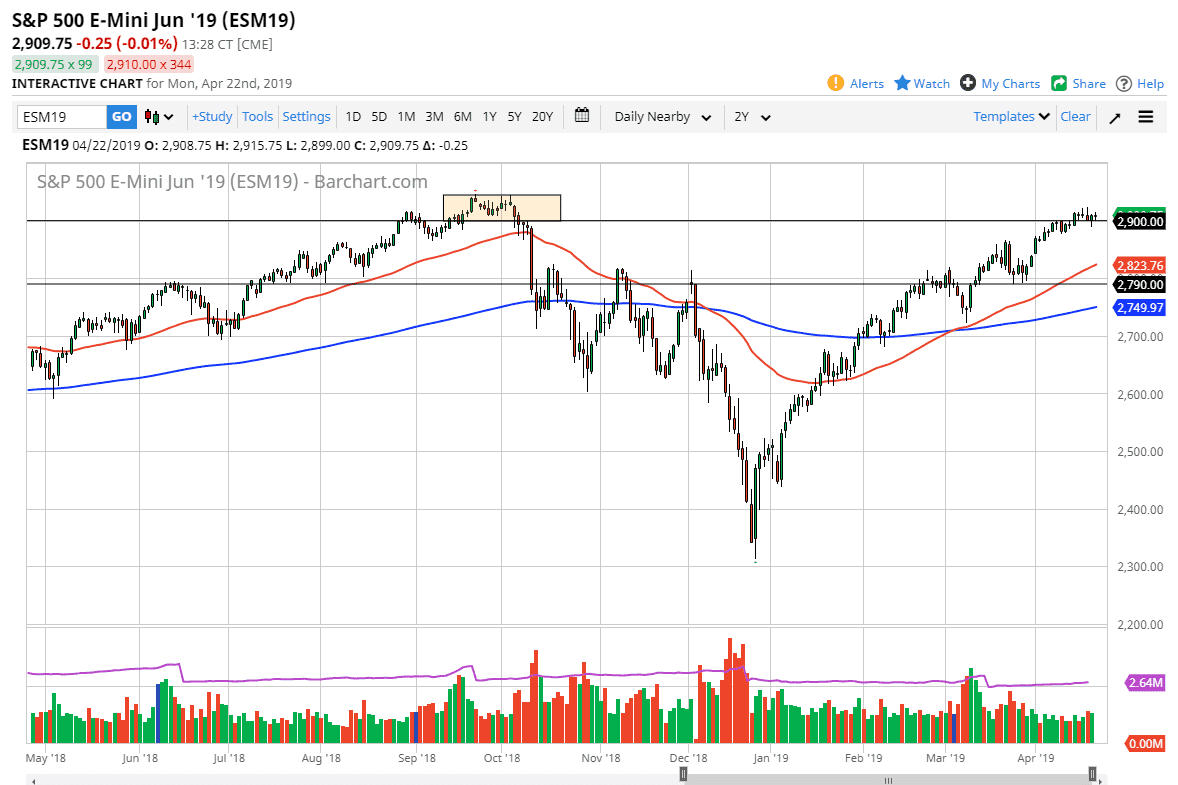

S&P 500

The S&P 500 has gone back and forth during the trading session on Monday as Europe was asleep due to the Easter Monday holiday. With that, there was no volume coming from overseas and there was nothing out there to move the market. We are hanging about the 2900 level, which of course is a larger round figure that will attract a lot of attention. There is significant resistance towards the 2940 level, so it makes sense that we are going to continue to simply meander around.

If we do pull back, and it wouldn’t surprise me at all, the 2880 level would be an area where buyers could return. Below there, the 2850 level could attract buying pressure as well, and then finally the 2790 level. Overall, I think that we are in need of some type of catalyst to go higher, but we are in the middle of earnings season so who knows? All things being equal though notice that I did not say anything about selling. Pullbacks make sense for value.

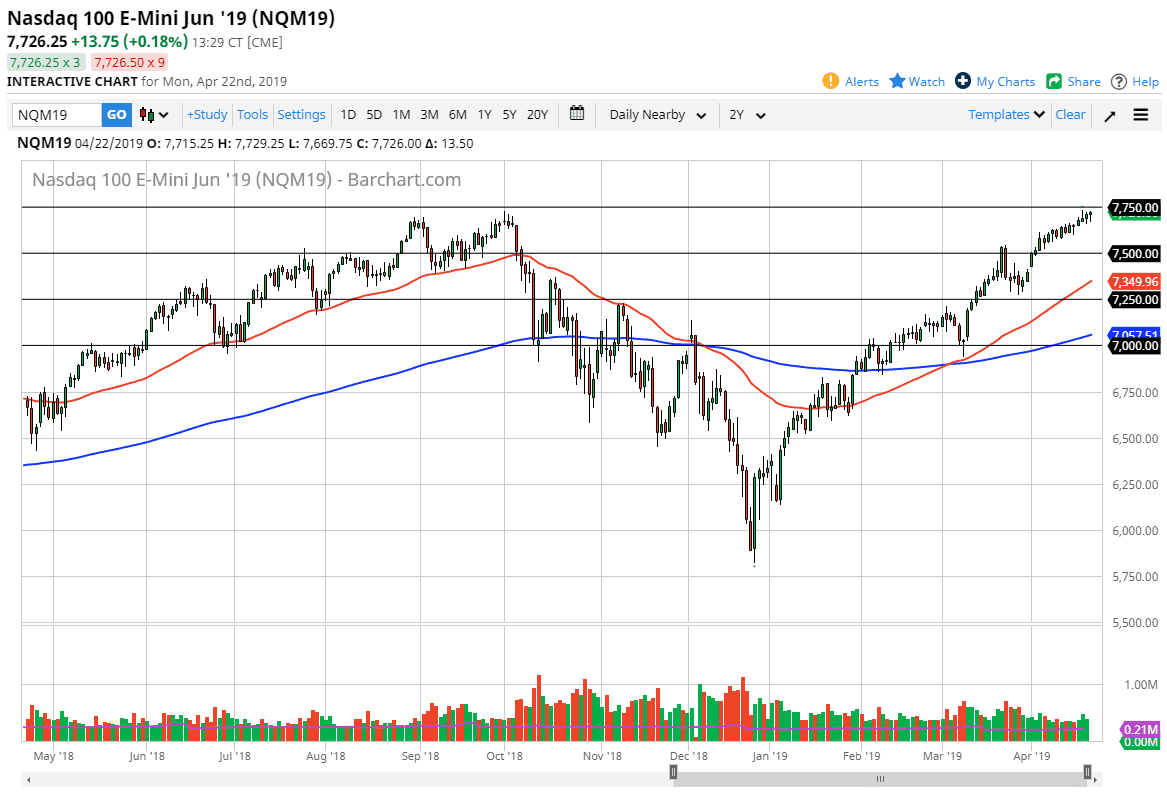

NASDAQ 100

The NASDAQ 100 initially fell during trading on Monday but then turned around to form a hammer like candle as we continue to grind higher. The 7750 level of course is psychological resistance but we have actually hit a fresh high and the NASDAQ 100 and as a result it certainly looks bullish. I would not be a seller of this market under any circumstances in the near term and look at pullbacks as opportunities to pick up a bit of value in a market that has been leading the way. If we can clear 7750, then I think the market goes looking towards the 8000 level over the longer-term.