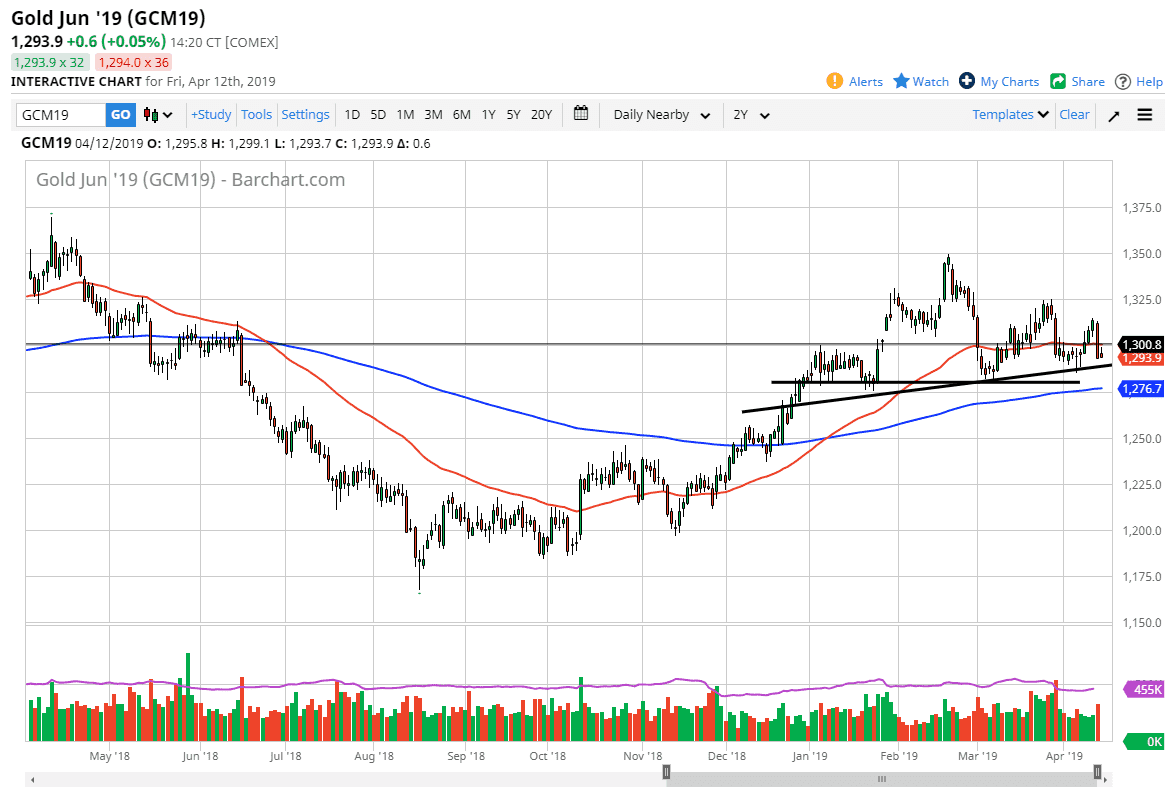

Gold markets tried to rally initially during the trading session on Friday but struggled at the $1300 level. That of course is a level that is psychologically important, and therefore it’s very likely that the area has attracted a lot of attention and volume. As we have tried to rally to break out above there and gave back the gains, the daily candle stick was a bit of a shooting star shaped market.

Looking at this chart, there is the massive support at the $1280 level, also with the 200 day EMA just below. Overall, the market continues to see a lot of volatility in this range, but the one thing that you cannot ignore is that the highs continue to get lower. The fact that the Thursday candle stick was so long and close at the bottom, as well as showing signs of extreme volume, the market looks very vulnerable at this point. Friday did nothing to massage any of those worries away.

The uptrend line underneath that I have now added to this market shows a potential in a “complex and shoulders.” At this point it looks very likely that the market is going to try to make a serious push lower. That doesn’t mean that it’s going to be easy to break down, but clearly this is an area that continues to attract a lot of sellers. If we do rally at this point it’s not until we make a fresh, new high that would be comfortable owning gold for a longer-term move.

On the break down we could send this market down to the 200 day EMA and then the $1250 level. Ultimately, rallies at that point would probably be sold until we got down to the $1200 level. The weekly candle stick is most certainly negative, forming a shooting star, just as we have seen on Friday. It is because of this that I think the sellers are about to make a serious push.