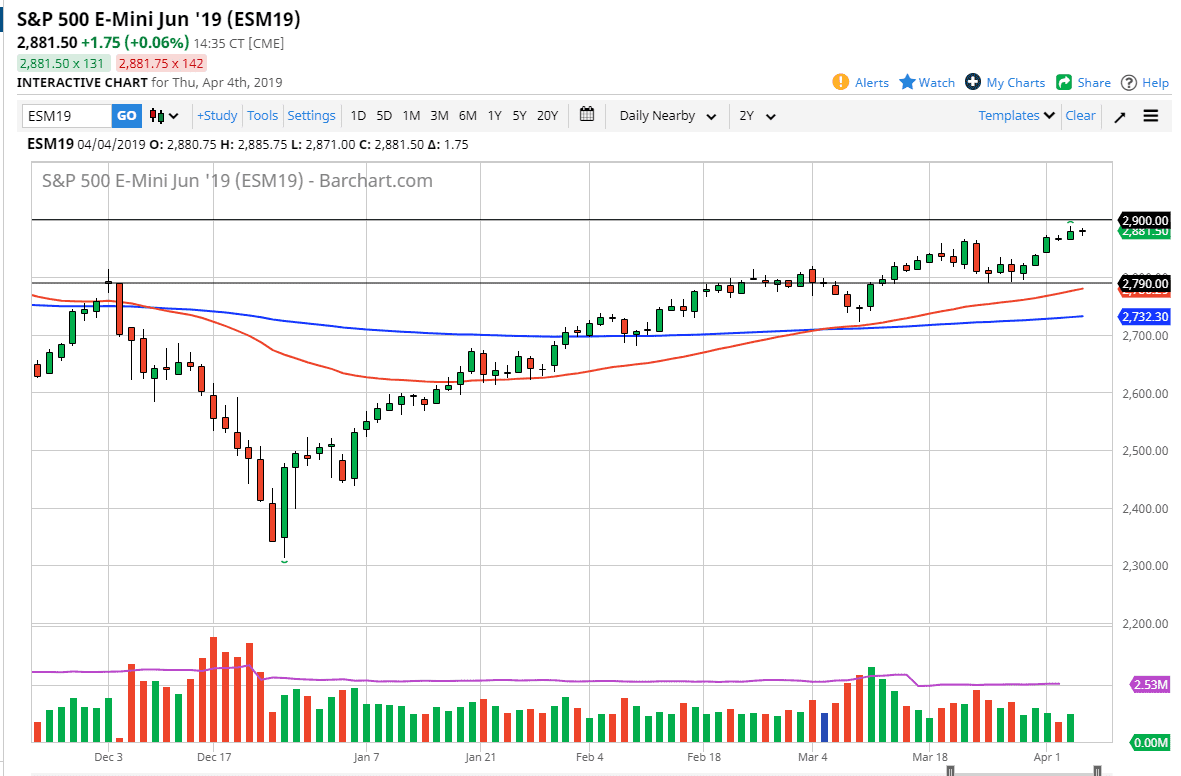

S&P 500

The S&P 500 had a fairly quiet session on Thursday, which makes quite a bit of sense considering that the jobs number comes out on Friday, it of course we are approaching a major round figure in the form of 2900. At this point, I suspect there’s probably more risk to the downside, although we did end up slightly positive for the session on Thursday. If we break above the 2900 level, then we will probably continue to go towards the highs. Overall though, I think that this market has plenty of buyers underneath so it’s not until we break down below the 2790 level that I would be remotely concerned. The market has shown a lot of resiliency, but then again the jobs number could change everything in an instant. Pullbacks should be buying opportunities after the initial “knee-jerk reaction.”

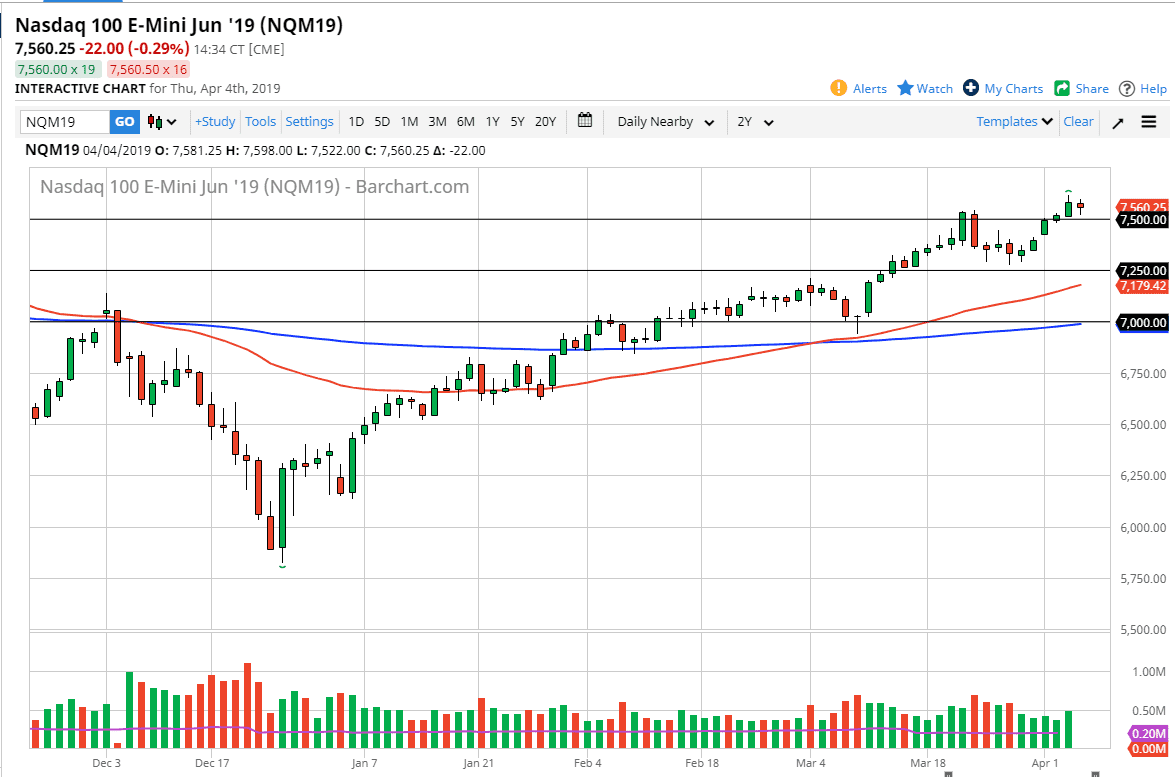

NASDAQ 100

The NASDAQ 100 has fallen during much of the session on Thursday but found enough support just above the 7500 level to turn around of form a bit of a hammer like candle. If we break down below the 7500 level that would be a “hanging man.” However, I think there is a massive amount of support also at the 7250 level, which could be another buying opportunity. Obviously, if we break out to the upside we could continue to go much higher and think that would be a reaction to the jobs number more than anything else. I believe between now and the jobs number, you are probably better off staying out of the market, and waiting to see what that reaction is. I like buying value if we get the opportunity on a dip, but otherwise we may have to simply by the breakout.