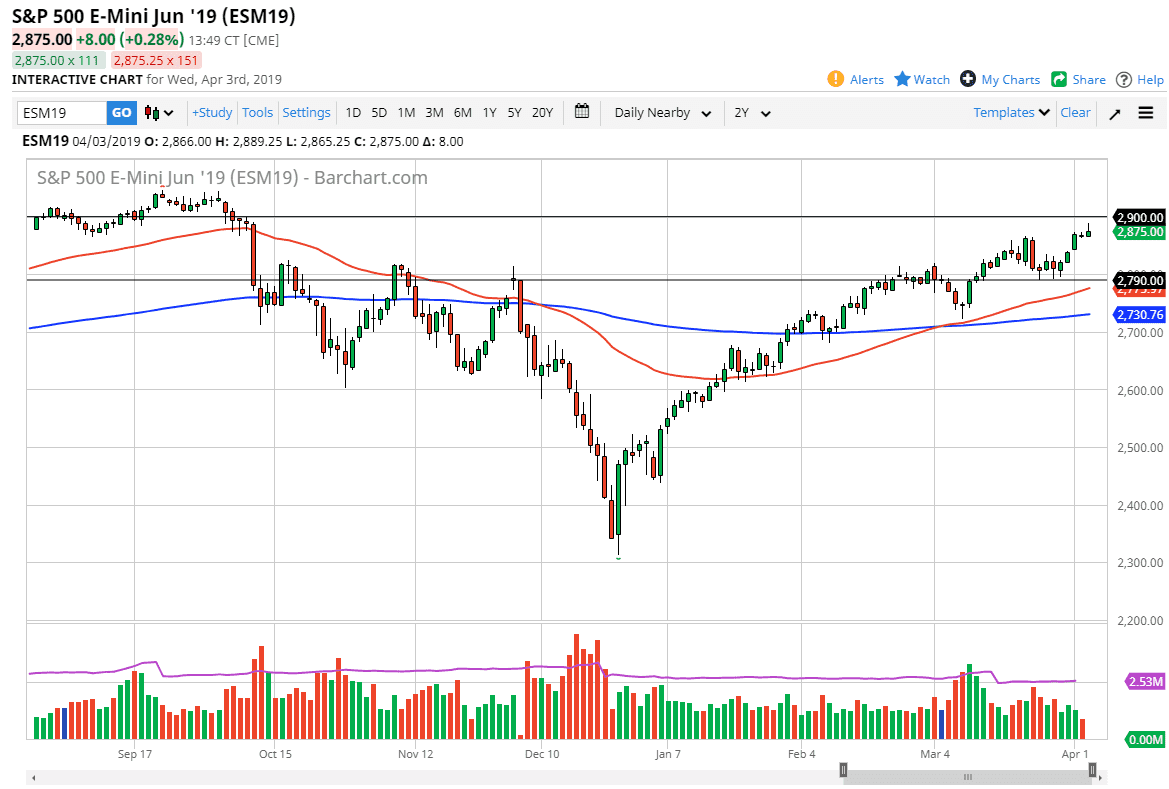

S&P 500

The S&P 500 initially tried to rally during the trading session on Wednesday but gave back almost all of the gains to form a less than impressive candlestick. With that being the case, it seems very unlikely that we are going to be able to break through the psychologically and structurally important 2900 level in one shot. I anticipate that we will probably get a bit of a pullback, but the question is whether or not there will be buyers underneath to pick up the market? I suspect that there will be, at least until we get to the 2790 handle.

If we were to break down below that level the market is more than likely to correct even further, probably down to the 200 day EMA which is currently at the 2730 handle. Overall, this is a market that I think has gotten a bit ahead of itself, so we may have a bit of a pullback in the short term.

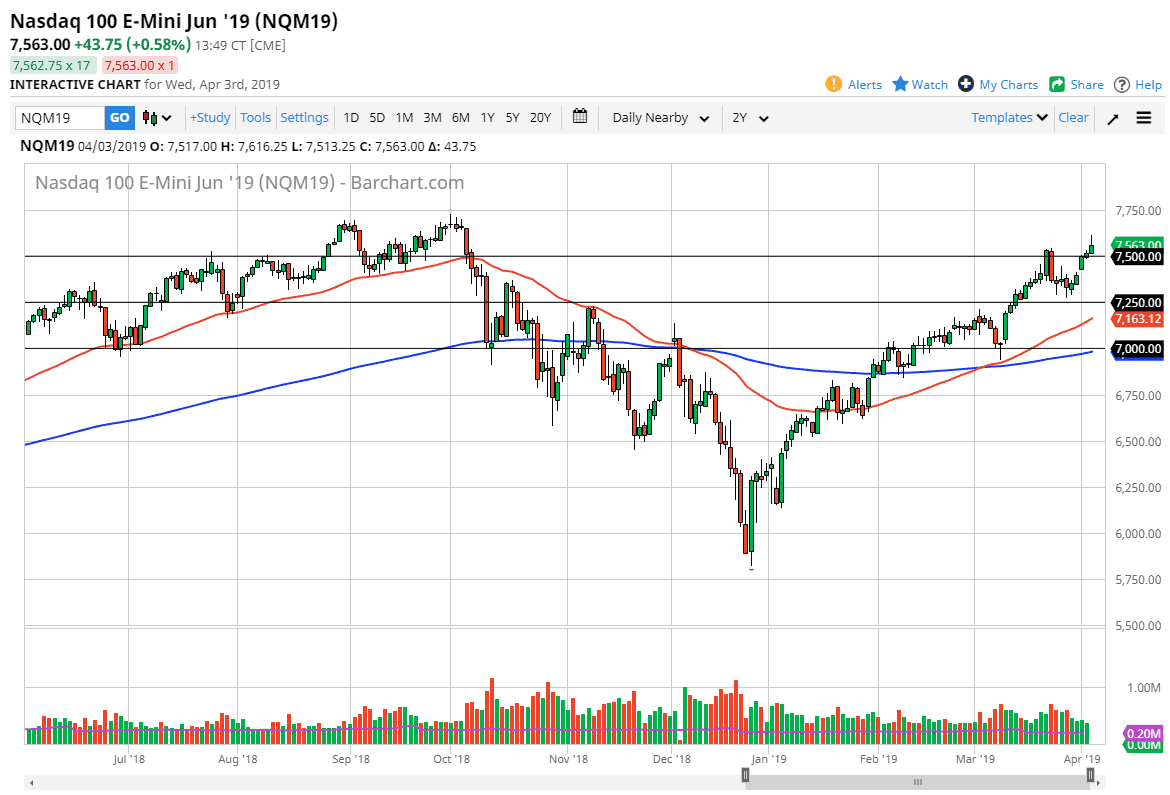

NASDAQ 100

The NASDAQ 100 also try to rally but gave back most of the gains to form a shooting star. This of course is a very negative sign, and as a result we will probably get a pullback from here as well. We are probably going to go down to fill the gap from the beginning of the week, which means we could go as low as 7400. I also recognize the 7250 level as massive support, and essentially the “floor” in the market. The 50 day EMA which is pictured in red on the chart also should offer support. Obviously, if we can break above the top of the shooting star for the day, that would be very bullish.