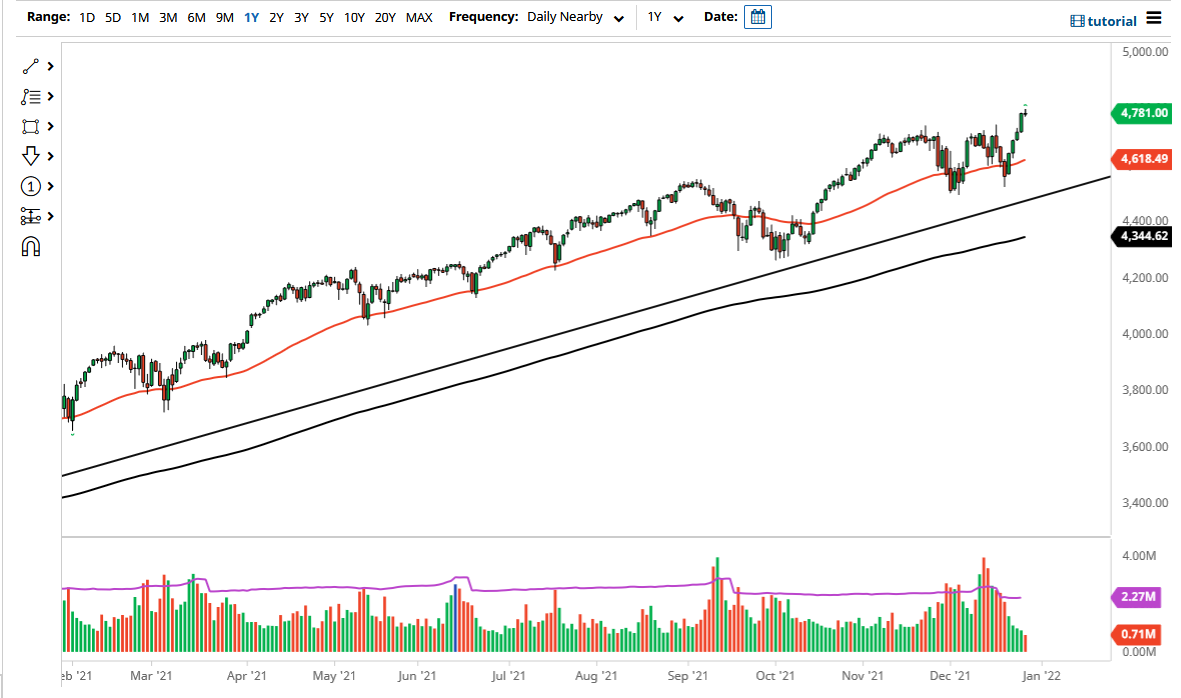

S&P 500

The S&P 500 rallied over the last several weeks as you know, but the Tuesday session was a completely different scenario. We broke the bottom of the hammer from the candle stick on Monday, which is what makes the hammer turn into a “hanging man.” With that being the case, it’s a very negative sign and it’s very likely that we will probably continue to drift a bit lower. That is acceptable from both sides of the conversation though, because we have reached a large, round, psychologically significant figure.

As we are approaching the highs, it makes sense that there would be a little bit of fear. Beyond that, we have had some headlines out there that have chopped up the market as well, including the IMF cutting global growth forecasts. There are also negative connotations to the possibility of a US/China trade deal, which looks less likely in the short term. Overall, we are overextended so a pullback makes sense I would suspect it will only end up offering a bit of a momentum building exercise and buying on the dips continues to work.

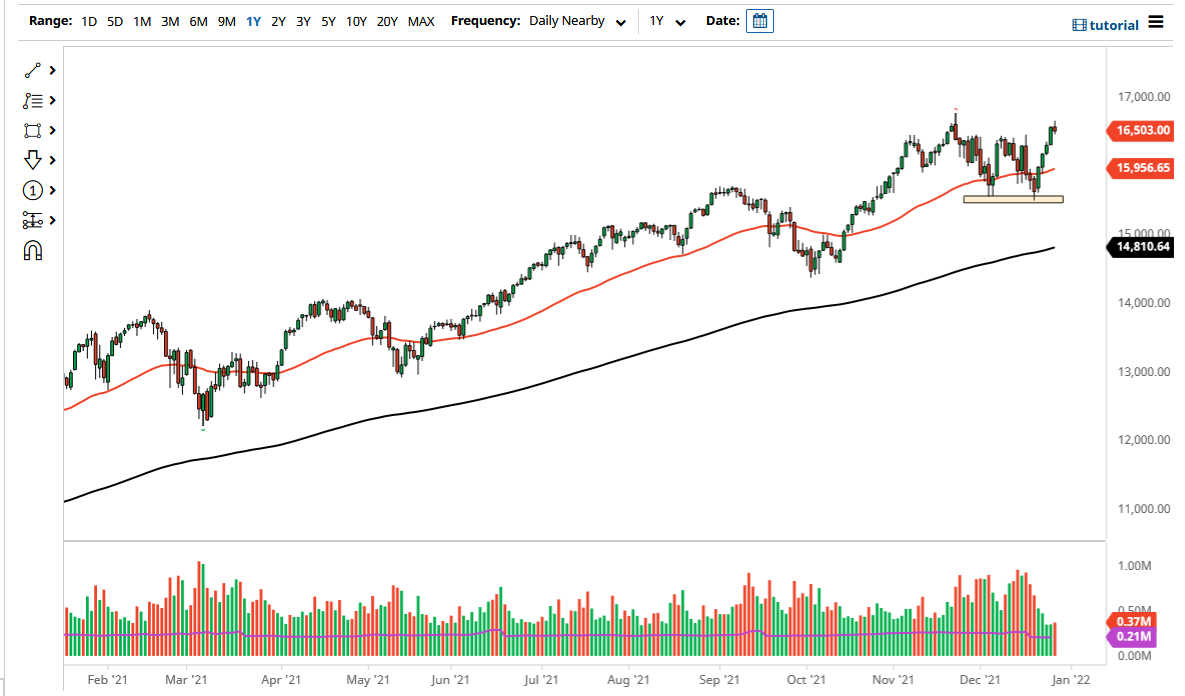

NASDAQ 100

The NASDAQ 100 has pulled back a bit as well, but on a relative strength basis still look stronger than the S&P 500. The 7500 level underneath will be supported, but quite frankly we may not even get down there. If we do test that area, I think a lot of value hunters will come back into the marketplace to take advantage of it. This is a market that has been leading the way and would more than likely continue to do so as it continues to hold up better even on the negative days. Overall, I’m still positive but I think that a little bit of value hunting on this dip might make sense.