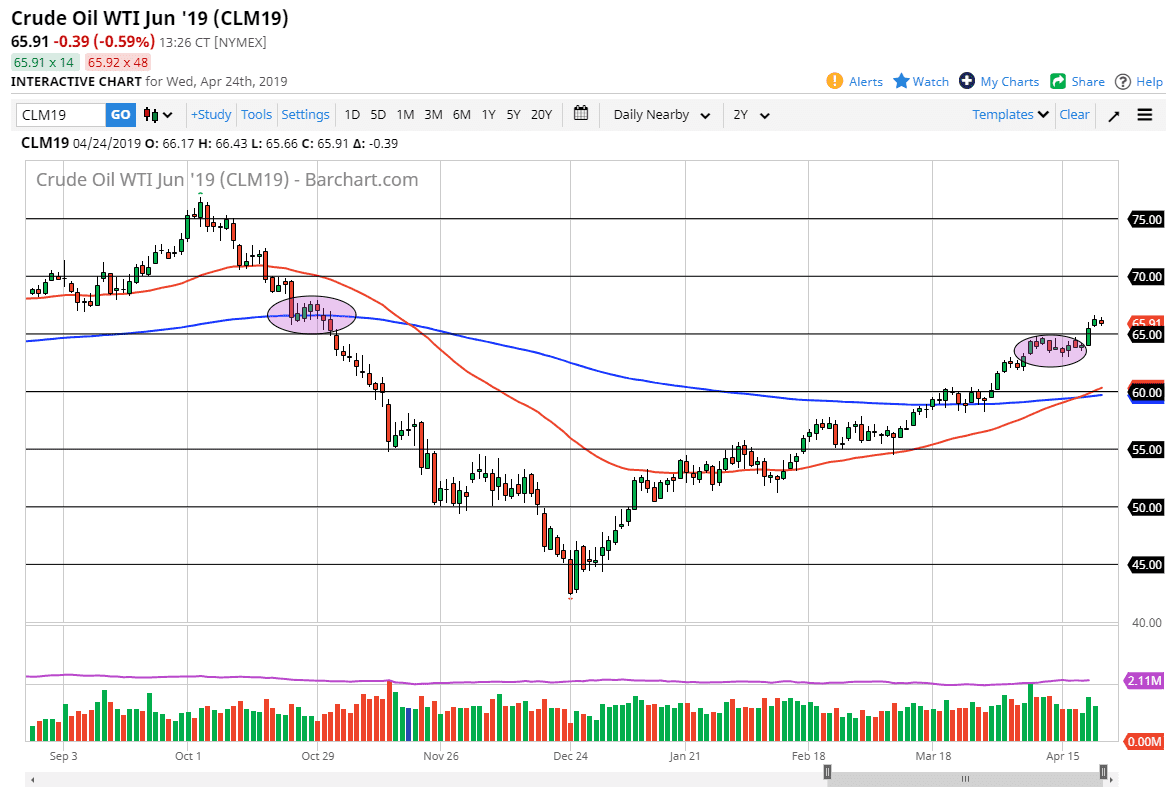

WTI Crude Oil

The WTI Crude Oil market pulled back just a bit during the trading session on Wednesday as the EIA numbers came out with a build of over 5 million barrels. Originally slated to be a build of 900,000 barrels, this of course was a very bearish figure. Beyond that, we have broken out recently and perhaps the market needed an excuse to take a bit of a breather. I still believe that were very bullish because traders will be focusing on the tensions with the Iranians again, as the Trump administration seems to be ready to get rid of waivers for sanctions when it comes to dealing with Iranian oil exports. As long as that’s the case, it’s only a matter time before the buyers return. The $65 level should be supportive and extend down to the $64 level.

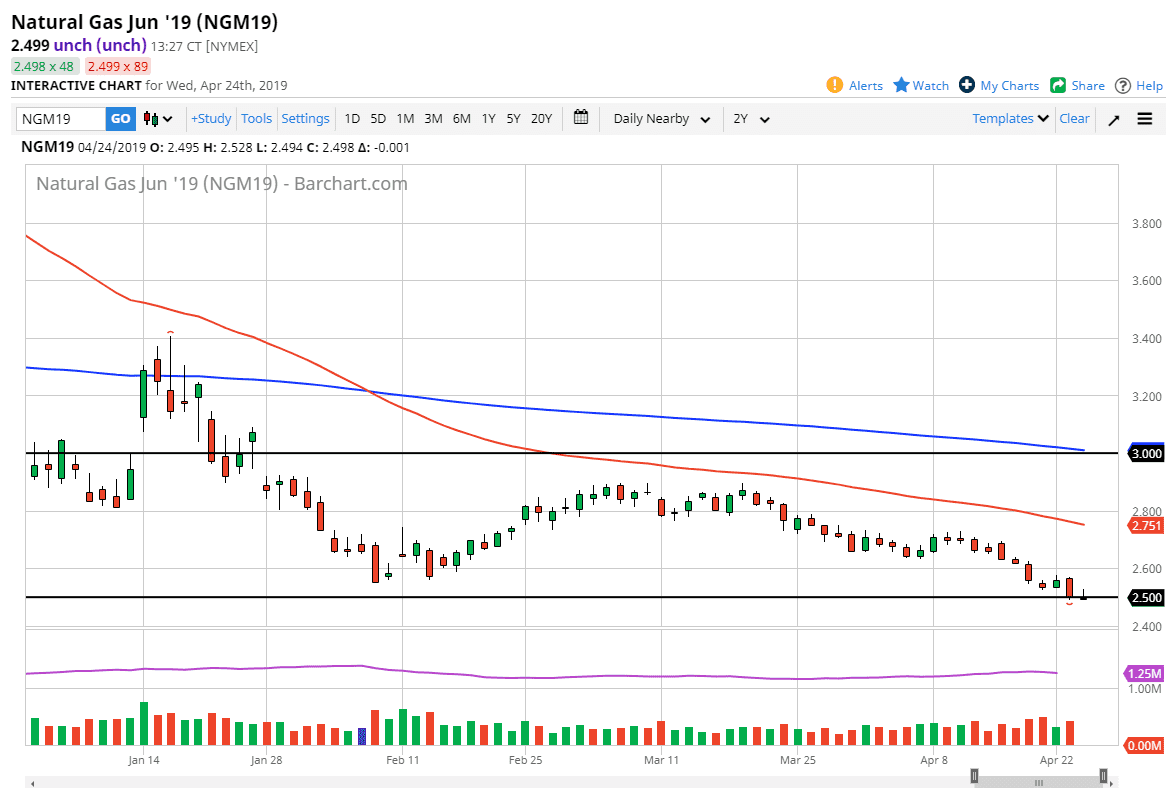

Natural Gas

Natural gas markets continue to look very weak and fragile. The market initially tried to rally during the trading session on Wednesday but gave back the gains to form a bit of an inverted hammer that sits right at the $2.50 level. This is the bottom of the larger consolidation area that we have been in for years. The market does occasionally break out of this range to the upside during the winter months in the United States and Europe, but that’s a short-term phenomenon. Overall, as we break down below the $2.50 level it looks extraordinarily weak and it looks like we could collapse a bit from here. As we entered the drilling season, although the supply tanks are running low, it’s only a matter of time before they are full again. With that in mind, natural gas markets are to be sold on short-term rallies that show signs of exhaustion, just as they should be sold on a break to a fresh, new low.