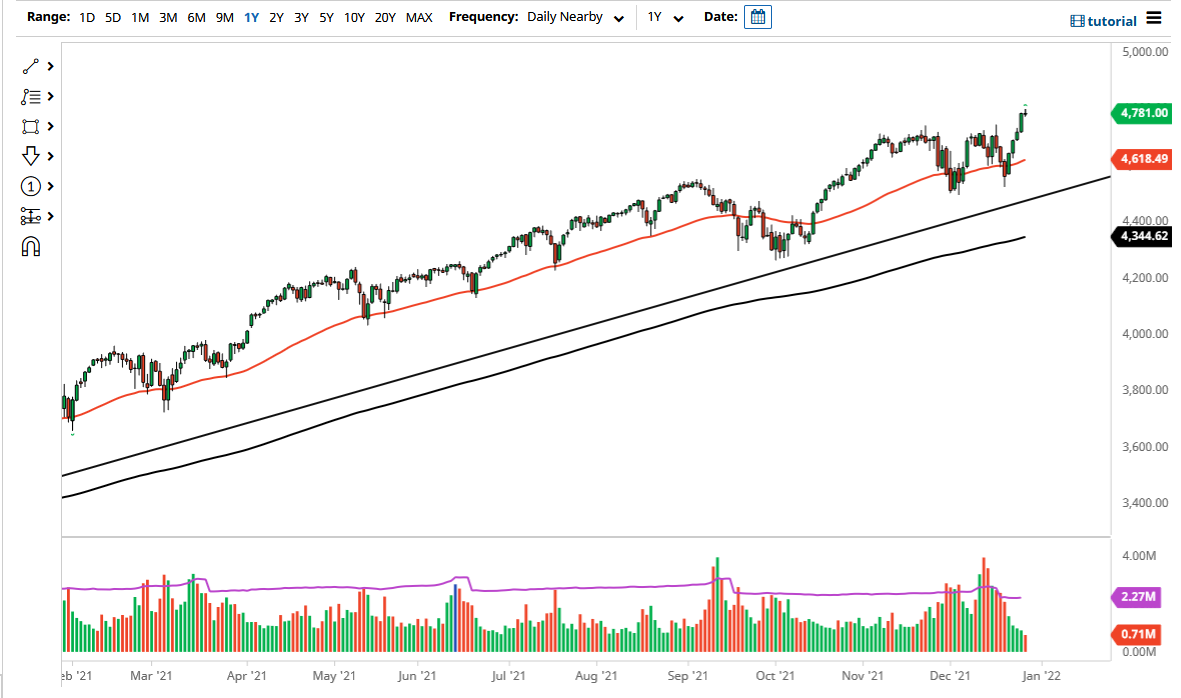

S&P 500

The S&P 500 has rallied again during the trading session on Friday after the jobs number came out. However, we have stopped just shy of 2900 late in the day, so it looks as if this area is going to continue to be massive resistance. That doesn’t mean that we can’t break above it, just that we may need to pull back a little bit to build up the necessary momentum to finally do so. I also recognize that we have traded above 2900 previously, so at this point the real test isn’t necessarily just the 2900 level, but the all-time highs that sits just above.

Looking at the chart, we could pull back as far as 2790 and still be in a very strong uptrend. However, I’d be surprised if we pull back that far. Other potential buying opportunities could present themselves closer to the 2850 level which has attracted a lot of attention as well.

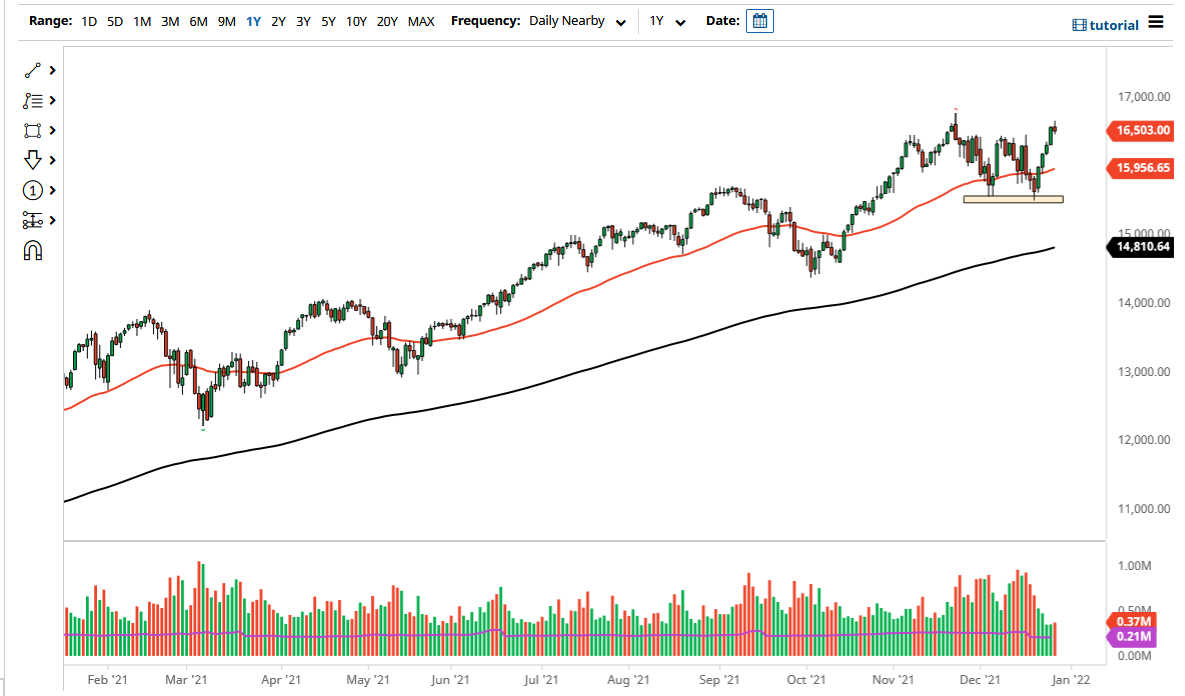

NASDAQ 100

The NASDAQ 100 has rallied significantly during the trading session on Friday as well, but we have not reached all-time highs either. At this point, the 7500 level will offer support from what I see, but we also have a gap from the beginning of the week that is closer to the 7400 level that is possible to be reached towards as well. If we break out above the 7750 level, then the market could go much higher. We are obviously in a very bullish trend, so don’t have any interest in shorting this market although I am the first to admit it desperately needs to pullback in order to pick up more buyers overall and keep up the longer-term uptrend. For me, the 7250 level is the “floor.”