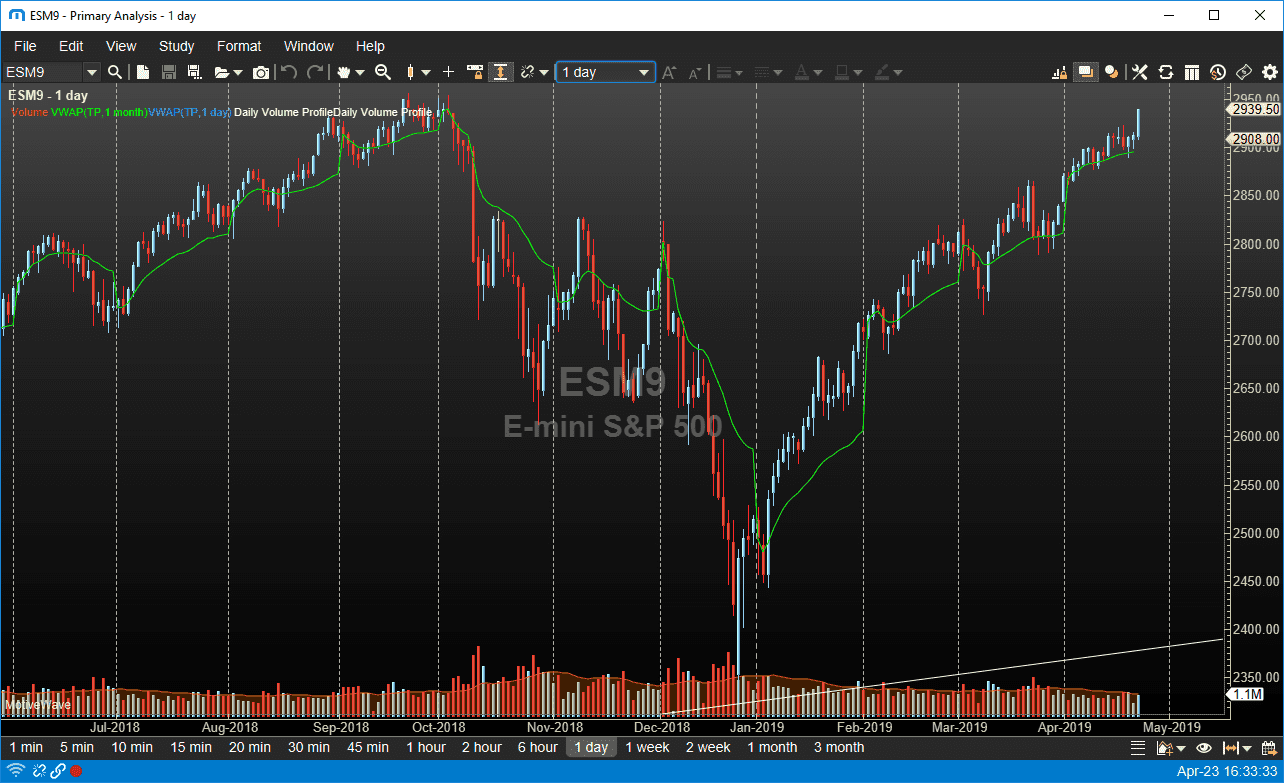

S&P 500

The S&P 500 ripped to the upside during the trading session on Tuesday, as we finally broke above the 2920 level. In fact, we closed right at the highs of the day, so that is a very bullish sign and it looks like we could very well go looking towards the all-time highs rather soon. Were in the middle of earnings season, so quite frankly that could happen right away. Pullbacks could happen, but at this point I would have to believe that they are value, especially if we reach down towards the 2920 handle, an area that will attract a lot of attention. The strength of the move was rather impressive during the day, and volume was decent. With that being said and the fact that VWAP from the monthly timeframe was sitting just below the last couple of candles, it makes sense that institutional flow continues to press forward, and it looks like a breakout is coming rather soon.

