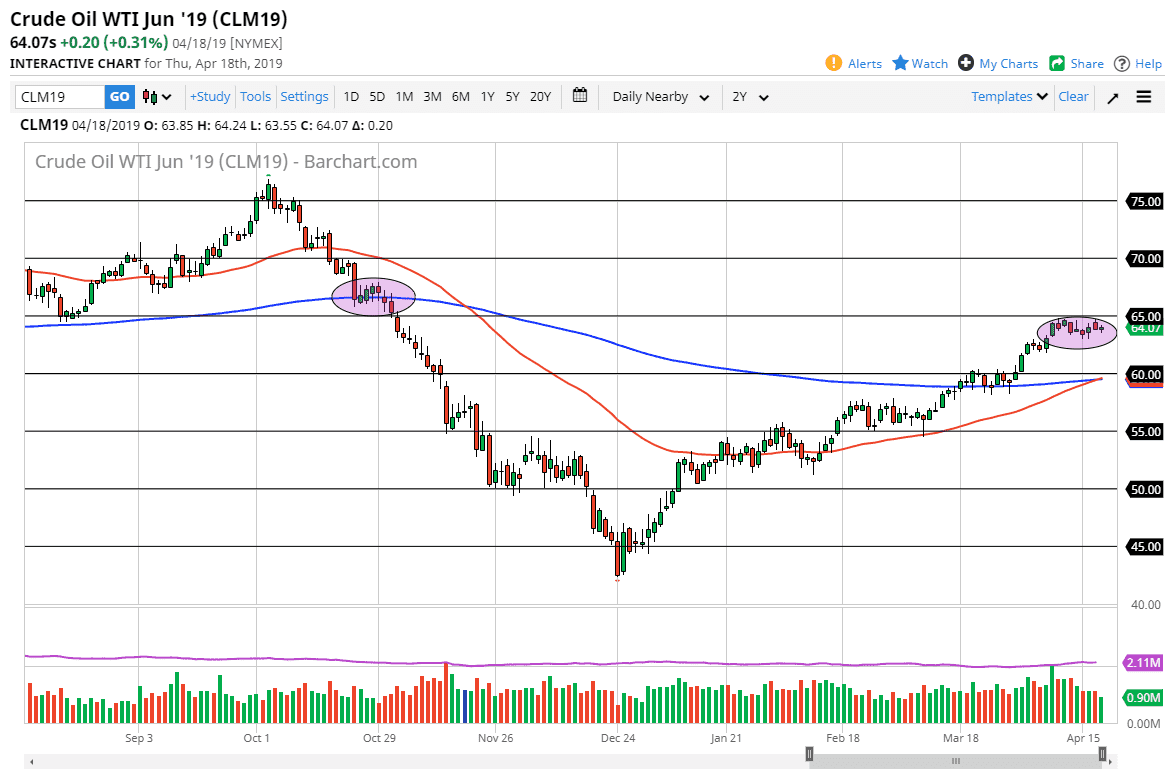

WTI Crude Oil

The WTI Crude Oil market continues to meander around the $65 level, as we closed out the market on Thursday. Ultimately, this is a market that should continue to see a lot of choppiness but I do think that eventually the $65 level gets broken above. Once it does, the markets free to go to the $67.50 level and then the $67 level. With all that being said we could get the occasional pullback but that pullback should only end up being a nice buying opportunity. The $62.50 level underneath is support, just as the $60 level is. In fact, it’s not until we break down below the $60 level that I would be concerned about the overall trend. Currently I find that it’s probably best to be value hunters, buying on the dips.

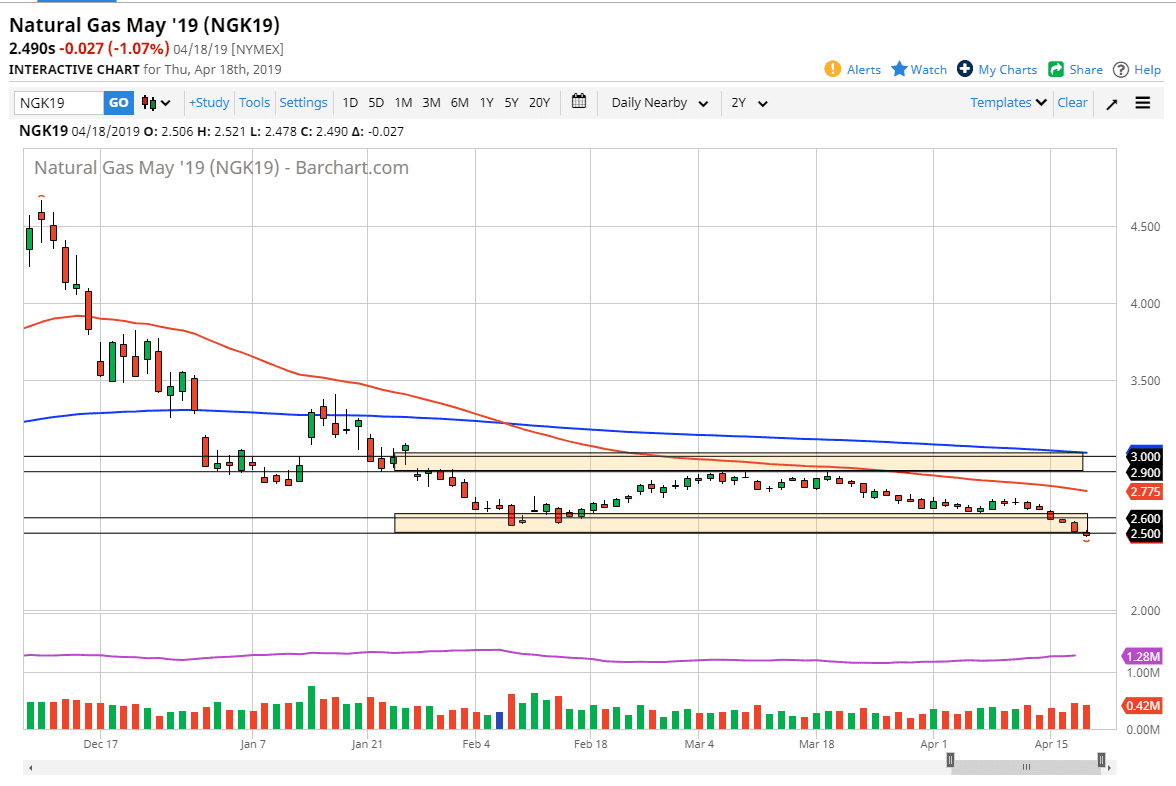

Natural Gas

Natural gas markets continue to press lower, breaking the $2.50 barrier slightly on Thursday. This of course is a very negative turn of events and could put significant pressure on this market and cause a bit of a capitulation. The $2.50 level is indeed crucial for the longer-term range and it now looks as if it’s being seriously threatened. Underneath here, the next logical place for minor support will be the $2.40 level, and then eventually the $2.25 level.

The alternate scenario is that we do in fact bounce, and if that’s going to be the case it’s very likely that we could go looking towards the $2.70 level. Above there, the market should continue to go towards the $3.00 level but that is obviously a very long term type of trade as we are in a sickle weekly negative time of year and what is typically a range bound market. Short-term buying opportunities to present themselves that we need to see an impulsive candle to the upside.