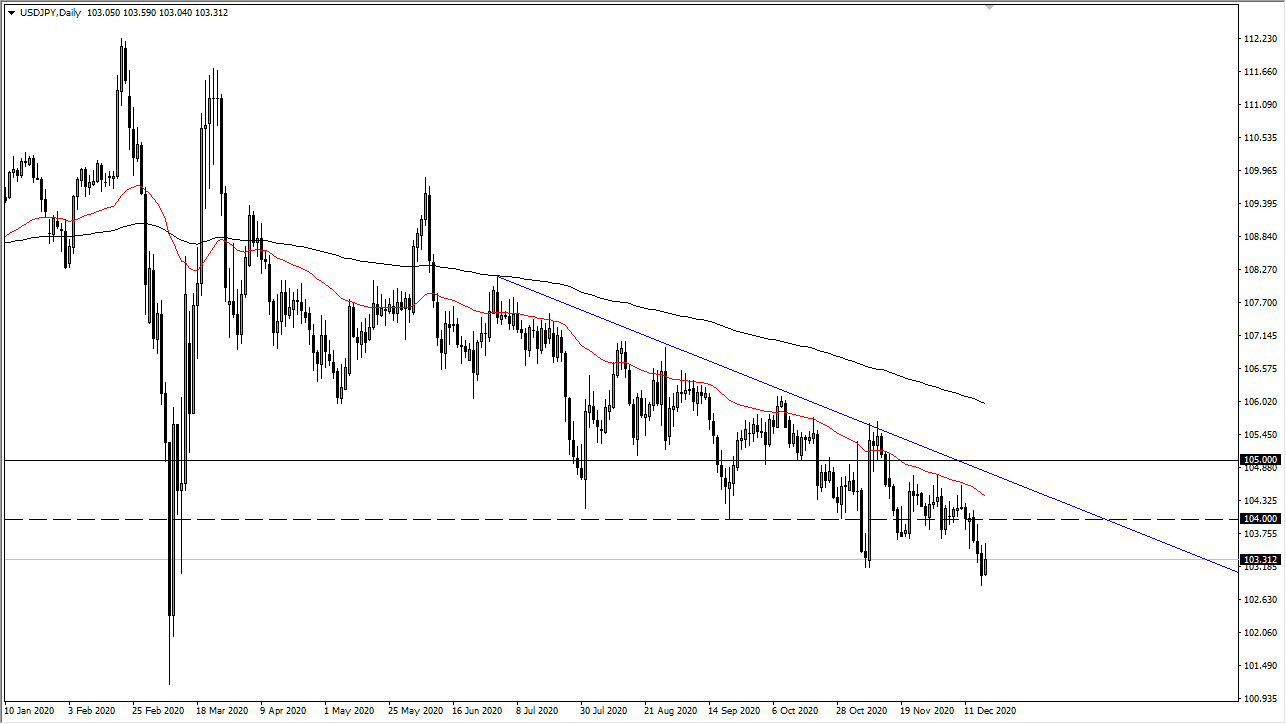

USD/JPY

The US dollar has fallen a bit during the trading session on Friday but did find support at the moving averages to show signs of life again. The market continues to be contained within the ¥112 level on the top and the ¥110 level on the bottom. Beyond that, you can also see that the resistance above is about a 50 pip range that starts at the ¥111.50 level. Looking at this market, it’s probably going to continue to be very choppy, and with the stock markets taking a bashing during the trading session on Tuesday in America, it makes sense that we did roll over a little bit and flee to the safety of the Japanese yen. Overall, I think we continue to go back and forth, but we are right in the middle of the range so I don’t see much of a way in a trade.

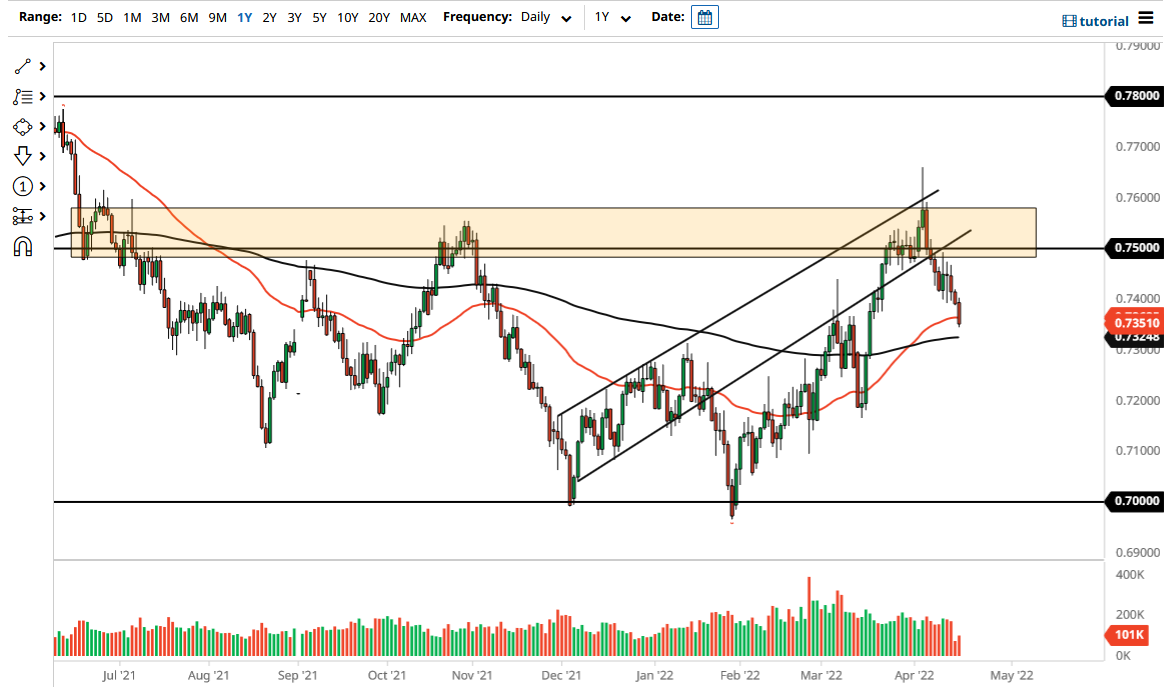

AUD/USD

The Australian dollar has rallied a bit during the trading session on Tuesday, reaching towards the 0.7150 level before selling. The market ended up forming a bit of a shooting star, and I think at this point a pullback makes sense but that pullback is more than likely going to be a significant amount of value for traders to get involved in the market. I think at this point waiting for this pullback to take advantage of it is probably the way to go forward, reaching back and forth in this range we have been in for a couple of weeks. Beyond that, I think that the 0.70 level underneath is massive support that we can take advantage of, as it shows up on the monthly charts as well. The alternate scenario of course is that we break above the 0.7175 handle, then we could go looking towards the 0.7250 level.