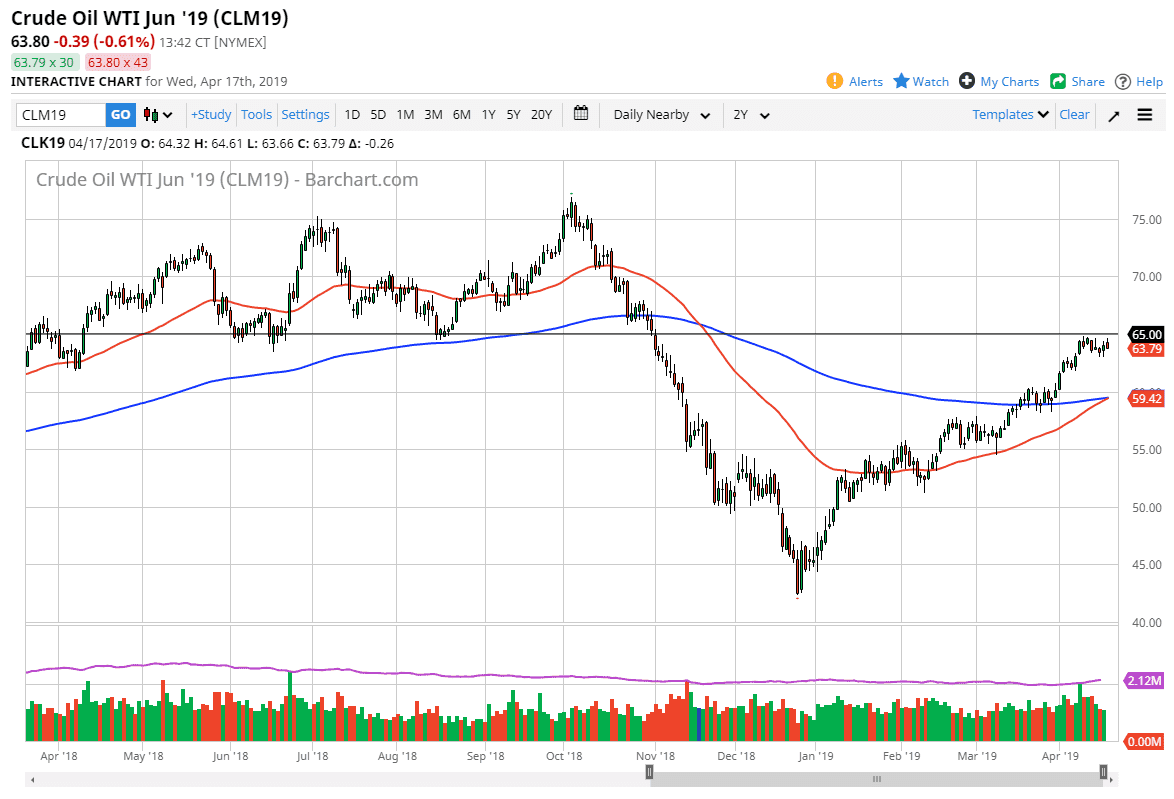

WTI Crude Oil

The WTI Crude Oil market rallied initially during trading on Wednesday but continues to see a lot of resistance near the $65 handle. That being the case, it’s very likely that we will continue to struggle at that area. However, if and when we can finally break above the $65 level, the market more than likely will go looking towards the $67.50 level, and then the $70 level if the little bullish flag that has formed is to be believed.

Below, I see the $62.50 level as support just as I see the $60 level as support based upon moving averages. I continue to buy short-term dips as the oil market has been very resilient. It’s going to take a lot of momentum to finally break out, so therefore we need to be very patient about the breakout but recognize when value presents itself we should be buyers.

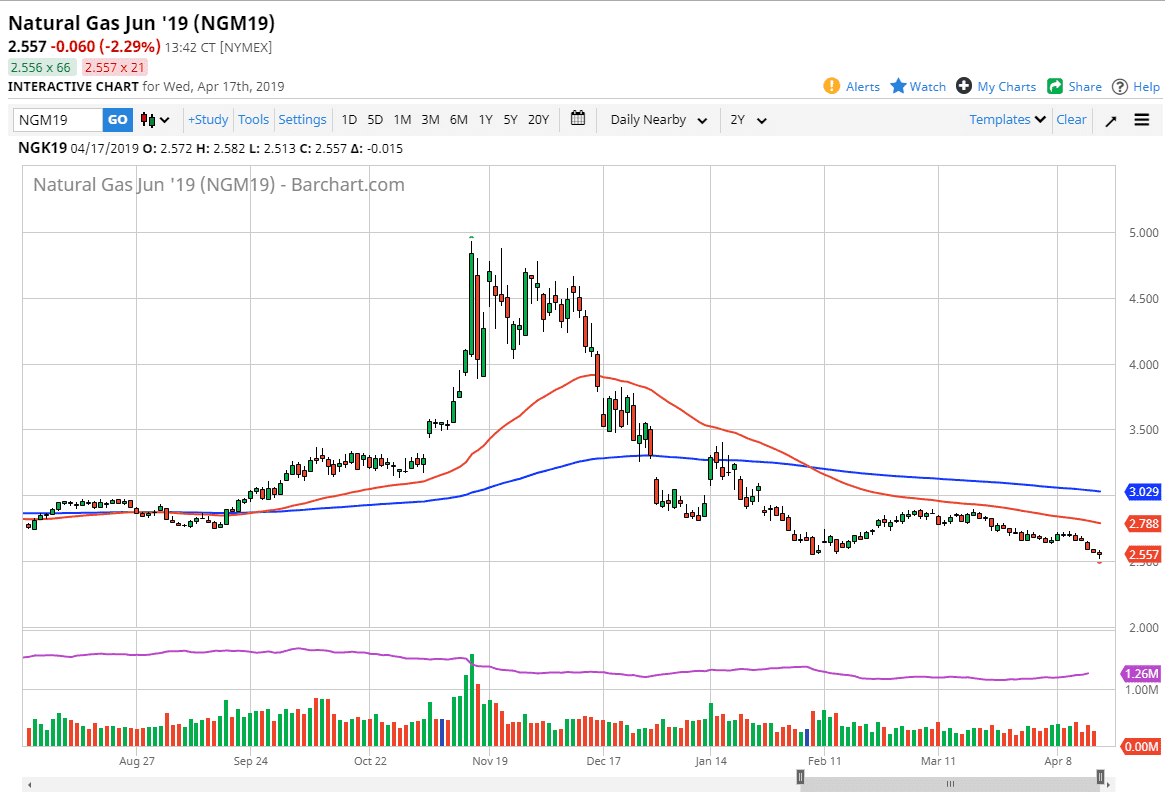

Natural Gas

Natural gas markets fell during the trading session on Wednesday as well but continues to find buyers underneath as we approach a major support level. Were essentially in a support zone at the moment, reaching down towards the $2.50 level. That is a level that would be almost impossible to imagine it being broken through, but if it does it’s likely that the market will capitulate and reach towards the $2.25 level. At this point, it’s very obvious that the inventory number on Thursday will have a massive influence on this market, as we are at extreme lows. We have been trading between $2.50 and $3.00 level for quite some time, and as we are at the bottom of the range there is much more risk to the upside then down right now. With that being the case I am willing to start buying but only with a small position.