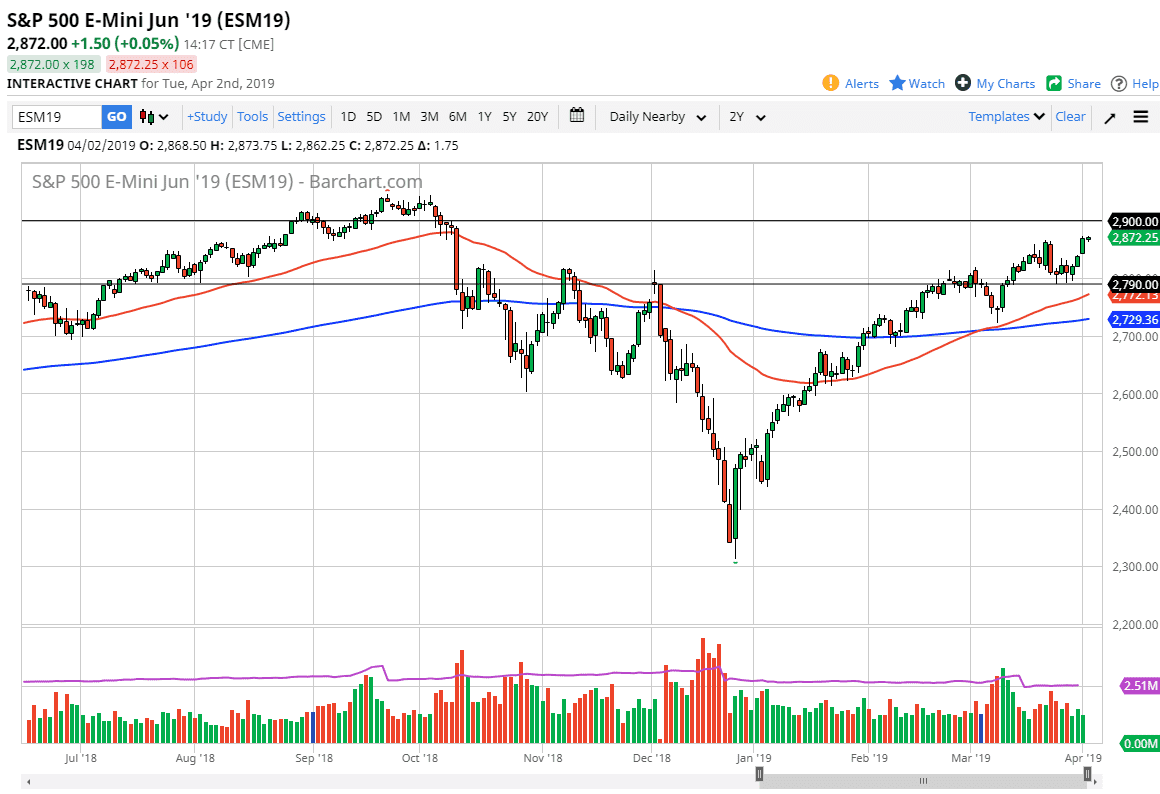

S&P 500

The S&P 500 has eked out a slight amount of gains during the trading session on Tuesday, as we are starting to run into a bit of resistance. At this point, it’s likely that we could get a short-term pullback but I think that will be a buying opportunity. To me, it’s obvious that the market has shown that it wants to go looking towards the 2900 level above. That is an area that of course will attract a lot of attention not only due to the previous selloff at that point, but also at the fact that it is a large come around, psychologically significant figure.

To the downside, the 2790 level continues to be massive support, and as we have had a “golden cross” happened recently, it’s yet another reason to think that the markets will continue to attract money. However, I recognize that the 2900 level is a significant threat.

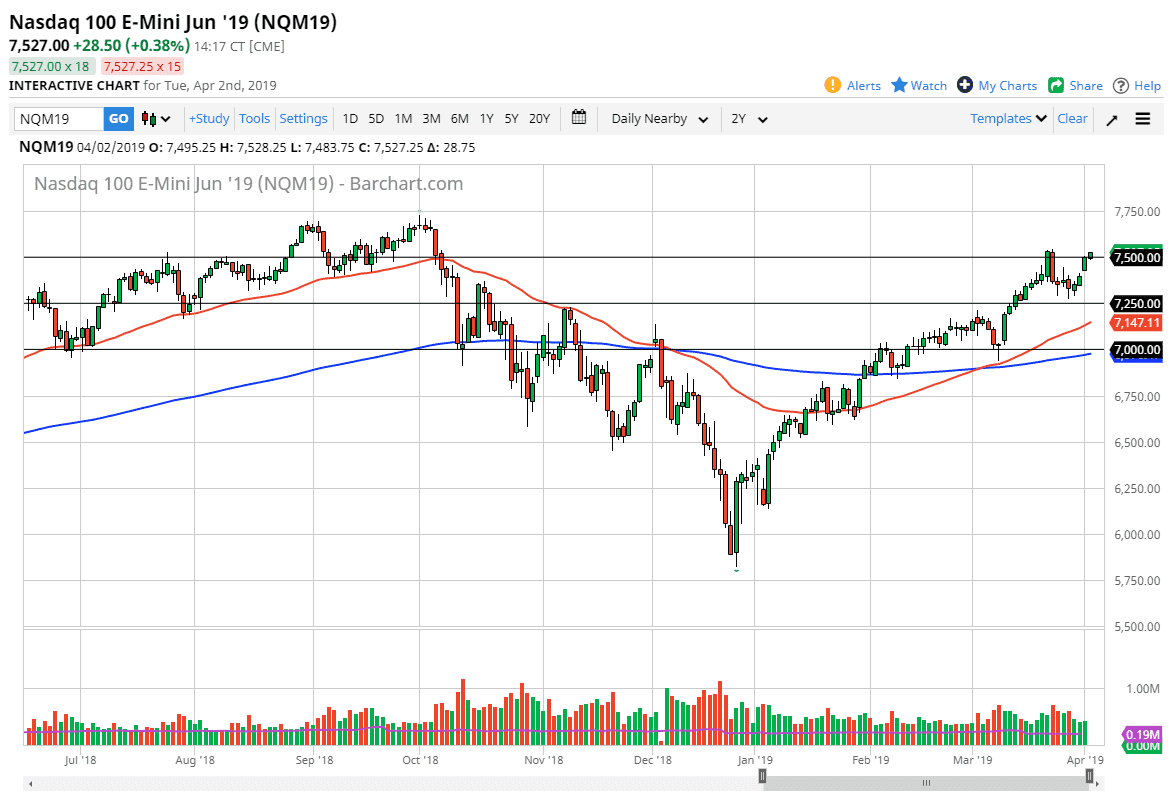

NASDAQ 100

The NASDAQ 100 has rallied a bit during the trading session on Tuesday, as we continue to press towards the highs. However, at this point it’s likely that the market participants will continue to look to the NASDAQ 100 initially, as it represents large technology companies that will quite often lead the way. At this point, the market should continue to find quite a bit of volatility, so I think at this point it’s likely that we will find buyers on dips as they occur. However, if we do break to the upside right away, we could then go looking towards the 7700 level which was the previous high back in October 2018. The 7250 level underneath is massive support, so if we broke down below there we could very well fall even further.