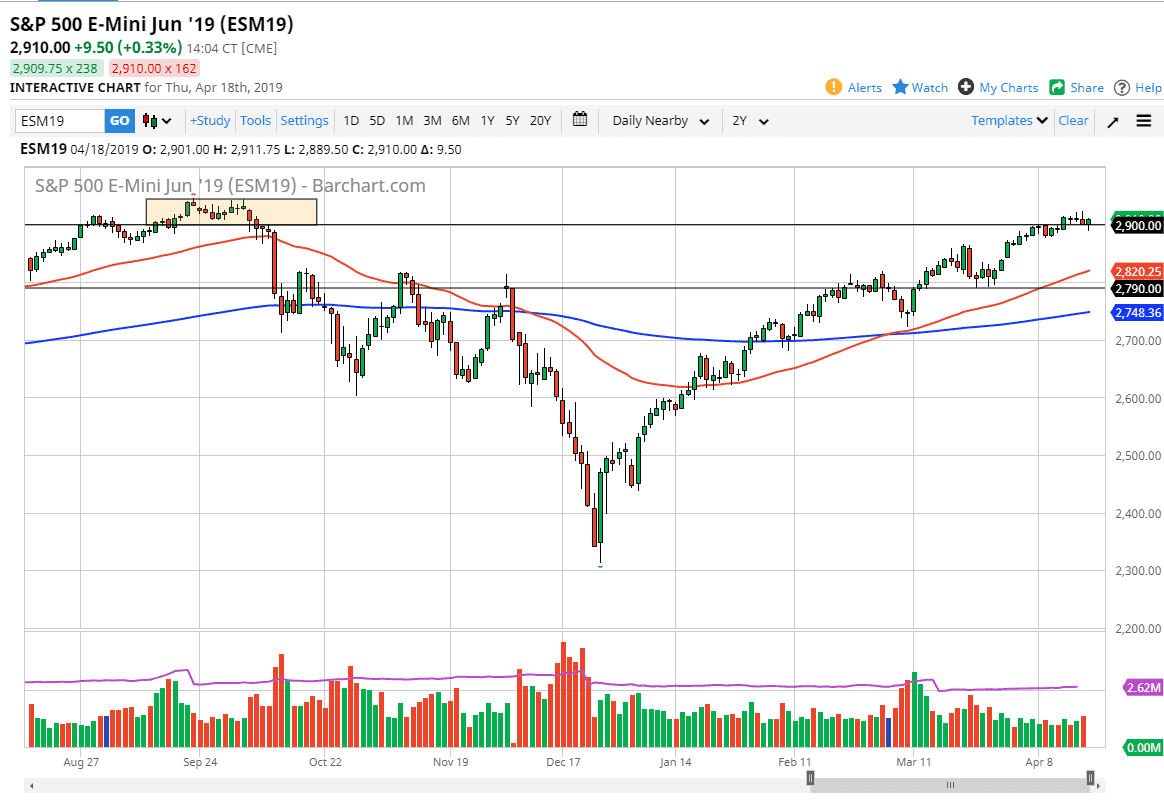

S&P 500

The S&P 500 initially fell during trading on Thursday but found buyers after we broke down below the 2900 level. This is a simple “buy on the dips” attitude that we see jump into this market, and at this point the market looks as if it is simply rotating in this area as we have no driving force to send this market in one direction or another ahead of Good Friday. Obviously the markets will be closed on Good Friday and the CFD markets should be ignored. With that being the case, it looks as if we have had a really flat week. With earnings season in full tilt though, it’s very likely that we should get significant momentum come back in and move this market. I still believe in buying dips until proven otherwise with an eye on the 2880 handle for support, the 2850 handle for support and the 2790 level as well.

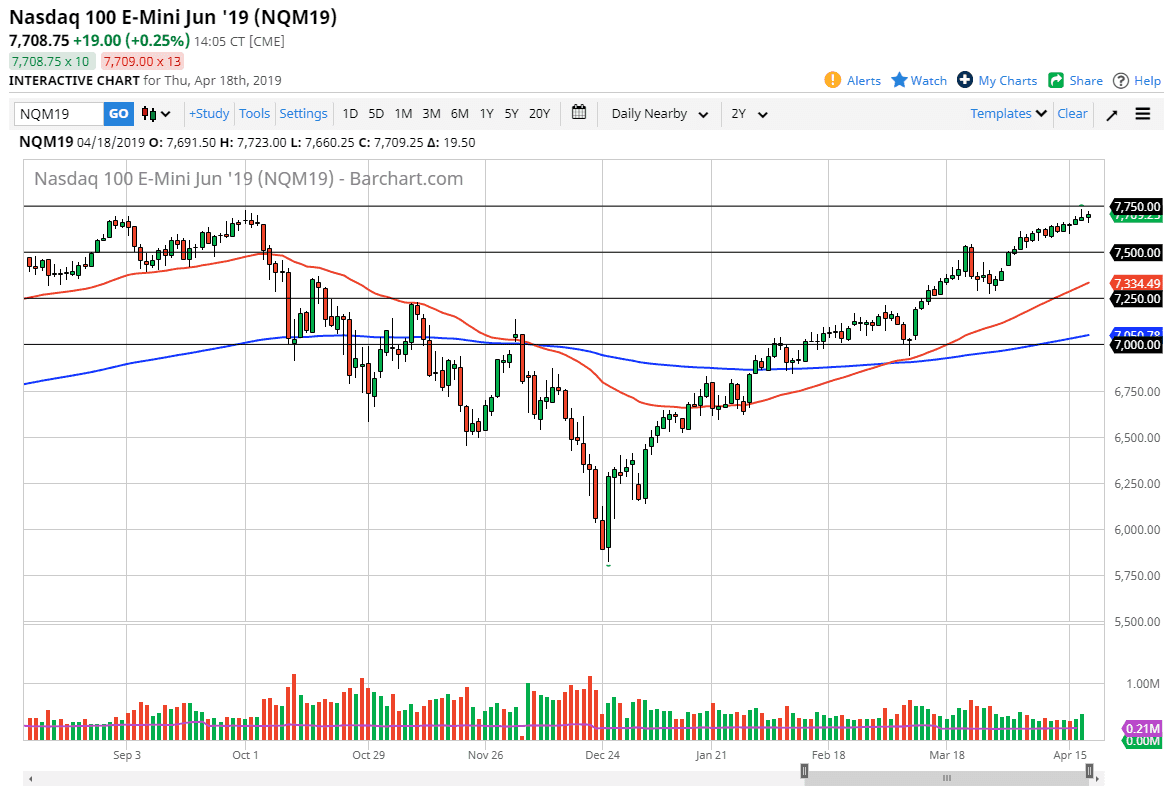

NASDAQ 100

The NASDAQ 100 went back and forth during the trading session on Thursday as well as we continue to see a lot of resistance at the 7750 handle. Ultimately, this is a market that looks as if it is struggling to break out, so I think that we may get a pullback here as well. Nonetheless, we are very much in and uptrend and a lesser some type of disastrous earnings season, I suspect that the NASDAQ 100 will eventually find a reason to break out. Below at the 7500 level I would have to believe that there is a lot of volume just waiting to jump in and take advantage of value, so that’s what I’m going to do, wait for some type of pullback to start buying early next week.