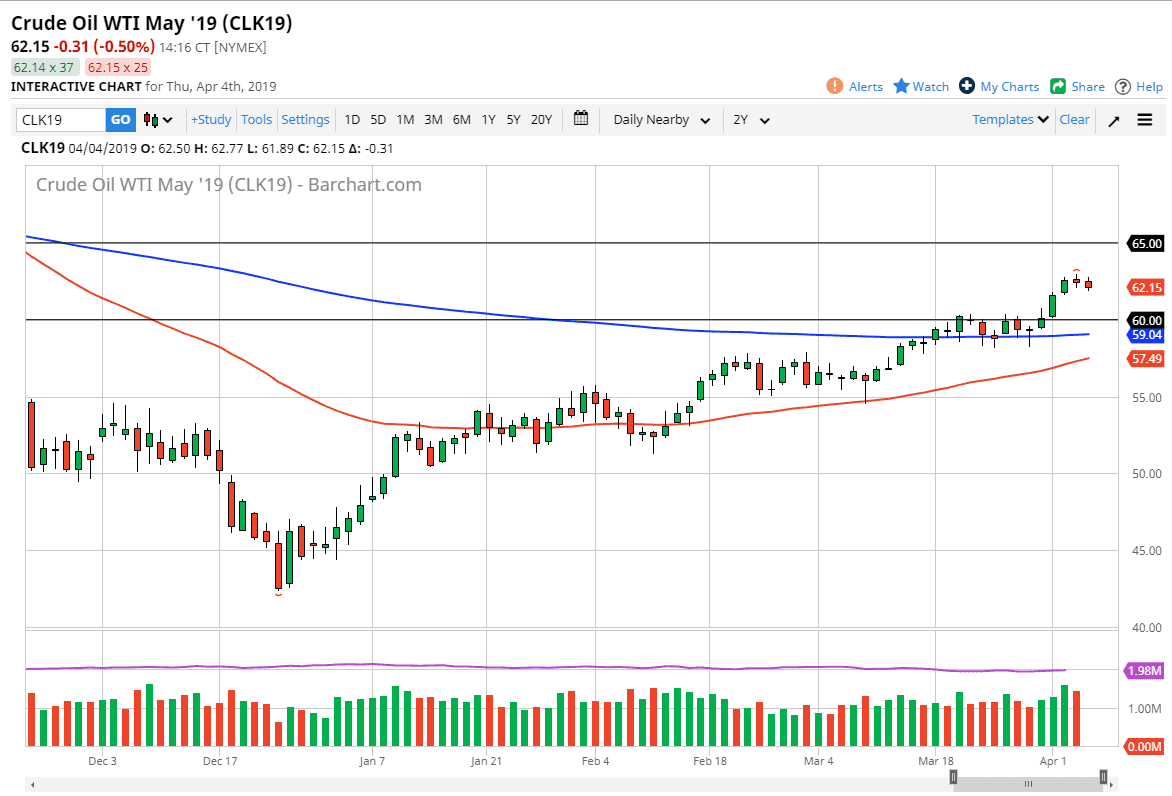

WTI Crude Oil

The WTI Crude Oil market had a slightly negative trading session during the day on Thursday, as we may have gotten a bit ahead of ourselves. Beyond that, we also have to worry about the jobs number coming out on Friday, so it’s likely that the majority market participants don’t have any interest in having a lot of risk on ahead of that massive event. That being said, this is a market that still has a lot of buying pressure underneath, so I think it is a “buy on the dips” situation that we find ourselves in. Ultimately, I believe that this market goes looking towards the $65 level and hope that we get a little bit of a pullback either ahead of the announcement or during the announcement that we can use for potential value. It is not until we break down below the $59 level that I would be concerned about the strength of crude oil.

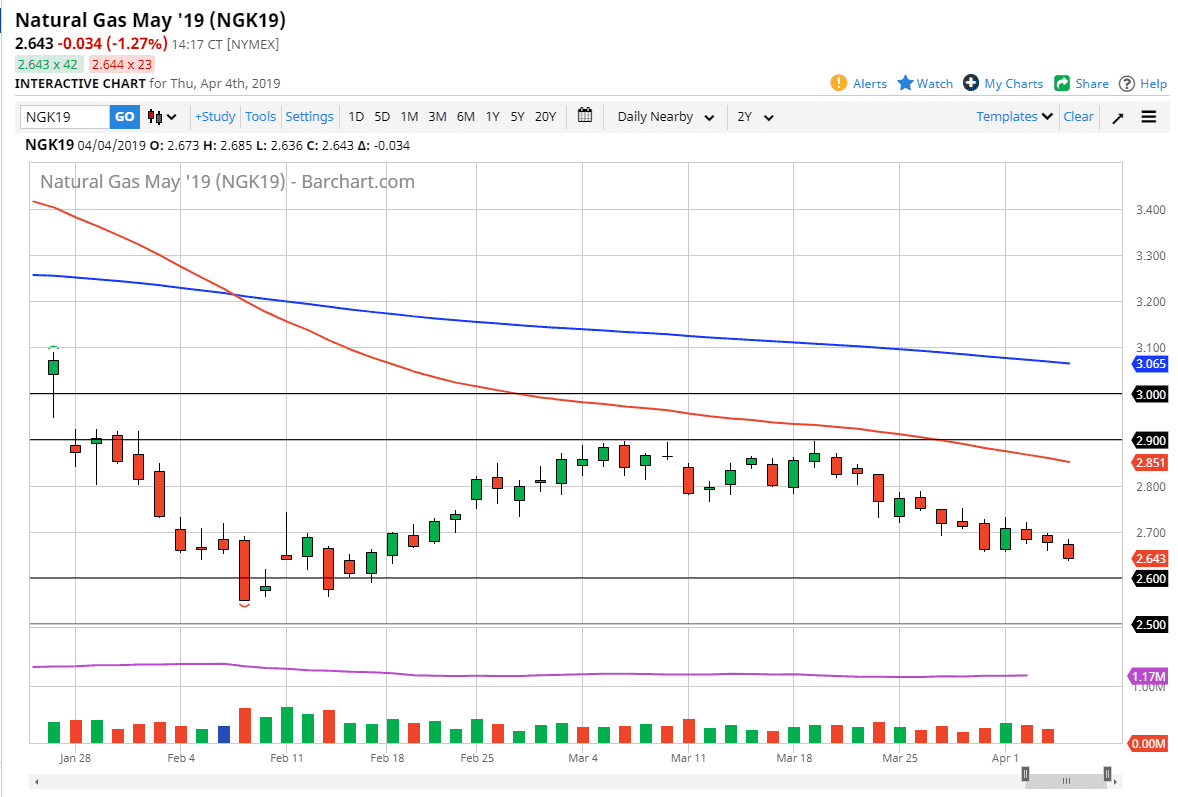

Natural Gas

Natural gas markets continue to drift a little bit lower, reaching towards the $2.60 level underneath. That is the beginning of support all the way down to the $2.50 level, and therefore it makes sense that the buyers will probably come back in to the market to take advantage of value. However, I do not suspect that it’s a longer-term trade, it is more or less going to be a situation where we will go back and forth, perhaps trying to reach towards the top of the consolidation area that we have been in longer-term, meaning we could go as high as $2.90 before finding a rollover. I don’t think this is a market that’s about to change the overall trend, but then again I don’t think that the extraordinarily strong $2.50 level is going to give way either.