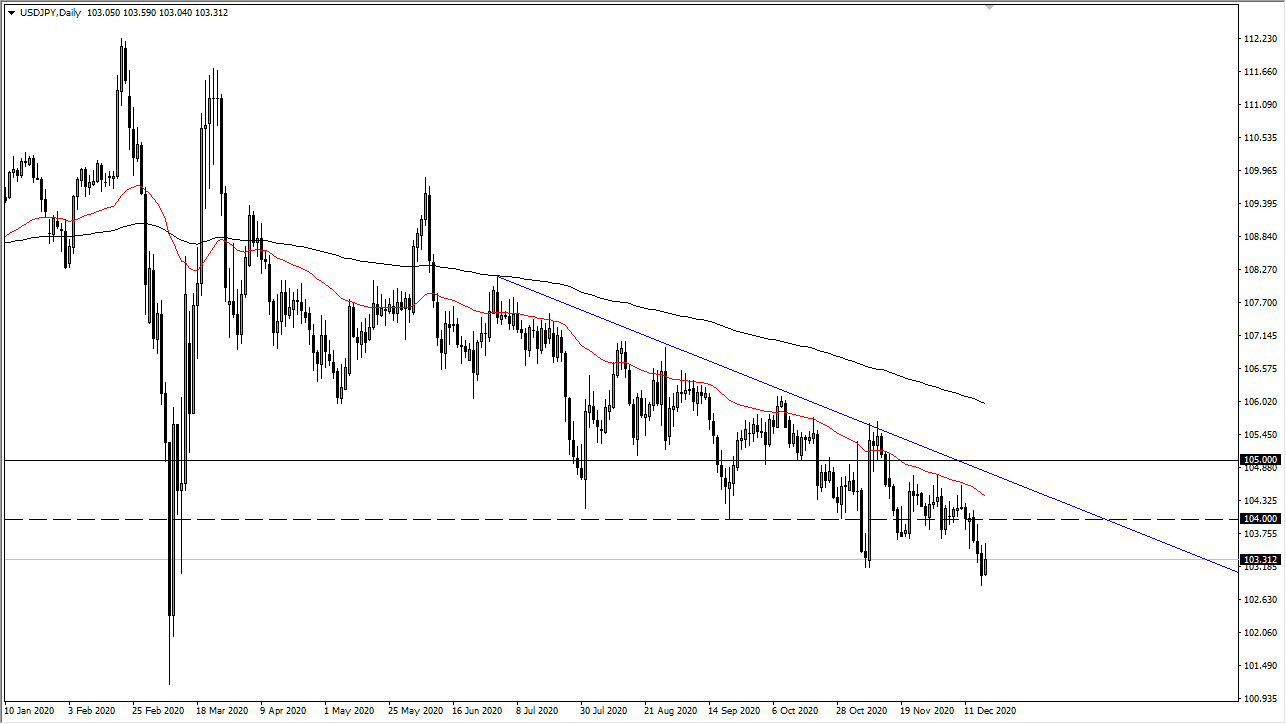

USD/JPY

The US dollar fell a bit during the trading session on Monday, as traders came back to the weekend. However, we are starting to see a little bit of resiliency later in the trading session on Monday, so it looks like we are going to continue to bounce around in this general vicinity. Overall, this is a market that tends to move with risk appetite, and therefore I think it will be interesting to see what happens with the stock markets, as they are a proxy for that risk appetite. The area between the ¥111.50 level and the ¥112 level is a massive barrier that’s going to take a lot of effort to break through.

If we do break through that area, then we could open up the possibility of reaching towards the ¥113.50 level. That area is significant resistance based upon the selloff that we had seen. On the other side of the equation, if we break down below the lows of the trading session from Monday, then we probably go looking towards the ¥110.75 level, and then possibly even the ¥110 level.

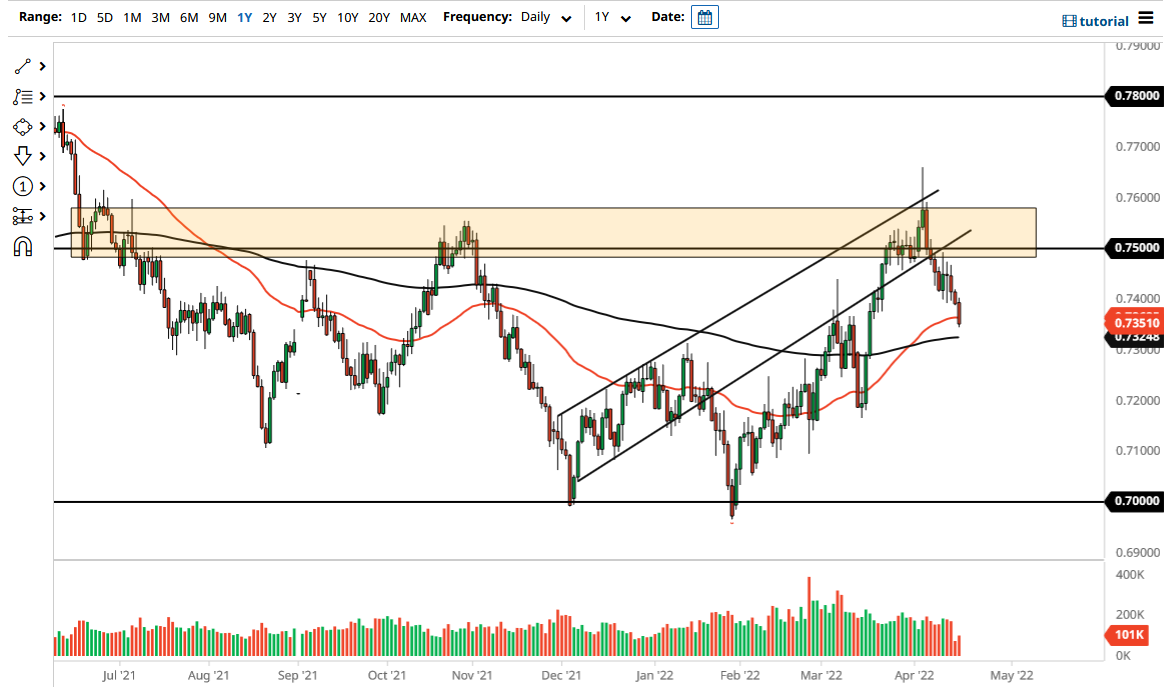

AUD/USD

The Australian dollar initially pulled back a bit during the trading session on Monday, but then turned around to reach towards the highs that we have seen over the last several days. Overall, the market looks very bullish, but you’re going to have to be cautious and more importantly patient when waiting for the potential upward move. At this point, the 0.7050 level is massively supportive, but we also have even more support at the 0.70 level, which extends all the way down to the 0.68 handle based upon monthly charts. In general, I continue to buy short-term dips and pick up 20 pips or so before closing the trade. However, I do think that eventually we will break out towards the 0.72 handle and beyond. This looks like a bottoming pattern, and a trend change which of course is always very messy.