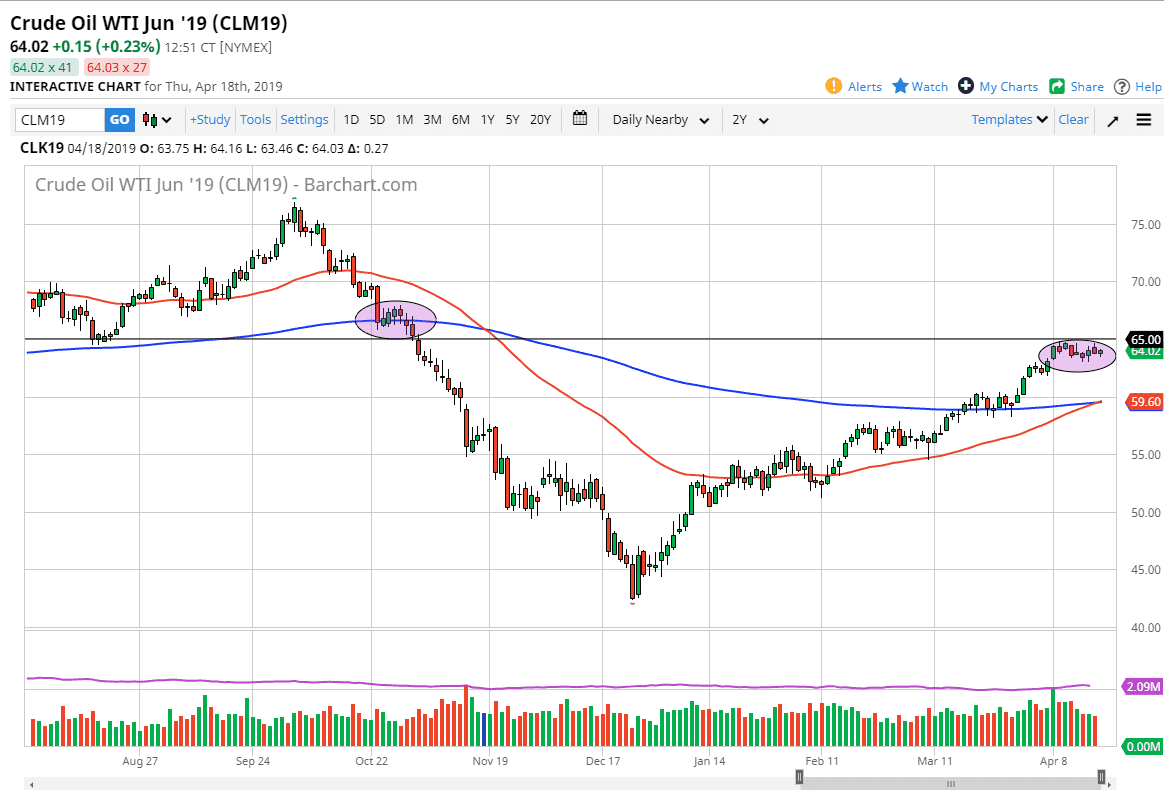

WTI Crude Oil

With very limited electronic trading, Friday probably will produce much in the way of action when it comes to the WTI Crude Oil market. However, we could look at the candle stick from the last several days and glean some type of information as to where we could go next. Looking at the chart, it’s easy to see that we have been banging up against the $65 level for some time. This is an area that is significant resistance so if we can break above there we can go towards the $67.50 level, possibly even the $70 level.

To the downside I see a lot of support at the $62.50 level and of course the $60 level. With that being the case it’s very likely that we will continue to see buyers coming in on dips. Currently I have no interest in shorting crude oil.

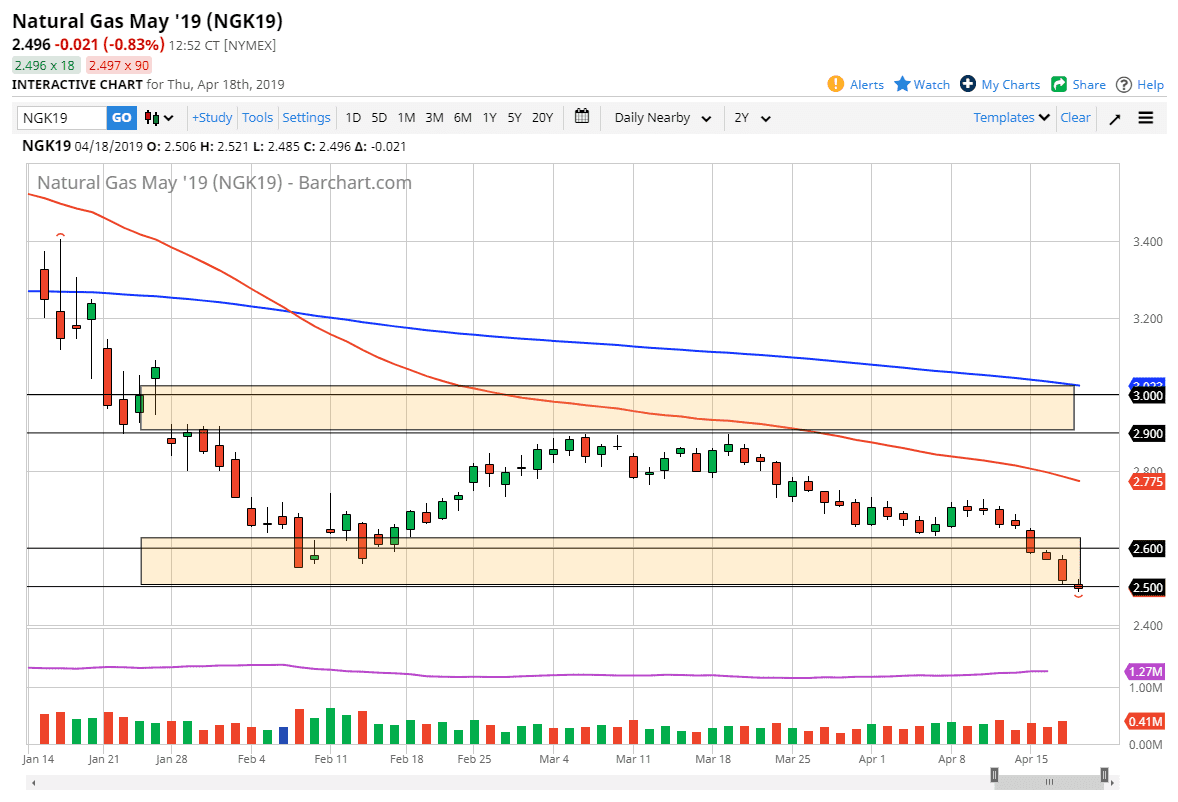

Natural Gas

Natural gas markets fell again during the trading session on Thursday, as we continue to bounce around the $2.50 level, an area that is the bottom of a larger consolidation area. At this point, the buyers better show up soon or we are heading towards the $2.40 level. A bounce would make sense but we need to see a break above the top of the candle stick for the Thursday session, which then could open the door to the $2.60 level, and then possibly the $2.70 level.

If we do break down, we could see a bit of a flush as this would be such a major level being broken. At this point it certainly looks as if there is the real possibility of this, but the range has held for quite some time historically, so at this point it’s probably Monday before we get an answer as Good Friday will causal lack of liquidity.