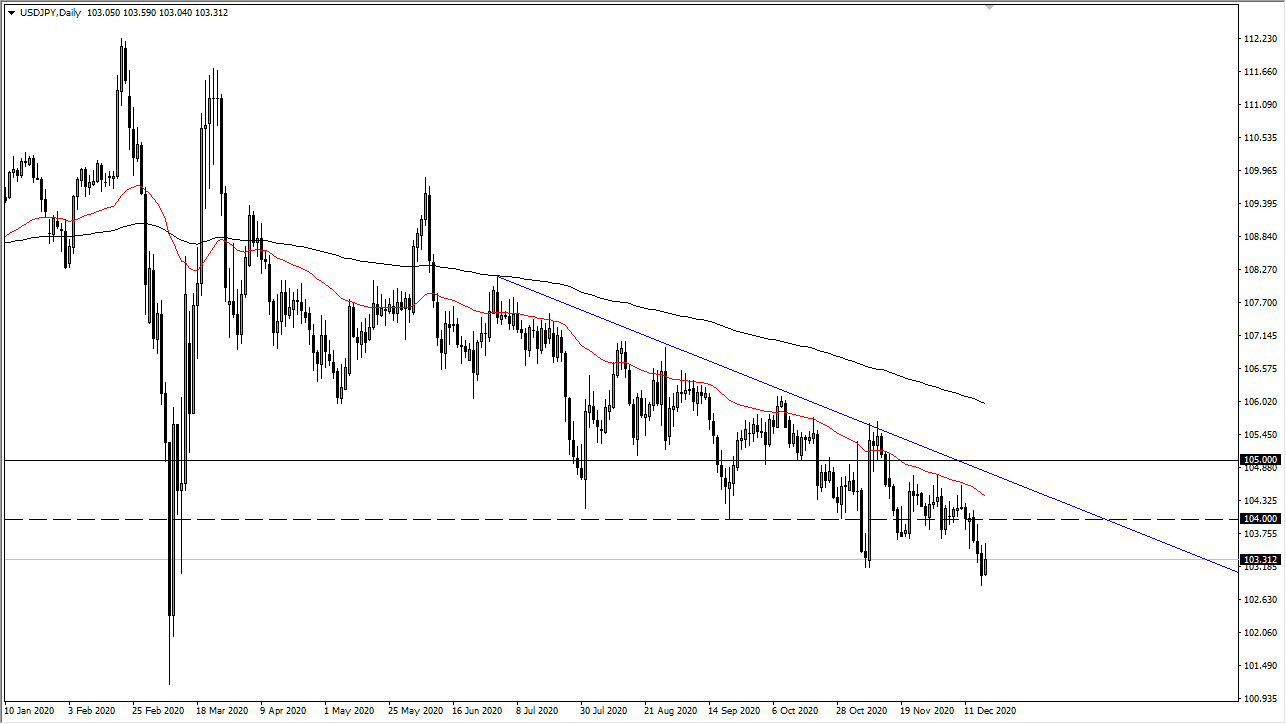

USD/JPY

The US dollar has rallied slightly during the trading session on Friday, as we got the jobs number in the United States at this point, it looks very likely that we are going to continue to struggle to go anywhere without some type of catalyst. I believe that catalyst is probably going to be the S&P 500, as it is at extreme highs, and extreme resistance. I think it is sense that the market is moving right along with the S&P 500, so if we can break out over there, it’s likely that the US dollar will break above the ¥112 level. Once it does, we could then go to the ¥113.50 level. To the downside, we have the ¥111.50 level that is the bottom of the 50 pip range that we are stuck in right now, and if the S&P 500 rolls over we could very well find this market falling down towards the ¥110 level.

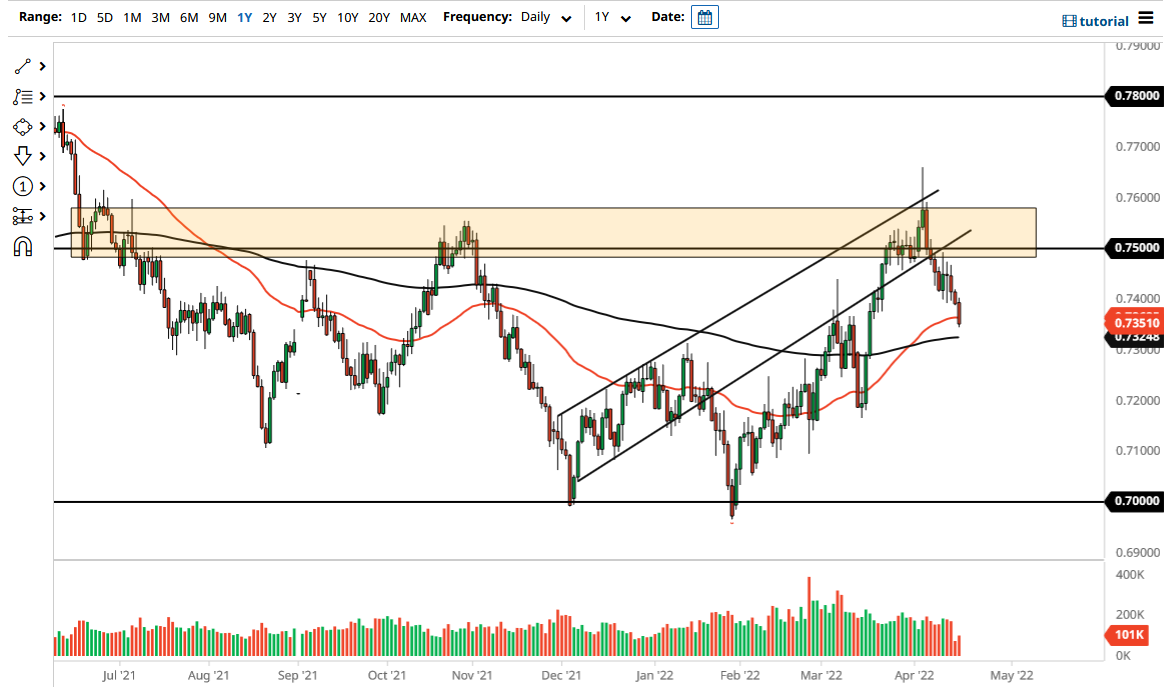

AUD/USD

The Australian dollar has initially tried to rally during the trading session on Friday but rolled over just a bit. We are stuck in a tight range and that makes sense considering that the Australian dollar is so highly levered to the Chinese economy. With the US and China in the midst of negotiations, we are waiting for some type of decision as to where things are going to go. Looking at this chart, it’s obvious that there is massive support underneath at the 0.70 level, that extends down to the 0.68 level. That being the case, the market is one that I continue to buy on short-term pullbacks and pick up 20 or 30 pips at a time. If we can get some type of decision out of the United States and China, that will more than likely send the Aussie much higher. I believe that we are in the middle of bottoming.