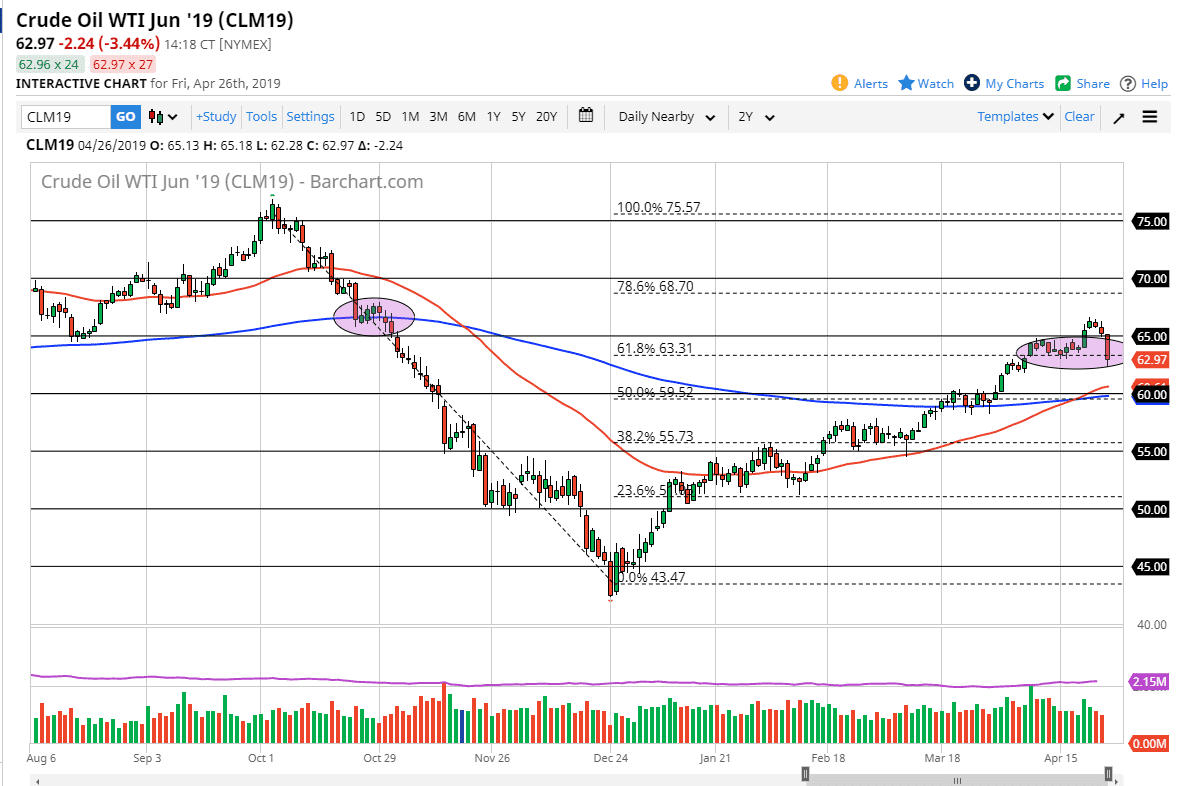

WTI Crude Oil

The WTI Crude Oil market got absolutely hammered on Friday, slicing through the $63 level. The market has broken down rather drastically, and the candle for the weekly timeframe looks horrible. However, there are some areas underneath that could cause a bit of support, so paying attention to those will be crucial. That being said, I think if we break down below the $62.50 level we will have more downward pressure come into the marketplace. The 50 day EMA is just below, and the 200 day EMA is at the $60 handle, which also has a certain amount of psychological importance as well. With all of that in mind it makes quite a bit of sense that we would see a bit of a fight there. That being said, this is a very ugly looking I think that we will probably see rallies continue to fail in the short term.

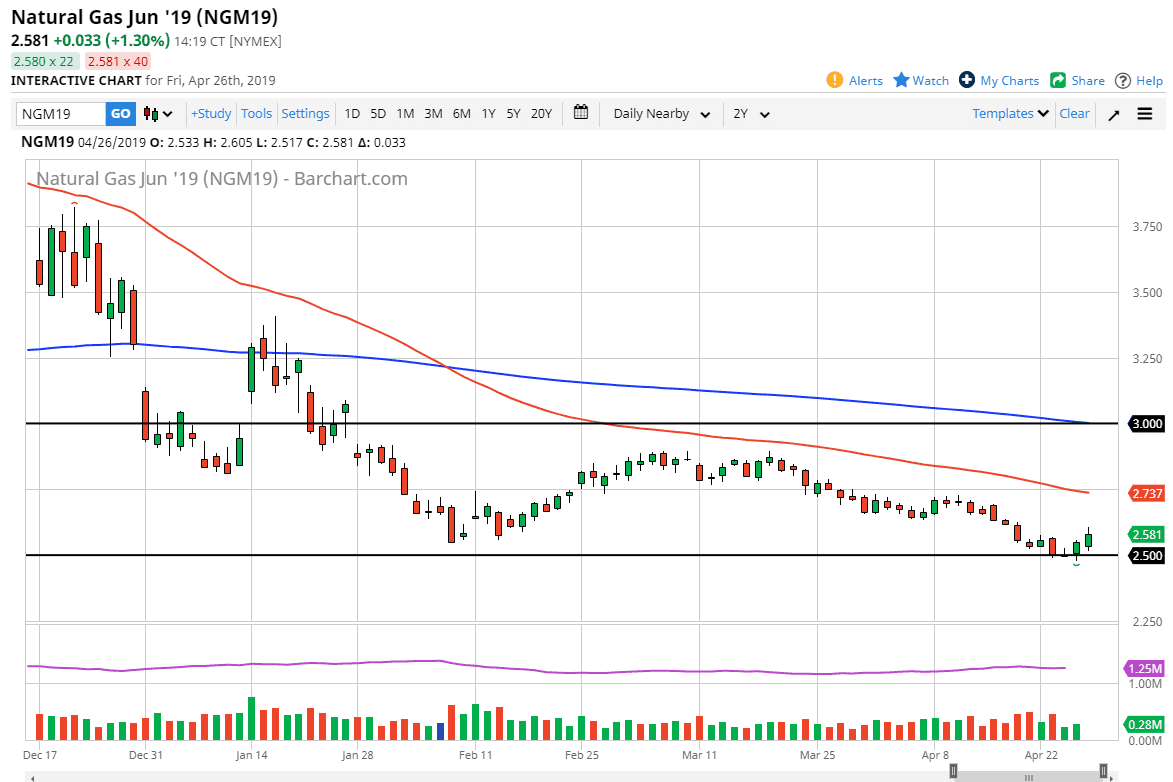

Natural Gas

Natural gas markets rallied during the trading session on Friday, as we continue to see the $2.50 level offer a bit of support. By doing so it looks as if we could go looking towards the $2.70 level above, perhaps even higher than that given enough time. However, it’s very negative overall, so I would expect that rallies would be somewhat short-lived. We have been bouncing around between $2.50 on the bottom and $3.00 level on the top, but I think it’s going to take a long time to get back towards the highs again. It will be much easier to sell signs of exhaustion above, as we are not in the right time of year to see significant natural gas rallies. That being said, in the short term we may get a bit of a bounce.