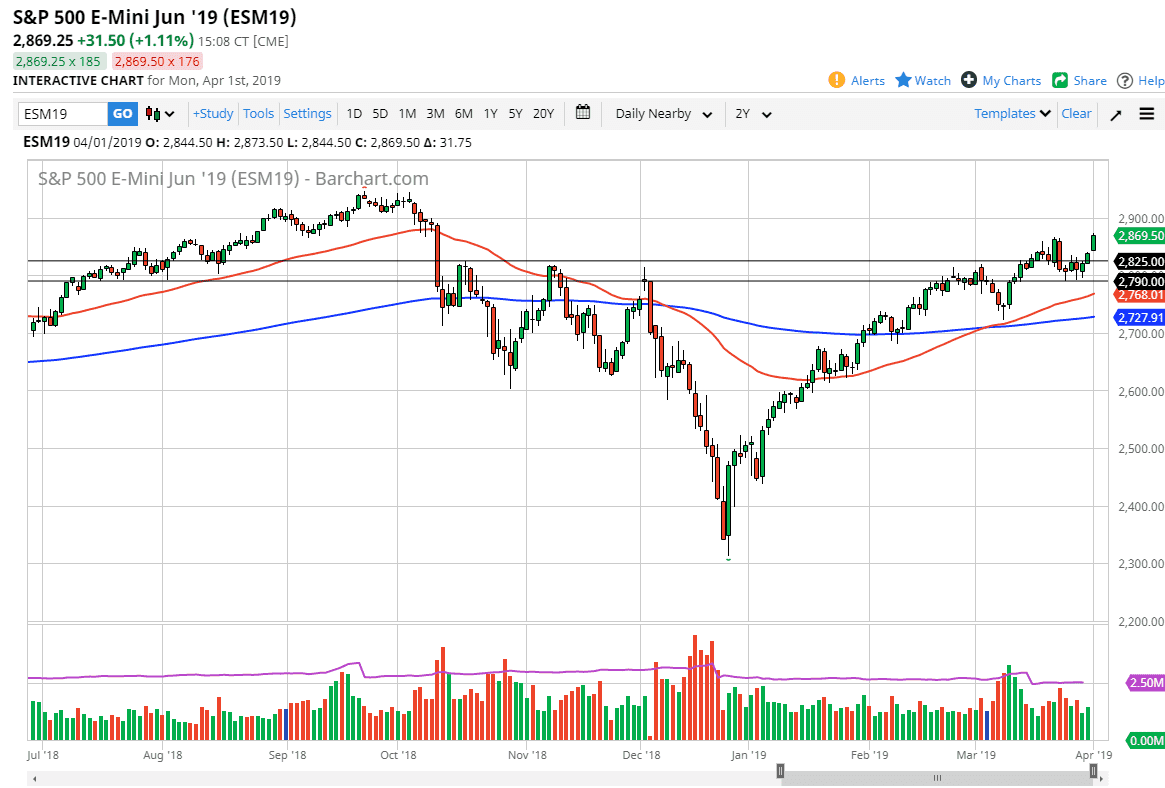

S&P 500

The S&P 500 took off like a rocket during the trading session on Monday, gapping higher and then shooting to a fresh, new high. By making the move it has, it looks as if this week is going to be a continuation of the buying that we had seen, and that the buyers are most certainly in control. The 2900 level above is a major barrier to overcome, and I think at this point you have to look at this market is one that you should be buying on dips as it offers plenty of value.

This isn’t to say that it’s going to be easy to get up there, but I do think that eventually we will. Underneath, I would anticipate the bottom of the Monday candle to be rather supportive, followed by the 2825 level, and most certainly the 2790 level which has been extreme support recently.

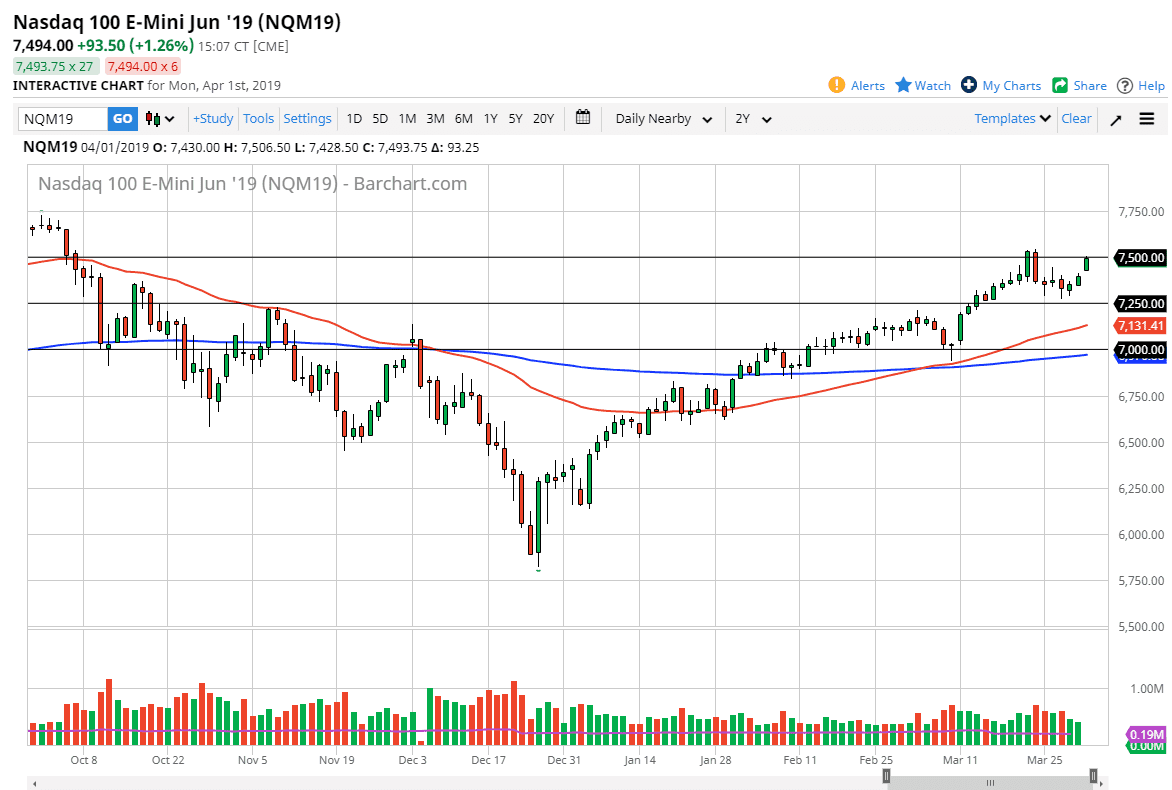

NASDAQ 100

Obviously, the NASDAQ 100 has follow right along, gapping at the open and then slamming into the 7500 level. There is a lot of resistance just above so I would anticipate a short-term pullback but for me it’s obvious that the market will continue to try to reach to the upside. In fact, it looks like a general “risk off” attitude is coming into play, and that of course will affect the NASDAQ 100 and of course the S&P 500. With all that being said, buying dips continues to be my best set up, with the 7400 level underneath offering plenty of support. To the upside, if we can break above the 7500 level we are probably going to go looking towards the 7700 level after that.