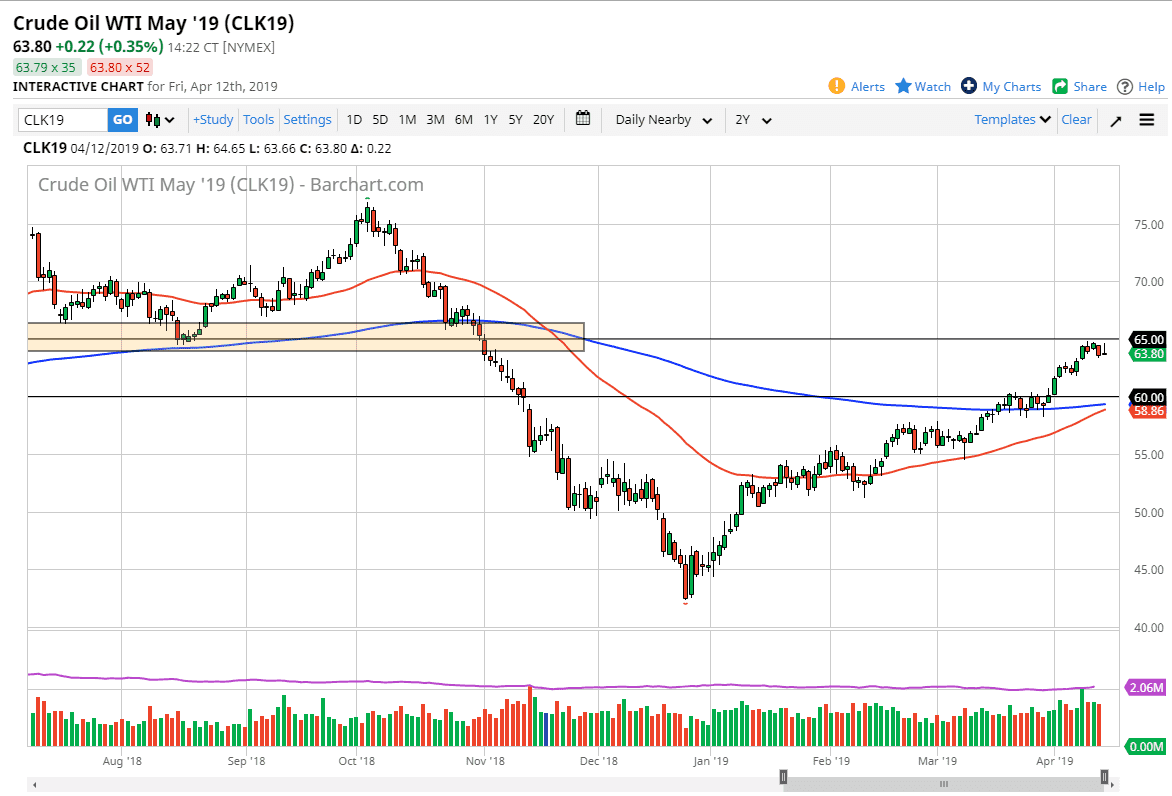

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the trading session on Friday but gave back most of the gains to form a bit of a shooting star. Beyond that, it’s obvious that the $65 level is going to be massive resistance as it was previous support, and it now looks as if the market is starting to get a bit exhausted in this area. If that’s going to be the case, we could pull back towards the $62.50 level. If we were to break above the $65 level, that would of course be a very bullish sign, but at this point it doesn’t look like we have the momentum. I would be much more likely to buy a pullback that show signs of support either at the $62.50 level or possibly even the $60 level underneath that. I have no interest in shorting oil but I recognize we are starting to get a little bit heavy.

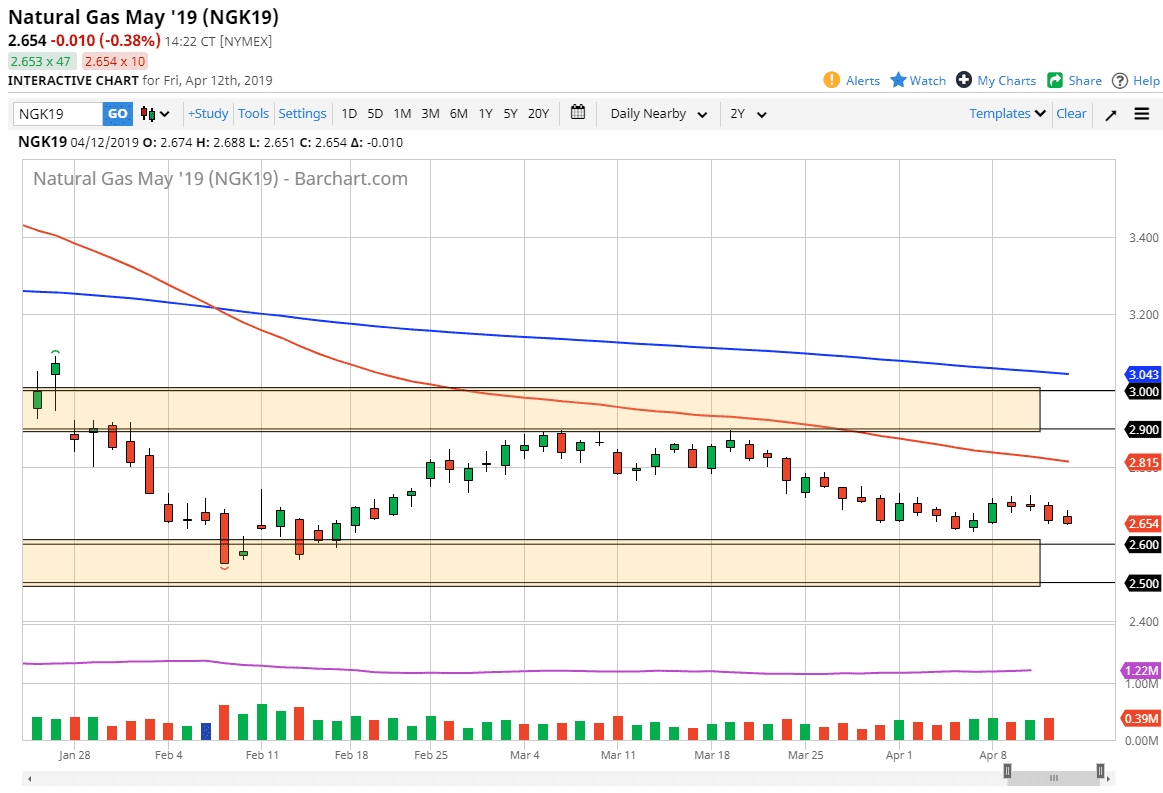

Natural Gas

Natural gas markets initially tried to rally during the trading session on Friday but gave back a significant amount of the gains to not only give them all back, but to break down a bit further. However, there is massive support underneath at the $2.60 level, so any type of bounce or supportive candle in that region should be thought of as a buying opportunity for short-term traders. If we break above the top of the candle stick then we could continue to go a little bit higher, as we are at the bottom of the overall trading range. Consolidation has held, and at this point it seems to be very unlikely that we break out of this range that I have marked on the chart.