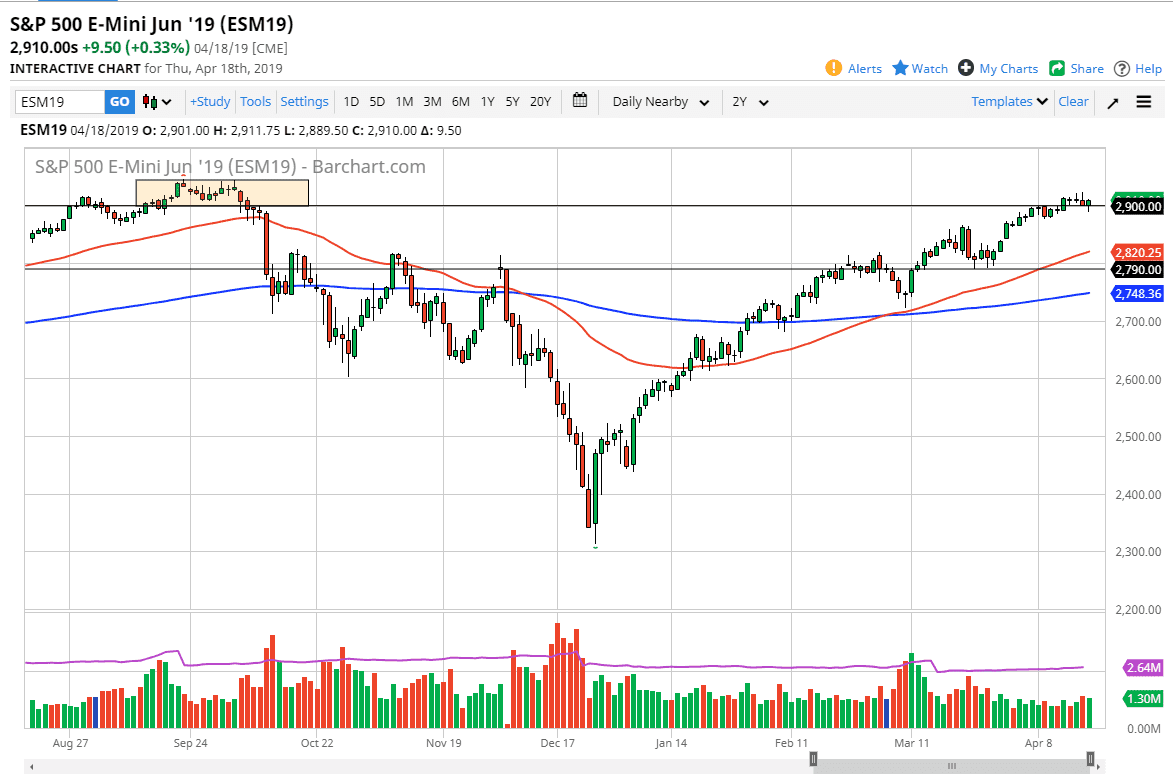

S&P 500

Obviously, the S&P 500 didn’t trade during Good Friday, but we have seen quite a bit of action over the last week that was choppy to say the least, and it’s likely that the market is simply killing time heading into the Easter weekend. Now that we are going to go through their, the reality is that we should see more of a reaction to earnings season. If we pull back from here, it’s very likely that we should find buyers at the 2880 handle, and perhaps even the 2850 level. As for the bottom of the overall uptrend right now, I think it’s closer to the 2790 level. If we were to sliced through there it would change a lot of things.

However, we could break to the upside and trying to get towards the highs of last week, and then perhaps reach towards the 2940 area, testing the all-time highs. A break above there could reach towards the 3000 handle. All things being equal, it is a much more bullish than bearish market but a pullback could come so therefore we must be willing to take advantage of the value when it occurs.

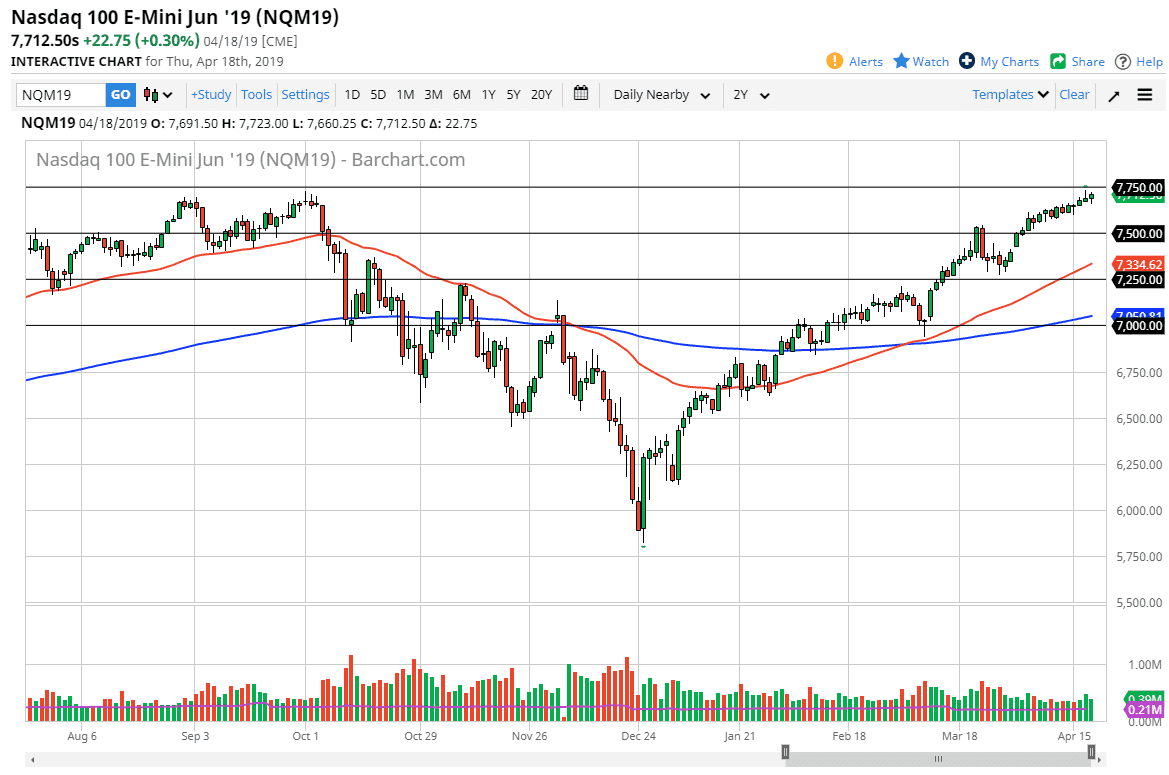

NASDAQ 100

The NASDAQ 100 has made a new high again, as we close the books on Thursday. We are now testing the 7750 level, an area that is crucial and important. Overall, I suspect that pullbacks will continue to be bought over here as well, and that if we break above the 7750 level, we could go to the 8000 level. To the downside I see the 7500 level is massive support, as well as a gap at lower levels, closer to the 7400 level. Either way, I don’t see much opportunity in shorting US stock markets right now.