WTI Crude Oil

The WTI Crude Oil market pulled back a bit initially during the trading session on Friday, but then shot higher after the jobs number came out. That being the case, it looks as if the $63 level is now giving way at the close of session, and it now looks likely that we are going to reach towards the $65 handle given enough time. Short-term pullbacks should be thought of as buying opportunities in a market that is clearly bullish. I believe that the $60 level underneath is massive support, and therefore I’m looking for pullbacks all the way between here and there that show signs of life on a bounce that I can take advantage of. If the US dollar rolls over a bit, that can only help the value of oil go higher. The $65 level will probably cause a significant amount of resistance, but at this point I think we are at the very least we are going to test it.

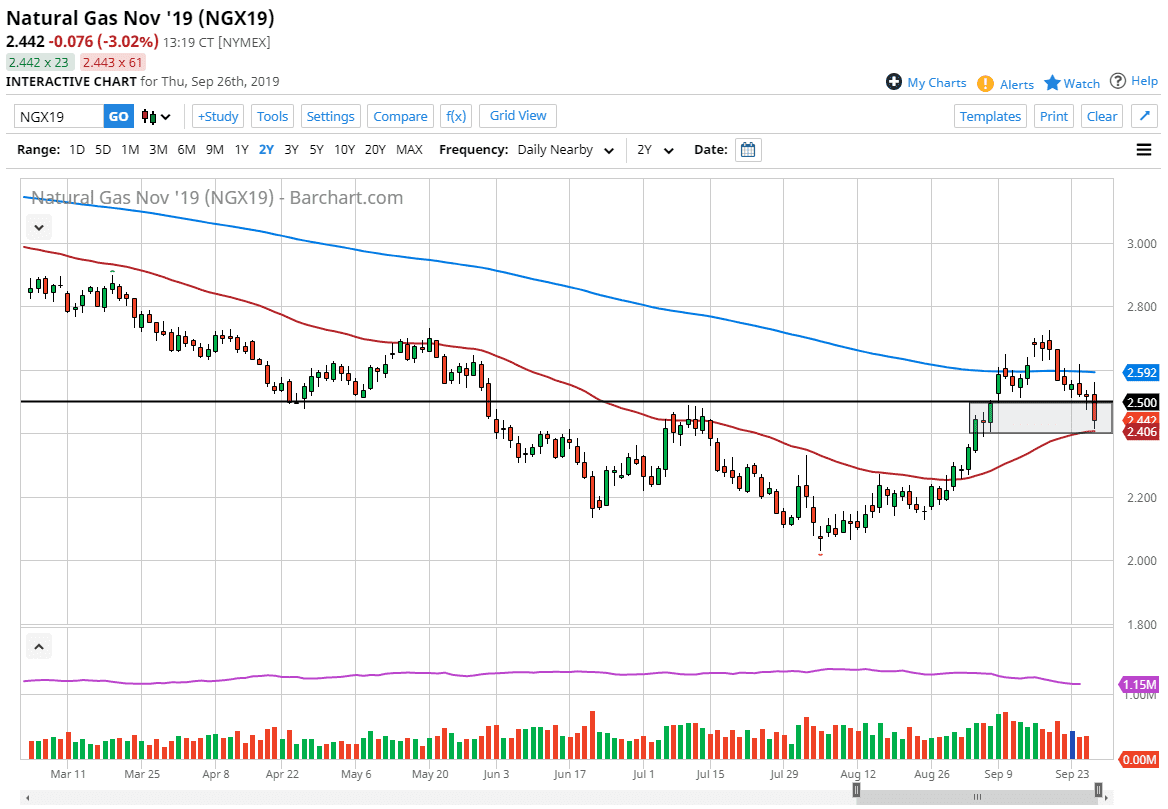

Natural Gas

Natural gas markets rallied a bit during the trading session on Friday, as we are getting close to the bottom of the overall range. The $2.60 level begins significant support down to the $2.50 level, as we have seen the area offer plenty of buying opportunities. At this point, the market looks as if it is ready to bounce relatively soon, and I like buying short-term dips but I’m not looking for anything major. I recognize that the $2.90 level above which is the beginning of massive resistance extending all the way to the $3.00 level in what has been a very negative market. I think we are just simply getting close to the bottom of the longer-term average range, so statistics favorite bounce.