WTI Crude Oil

The WTI Crude Oil market pulled back a bit during the trading session initially on Tuesday but found enough buyers underneath the turn around to break above the $64 level again. By doing so, this is a market that shows extreme resiliency, after we ran into a lot of selling pressure earlier. The market was very volatile on the short-term charts, but by the time we closed out the day it was obvious that the buyers had won the session as the turnaround was quite complete.

The $65 level above will continue to cause a significant amount of resistance but I do think that we will eventually break out above it. In the short term, it’s pretty easy to see that we are bullish, but ultimately it is a market that has a lot of work to do to finally break out to the upside. To the downside, I still believe that the $62.50 level should be rather supportive, followed by the $60 level.

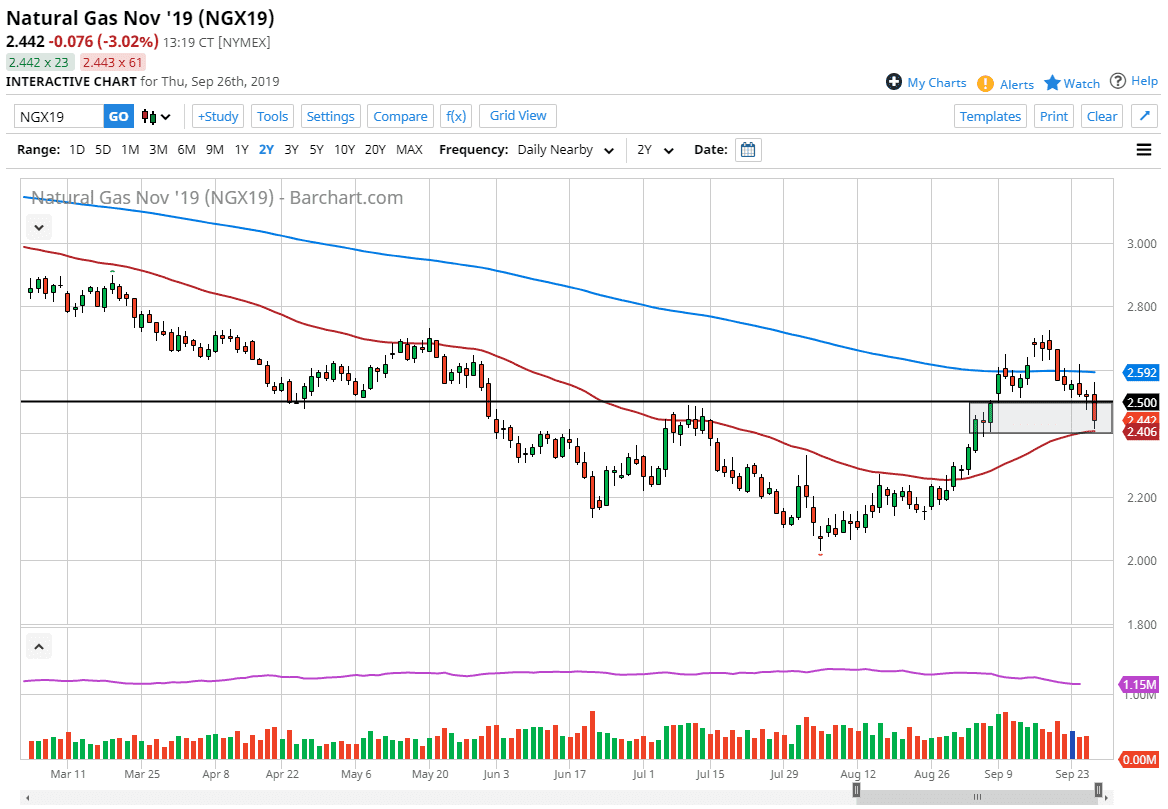

Natural Gas

The natural gas markets fell again during the trading session on Tuesday as we broke down below the $2.60 level. We are still very much in the range of support though, so ultimately it’s not until we break down below the $2.50 level that I’m convinced that the range has given up. Any type of bounce from here will more than likely attract a lot of value hunters and could move the market towards the $2.70 level, and then if we get some real momentum, we could go down to the $2.90 level.

The alternate scenario of course is that we finally do break down below the $2.50 level, which could open the door to $2.25 below. That would of course be a complete capitulation by the buyers in this market. Overall, I still believe that we are going to consolidate more than anything else.