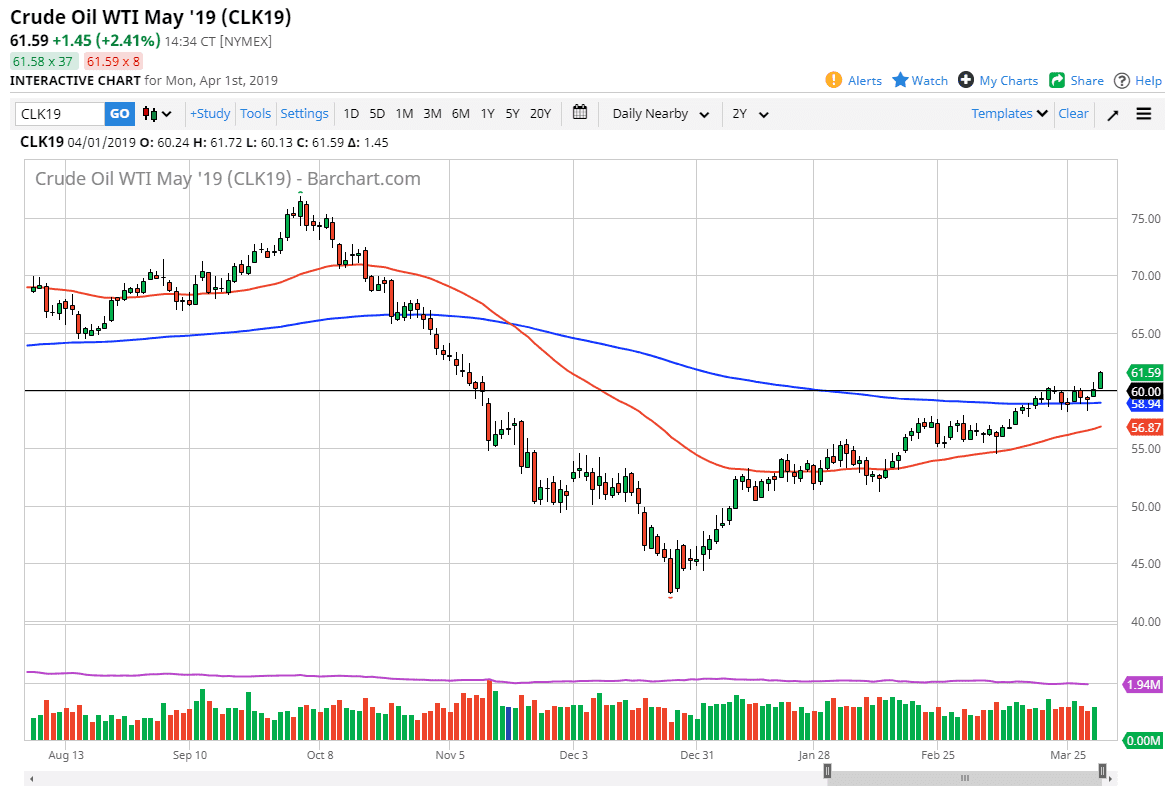

WTI Crude Oil

The WTI Crude Oil market broke higher during the trading session on Monday, clearing the lot of the resistance that we had seen. At this point, it’s likely that we will continue to go reaching much higher as this was a major development in this market. Going forward, I look at short-term pullbacks as buying opportunities in the oil market and recognize that the $60 level now should offer quite a bit of support, followed by the 200 day EMA which is just below at the $59 region. To the upside, I believe that the $62.50 level will be the initial target, followed by the $65 level given enough time. I have no interest in shorting crude oil, it’s obvious that we are in a very bullish market at this point in time.

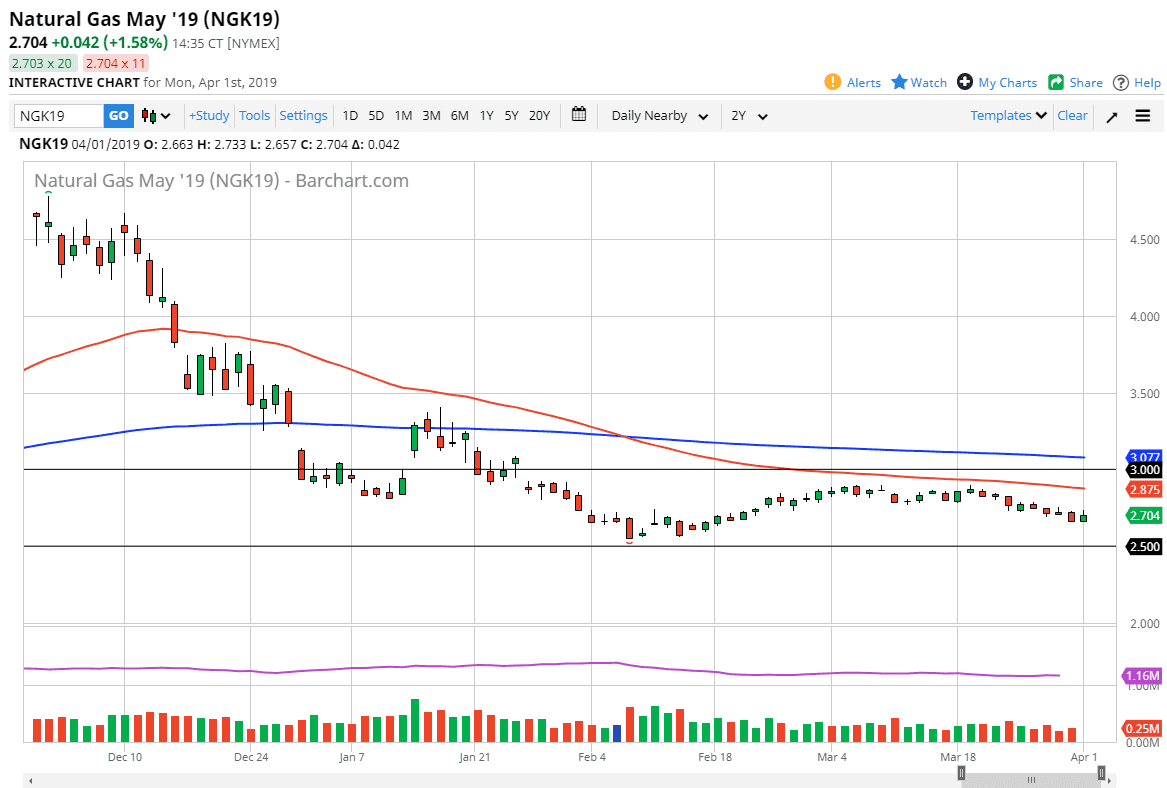

Natural Gas

Natural gas markets rallied a bit during the trading session on Monday but gave back quite a bit of the gains later in the day. The $2.60 level is a significant level of support that extends down to the $2.50 level, and I think that the buyers will probably return once we reach down towards that area. Beyond that, if we rally from here I think that the $2.90 level is the beginning of significant resistance that extends to the $3.00 level.

In general, the natural gas markets are more bearish than bullish, although I think we are essentially stuck in a range going forward. At this point, it’s simply a matter of time before we reach one of the outer levels, and that of course is what I’m waiting for. With that in mind, I’m on the sidelines until we reach one of those barriers.