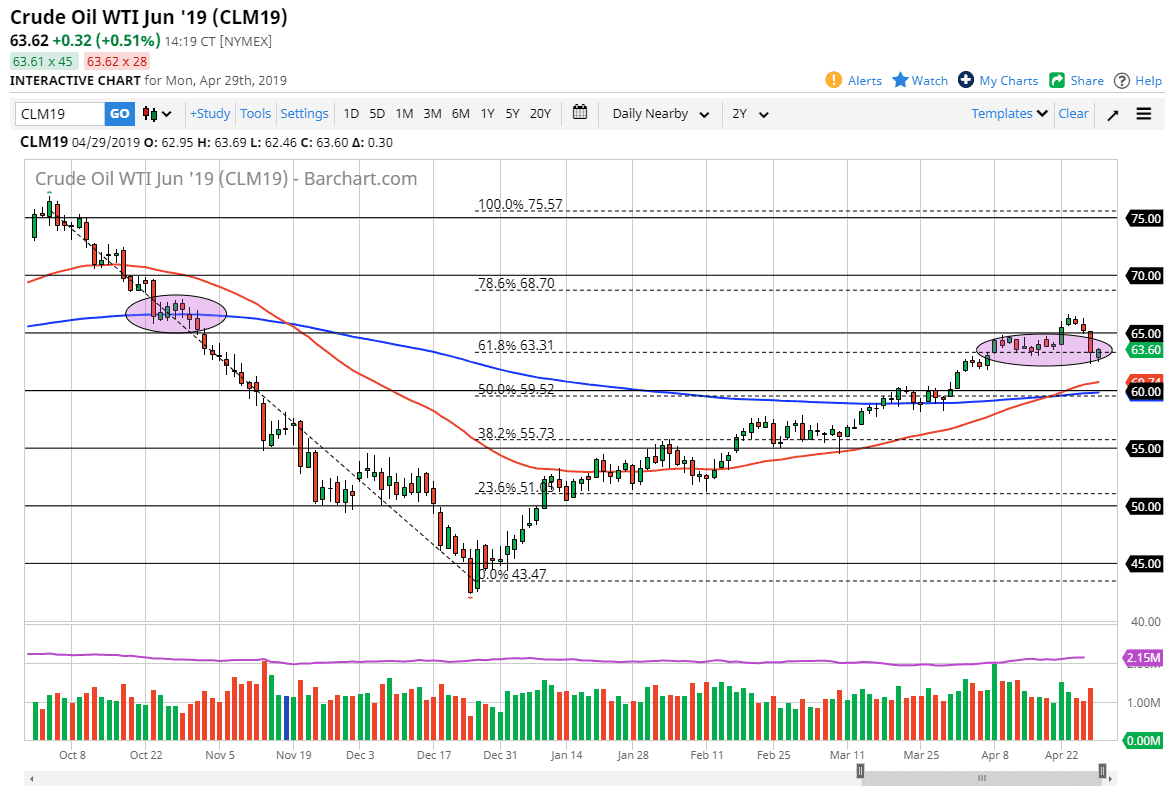

WTI Crude Oil

The WTI Crude Oil market has shown bullish pressure yet again during the trading session on Monday, recovering quite nicely late in the day. The market is looking like it’s trying to recover for a bigger move, but keep in mind that the weekly candle stick last week was very rough looking. With that in mind, it’s going to be easier to sit on the sidelines instead of trying to suss out what’s going to happen next. If we were to break down below the $62.50 level, then I believe that that point the market probably goes down to the $60 level. Otherwise, if we can make a fresh, new high, then the market could go much higher, perhaps reaching towards the $70 level. All things being equal, we are at extreme levels so I would anticipate a lot of consolidation and choppiness.

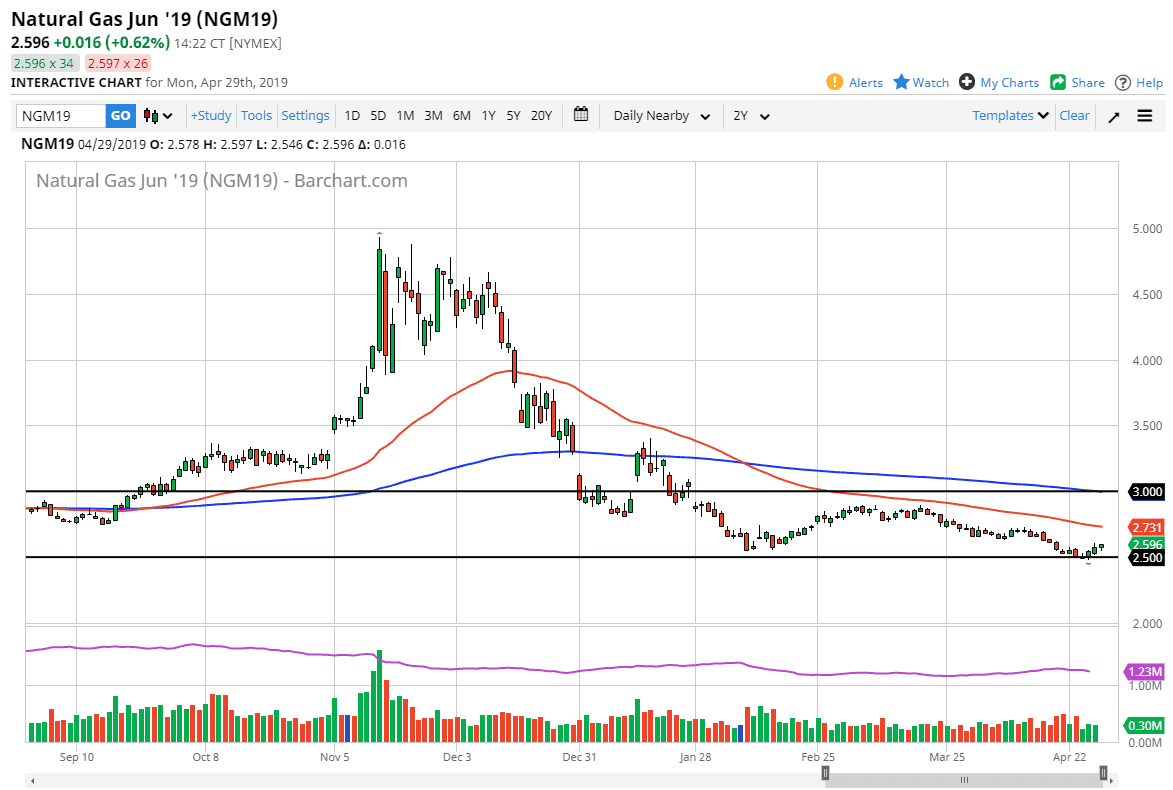

Natural Gas

Natural gas markets pulled back slightly during the trading session initially on Monday, and then shot much higher, perhaps reaching towards the $2.60 level. Overall though, there is a lot of resistance and I think that rallies will end up being selling opportunities. There is significant support below at the $2.50 level, so I think that given enough time people will test that area again. If we can break above the 50 day EMA, which is pictured in red on this chart, then we could go towards the $2.90 level. Overall though, I think that it’s only a matter of time before the sellers would come back into this market to take advantage of the softness that we have seen in the fact that we are leaving the high demand season and therefore natural gas is going to have a lot of headwinds.