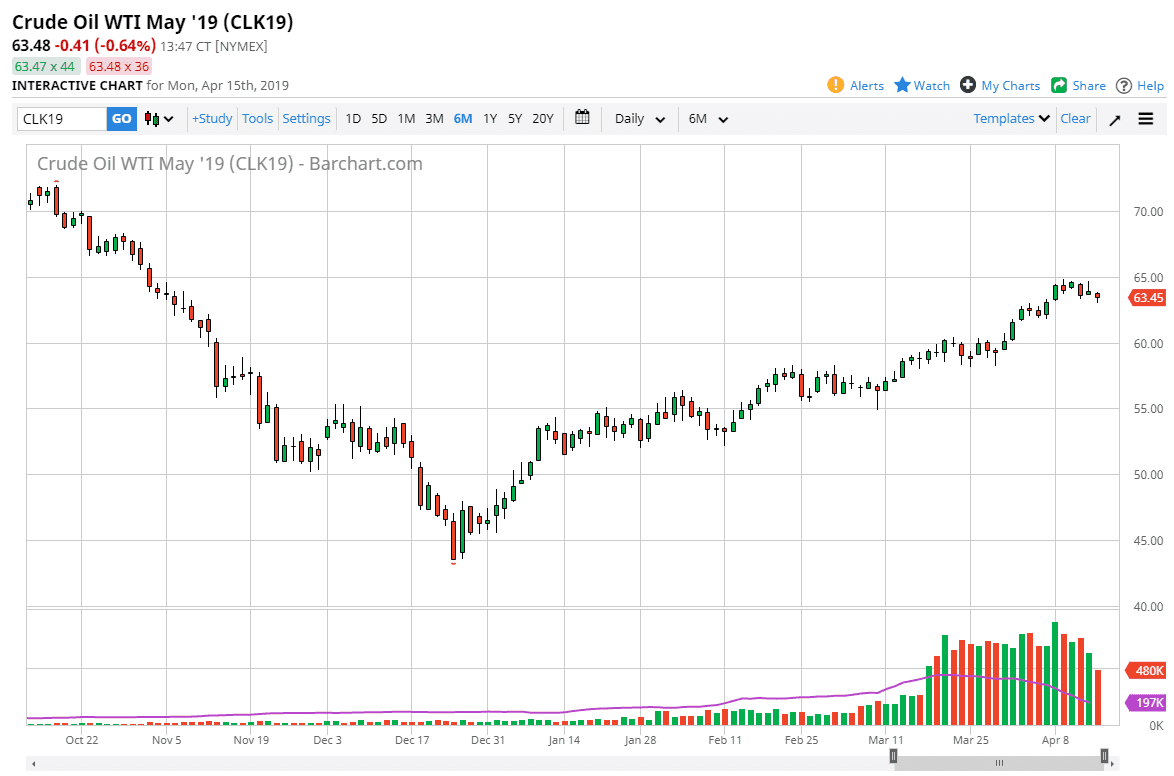

WTI Crude Oil

The WTI Crude Oil market initially fell during trading on Monday as traders came back to work. This probably shouldn’t have been too much of a surprise considering this sickly looking candle stick that we formed for Friday. However, we have turned around to show signs of life and support near the $63 level and have formed something to the effect of a hammer. This shows just what this market is: a game of tug-of-war. To the upside we have the $65 level offering significant resistance, and below I think that the $63 level is one of many support levels that could come into play.

On a break down below the $63 level I anticipate that the $62.50 level will be very supportive, and then the $60 level after that. To the upside, if we can finally break above the $65 level then we will start to make bigger moves, with an eye on the $70 level longer-term.

Natural Gas

Natural gas markets came unraveled during the Monday session by breaking below the $2.60 level. There is massive support below the $2.50 level so I anticipate that sooner or later we are going to get a bit of a bounce or supportive candle stick. This is based upon warmer temperatures coming to the United States, which considering that it’s April 15 as I write this there shouldn’t be much of a surprise and that statement. However, natural gas markets tend to work on short-term thought more than anything else, and therefore it makes sense that it got hammered. At this point in time though, I’m looking for supportive daily candle stick to start buying as we are at the bottom of a longer-term range that has been quite reliable. In the next 24 hours I probably won’t be doing much.