WTI Crude Oil

The WTI Crude Oil market had a very bullish move during the trading session on Monday, reaching towards the $64.55 level towards the end of the day. At this point, the $65 level is well within grasp, but I think this is an area that you need to be careful with. It’s an area that previously had been massive support, and now is probably going to be massive resistance. This doesn’t mean that the market is going to suddenly collapse, rather that we are about to run into a significant amount of resistance that is going to be difficult to break through right away. However, I think what we are likely to see is more of a “buy on the dips” scenario. Overall, I think you should be looking for value but what I’m essentially saying is that buying at this level is simply “chasing the trade.”

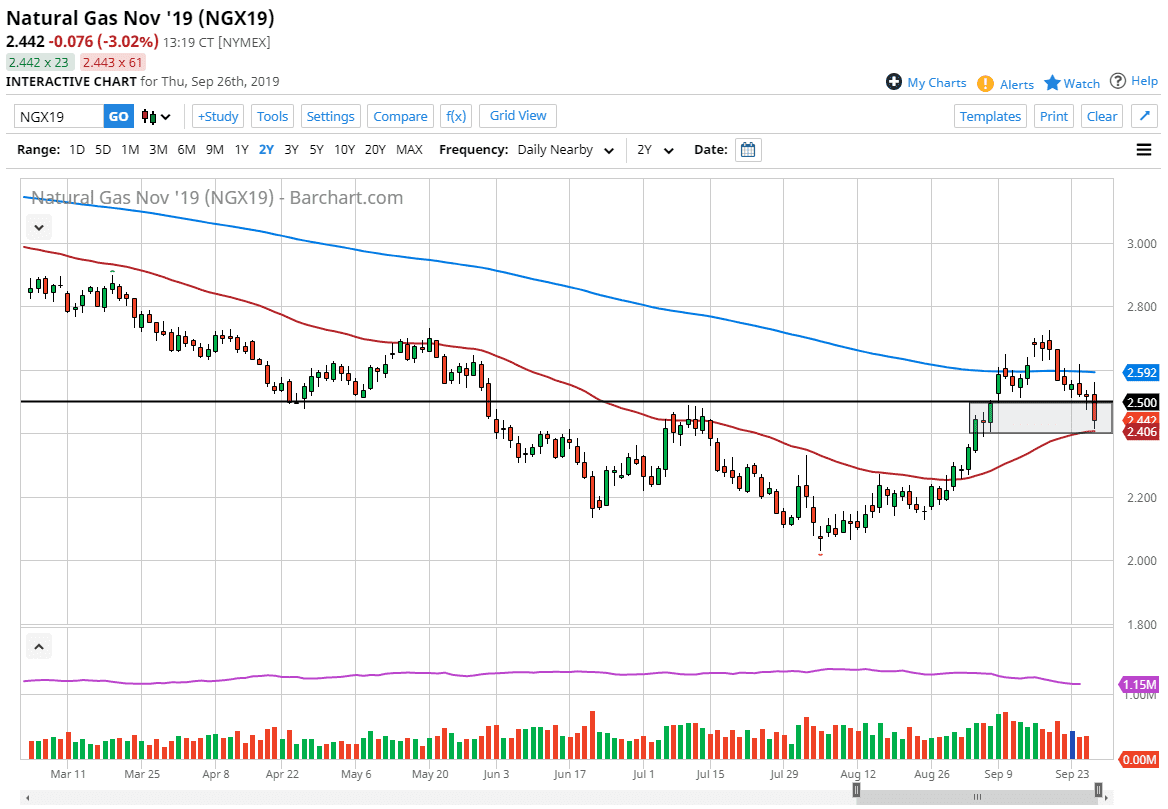

Natural Gas

Natural gas markets had a strong session as well, something that you can’t say every day. As we broke above the $2.70 level, it suggests that we are probably going to continue to find buyers at these low levels. We have been consolidating for some time as I have marked on the chart, with the $2.60 level being a major support level that extends down to the $2.50 level. To the upside, the $2.90 level continues to be resistance that extends to the $3.00 level. In general, I believe that we continue to go back and forth, as the area has been crucial for some time. Range bound trading continues to be the best way to play this market, as I don’t think we will be able to break out of this range anytime soon.