WTI Crude Oil

The WTI Crude Oil market struggle during the trading session to find a direction on Tuesday, as we are approaching the crucial $65 handle. This is an area that has previously been massive support, and of course is a significant round figure, so of course a lot of attention will be paid to this area. Ultimately though, a pullback is probably going to end up being a buying opportunity if we can get a bit of a “reset.”.

I like the idea of buying closer to the $62.50 level if we get the opportunity, otherwise I will probably have to look at buying oil on a significant break above the $65 handle on a daily close. Until then, this is a market that I will probably leave alone because I certainly don’t want to short what is a very strong marketplace.

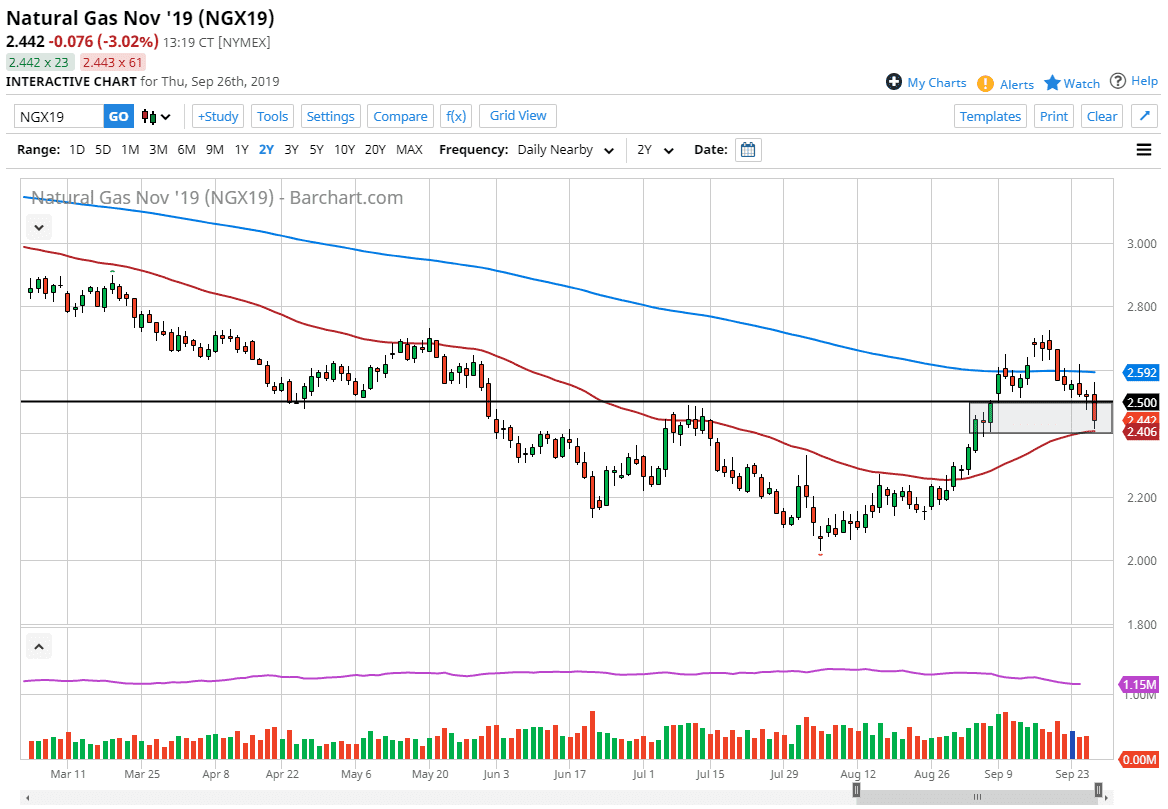

Natural Gas

Natural gas markets did very little during the trading session on Tuesday, as we continue to see a lot of meandering between two major levels. As we are closer to the bottom, there’s probably more likely to see a bit of buying pressure but it’s not enough of a reason to get involved in this market. If we found some type of supportive candle stick near the $2.60 level, then I’d be more than willing to start buying. I think that support level runs down to the $2.50 level below. Otherwise, if we rally to the upside I think that there is plenty of resistance at the $2.90 level that extends to the $3.00 level.

In general, I believe that we are consolidating but are far enough away from the outer parts of the range to keep the market very noisy and probably untradeable in the short term.