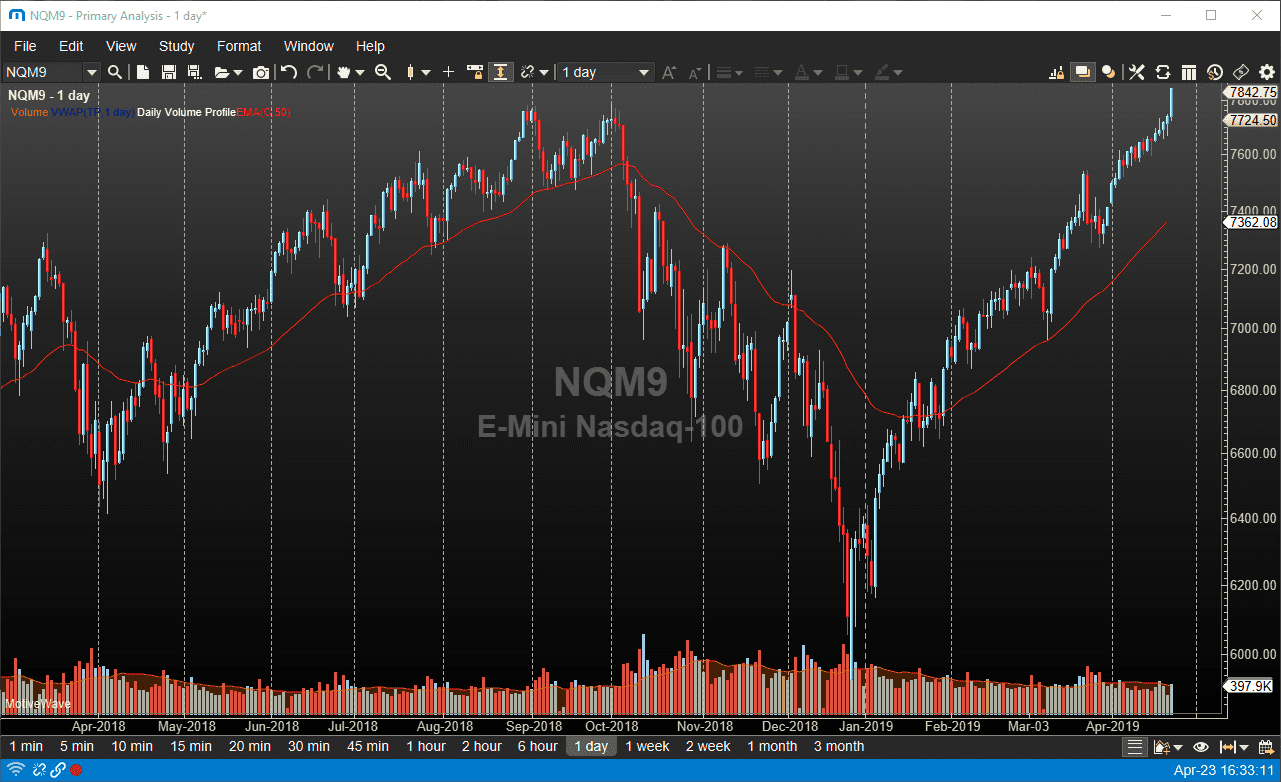

NASDAQ 100

The NASDAQ 100 was also straight up in the air during the trading session on Tuesday, but unlike the S&P 500 we have already made a fresh all-time high. At this point any pullback should be thought of as a gift, and the 7750 level should be rather supportive. However, it would not surprise me at all if we could even break down to that area and therefore I would look to short-term charts for an opportunity to pick up a bit of a bounce. This is a market that cannot be sold, and it looks as if it is going to continue to lead the way. Remember, there are handful of big companies such as Facebook that have an inordinate amount of influence on the NASDAQ 100, so keep that in mind.